AT&T’s (NYSE:T) shares have taken a bit of a tumble as the company’s CFO, Pascal Desroches, hinted at second-quarter new phone subscribers falling short of Wall Street’s predictions. At a recent Bank of America Conference, Desroches disclosed that the telecom heavyweight expects new phone customers to be around the 300,000 mark, a considerable drop from the anticipated 476,000 figure by Wall Street pundits.

Nevertheless, it’s not all doom and gloom. Desroches reassured that AT&T is on a solid path to hit, or possibly surpass, its goal of raking in $16 billion in free cash flow this year. He further emphasized the potential for significant cost cuts within the company’s structure. In another interesting development, Desroches seems to have put to rest the circulating rumors about Amazon’s (NASDAQ:AMZN) potential move to provide a mobile service for Prime customers. He stated that there were no real incentives for the wireless industry to collaborate with Amazon, despite reports of Amazon negotiating with Verizon (NYSE:VZ), T-Mobile US (NASDAQ:TMUS), and Dish Network (NASDAQ:DISH) to secure bargain wholesale prices.

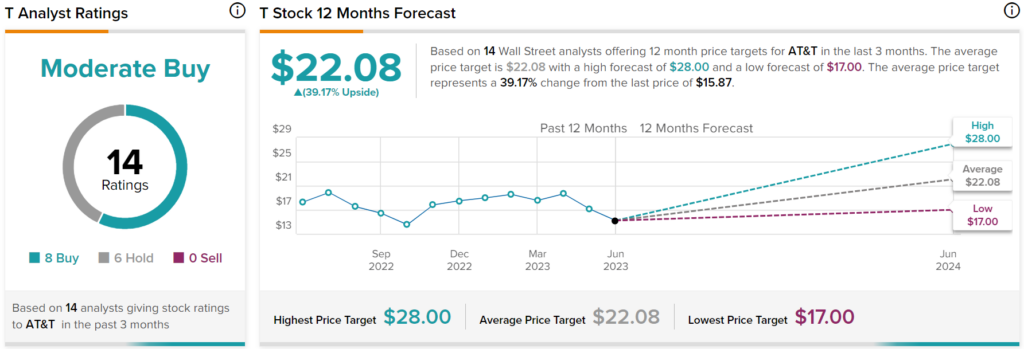

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AT&T stock based on eight Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $22.08 per share implies 39.17% upside potential.