Telecommunication giant AT&T (NYSE:T) said it will compensate users affected by last week’s network outage. The company will credit affected customers a full day of service. While the move will financially impact its business, AT&T’s CEO, John Stankey, remains optimistic and reiterated the 2024 forecast.

Notably, the outage began in the early hours of Thursday, February 22, due to the execution of an incorrect process used to expand the network. Stankey said that the affected consumers and small business customers will receive automatic account credits as compensation. He stated that the prepaid customers will also have options for compensation if they were affected. Meanwhile, the company is addressing the concerns of mid-market and enterprise customers.

Against this backdrop, let’s delve into AT&T’s 2024 guidance.

AT&T’s 2024 Outlook

AT&T is benefiting from growth in its 5G and Fiber subscriber base. Further, it continues to expand its 5G and fiber networks, which will likely add more subscribers and support its financials.

The company expects its Wireless service revenue to grow by 3% in 2024. Additionally, Broadband revenue is forecasted to grow by over 7%. AT&T expects to generate free cash flow of $17 to $18 billion in 2024, compared to $16.8 billion in 2023. Its adjusted EPS is projected to be in the range of $2.15 to $2.25, down from $2.41 in 2023.

What is the Prediction for AT&T Stock?

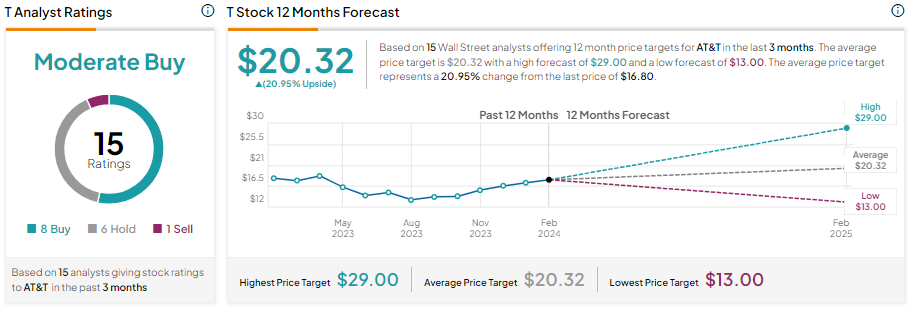

AT&T stock is down about 5.6% in one year, underperforming the S&P 500’s (SPX) nearly 28% gain. Analysts are cautiously optimistic about AT&T stock.

With eight Buys, six Holds, and one Sell recommendation, AT&T stock has a Moderate Buy consensus rating. Analysts’ average price target of $20.32 implies 20.95% upside potential from current levels. Interestingly, based on its quarterly dividend of $0.28 per share, AT&T stock offers a forward yield of about 6.7%.