Shares of AutoZone fell 5.3% on Tuesday after the automotive parts and accessories retailer reported lower-than-expected top-line results for 1Q.

AutoZone’s (AZO) 1Q revenues of $3.15 billion fell short of analysts’ expectations of $3.16 billion. However, top-line results marked a year-over-year improvement of 12.9%, reflecting same-store sales growth of 12.3%. Its earnings grew 30.1% to $18.61 per share year-on-year and beat the Street’s estimates of $17.77.

AutoZone’s CEO Bill Rhodes said, “While our sales have certainly been aided by the COVID-19 pandemic related government stimulus and consumer behavior changes, we have continued to execute on our strategies to improve inventory availability including expanding our Hub and Mega-Hub networks. We are also leveraging technology to improve our service capabilities and efficiency and further penetrating the Commercial market.” (See AZO stock analysis on TipRanks)

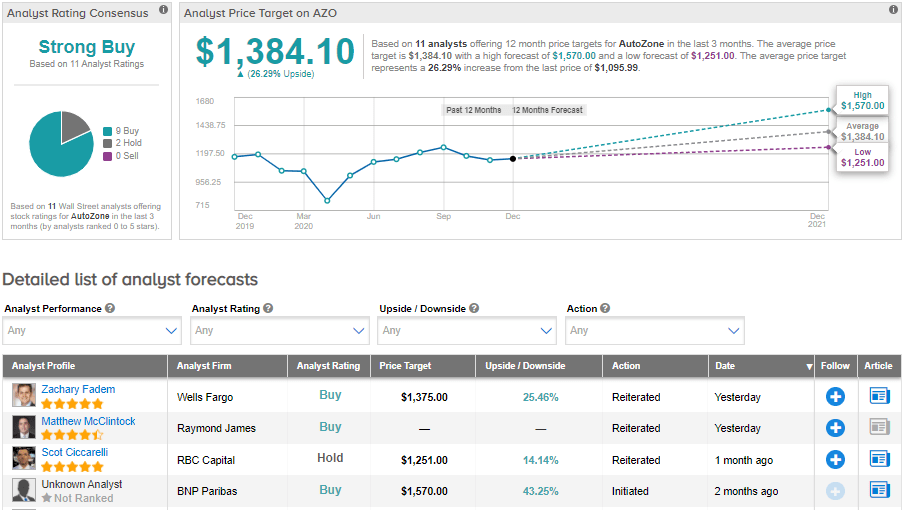

Following the earnings release, Wells Fargo analyst Zachary Fadem reiterated a Buy rating on the stock with a price target of $1,375 (25.5% upside potential). In a note to investors, Fadem wrote, “As the largest aftermarket auto part retailer in the U.S., we see positives from favorable industry dynamics and opportunities to scale its under-indexed commercial business (77% DIY (do-it-yourself) and 23% Pro), International footprint (Mexico/Brazil) and budding online sales platform.”

Overall, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 9 Buys and 2 Holds. The average price target stands at $1,384.10 and implies upside potential of about 26.3% to current levels. Shares have declined by about 8% year-to-date.

Related News:

Uber Sells Self-Driving Unit To Start-Up Aurora; Street Is Bullish

Casey’s Falls Despite 2Q Earnings Beat And Dividend Hike

Stitch Fix Surprises With 1Q Profit; Shares Spike 34%