I have been aggressively accumulating AutoZone stock (NYSE:AZO) recently. Why? Well, the automotive replacement parts retailer has proven to be a long-term compounder. Essentially, Autozone employs a tried-and-true recipe to drive growth. In the meantime, management has mastered the art of maximizing shareholder value through strategic buybacks. Accordingly, the stock has constantly delivered exceptional returns over the years, a trend that I believe will persist. Thus, I am bullish on AZO stock.

AutoZone’s Phenomenal Track Record Says a Lot

One of the reasons that initially drew me to AutoZone stock is its absolutely phenomenal track record. In the world of investing, we often encounter the cautionary phrase, “Past performance is no guarantee of future results.” While this old saying has merit, I think it’s fair to say that past performance serves as a reliable indicator of a company’s ability to create shareholder value, especially if we are talking about an extended time frame.

In that sense, AutoZone clearly excels, boasting a few decades of consistent growth and market-beating shareholder value creation. As far back as I can analyze for comparison, since late January 1993, AutoZone stock has delivered annualized returns of 17.8%, outperforming the S&P 500’s (SPX) annualized return of 10.2%. This holds true for the past 10 years as well, with AutoZone stock delivering annualized returns of 19.1%, beating the S&P 500’s rate of 12.8% by a wide margin.

The stock’s exceptional returns mirror the exceptional progress in AutoZone’s financials. To provide some context, there has not been a single year since 1992, when AutoZone went public, in which the company hasn’t grown its revenues. Further, despite decades of growth, the rate at which AutoZone continues to grow remains robust to this day.

Impressively, the company has grown revenues at a compound annual growth rate of 6.7% over the past 10 years (2014-2023), which actually even implies an acceleration compared to the 10-year revenue CAGR of the previous decade (2004-2013) of 5.3%. The company has managed to achieve this by following the tried-and-true, straightforward recipe of opening new locations and improving sales at existing locations.

This strategy makes it very easy to achieve economies of scale and improve unit economies, evident in the fact that AutoZone’s earnings growth has consistently outpaced revenue growth. Specifically, the company’s earnings have grown at a CAGR of 9.5%.

However, what has really accelerated shareholder value creation is AutoZone’s management team’s mastery of stock buybacks. The company features one of the most impressive share repurchase track records I have ever encountered. In particular, AutoZone has shrunk its share count by nearly 89% since 1998, with buybacks being the sole avenue of capital returns.

Of course, share buybacks would matter little if they weren’t taking place at attractive share prices. There is little reason to think this is the case, however, as AutoZone’s unfailingly impressive growth has resulted in buybacks proving significantly accretive to EPS. To my point, AutoZone’s EPS has compounded at a rate of 16.9% over the past decade. Besides the notable outperformance to net income growth, this figure is quite impressive when considering how mature AutoZone as a business is at this point, as well.

Tried-and-True Recipe Stays Strong to Sustain This Trend

As I mentioned, AutoZone’s consistent growth over the decades has been powered by its tried-and-true recipe. Despite gradually maturing as a company, AutoZone’s performance has shown no signs that this strategy is going to evolve less effectively anytime soon. In fact, the company’s Q2-2024 results indicate that FY 2024 will be another year of record revenues, earnings, and EPS.

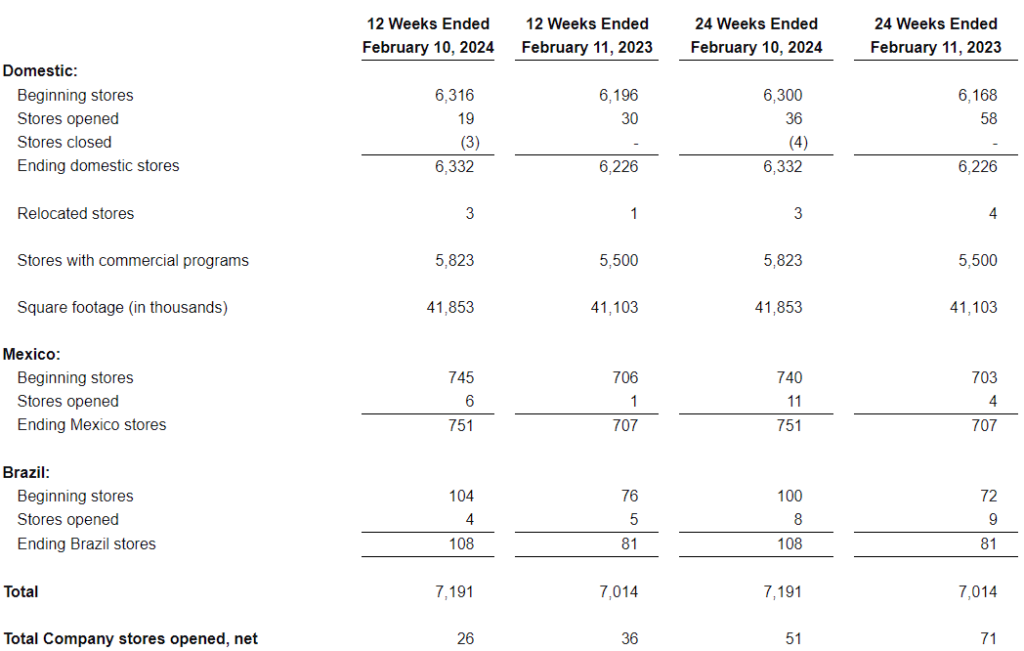

To illustrate, AutoZone continued to expand its footprint through its well-established strategy of opening new stores in underserved areas. During Q2, the company opened 19 new stores in the U.S., six in Mexico, and four in Brazil. Thus, despite closing three stores in the U.S., the quarter ended with 26 net new stores. In the meantime, same-store sales in existing locations grew by 3%, fueling total revenue growth for the quarter to 4.6%.

By following the same logic explained earlier, AutoZone managed to grow its earnings and EPS by 8.1% and 17.2%, respectively. Again, the huge gap between earnings and EPS illustrates AutoZone’s massive share repurchases. In any case, with a strong first half of the year and ongoing momentum, Wall Street expects that full-year revenues will grow by about 7% to a record $18.69 billion. EPS is also poised to set a new record, growing by around 15.7% to $153.11 and sustaining AutoZone’s long-term growth trend.

AZO’s Valuation Can Sustain Strong Returns

To justify my recent share accumulation, I have made sure to buy AutoZone at what I think are reasonable valuation levels that, along with strong double-digit EPS growth, can sustain strong returns. My buys have taken place at forward P/Es between 16x and 19x, a level that more or less aligns with the stock’s historical average. Currently trading at a forward P/E of about 19x and poised for another year of exceptional EPS growth, I believe the stock remains well-positioned to keep delivering market-beating returns.

Is AZO Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, AutoZone features a Strong Buy consensus rating based on 16 Buys and two Holds assigned in the past three months. At $3,319.44, the average AZO stock price target suggests 12.9% upside potential over the next 12 months.

If you’re unsure which analyst you should follow if you want to buy and sell AZO stock, the most accurate analyst covering the stock (on a one-year timeframe) is Zachary Fadem of Wells Fargo (NYSE:WFC), with an average return of 26.11% per rating and a 95% success rate. Click on the image below to learn more.

The Takeaway

By and large, I think that AutoZone’s remarkable track record speaks volumes about its ability to create enduring shareholder value. Its tried-and-true strategy of expanding store locations and maximizing sales at existing ones, coupled with smart share buybacks, keeps driving outstanding results. With this strategy set to endure and shares trading at a reasonable valuation, I will likely continue to accumulate shares on a regular basis.