AT&T (NYSE:T) is one of the biggest names in telecommunications around, and it showed today when JPMorgan cut its estimates for the upcoming quarter. Despite this cut, which should have spooked investors, they instead rallied behind AT&T and sent shares up fractionally in the closing minutes of Wednesday’s trading session.

The report from JPMorgan, via analyst Sebastiano Petti, revealed that the recent service outage seen at AT&T left it hurt. Though it did indeed recover quickly, that wasn’t going to be quick enough to keep it from losing subscribers. The impact wouldn’t be substantial, however, as Petti’s report expected a “slight subscriber impact” and a “…lower 1Q postpaid phone net adds to 300k.”

Further, thanks to the $5 credit that customers would receive as a result of the outage—itself the topic of some controversy—this would lower the average revenue per user (ARPU) figure to $55.59, hurting AT&T in two different directions.

But Then, Something Else Hit

This is bad news for AT&T, certainly, but then another major problem hit AT&T: a massive data leak. How massive? The archive containing the leak in question is five gigabytes in size, or roughly the size of an entire blank DVD, and then some.

The leak contained a substantial amount of customer data, including names, addresses, and even Social Security numbers, and impacted around 73 million customers. AT&T, for its part, noted that the data “…did not originate from them and that its systems were not breached.” That’s likely cold comfort to the thousands of customers whose data has been compromised.

Is AT&T Stock a Buy or a Hold?

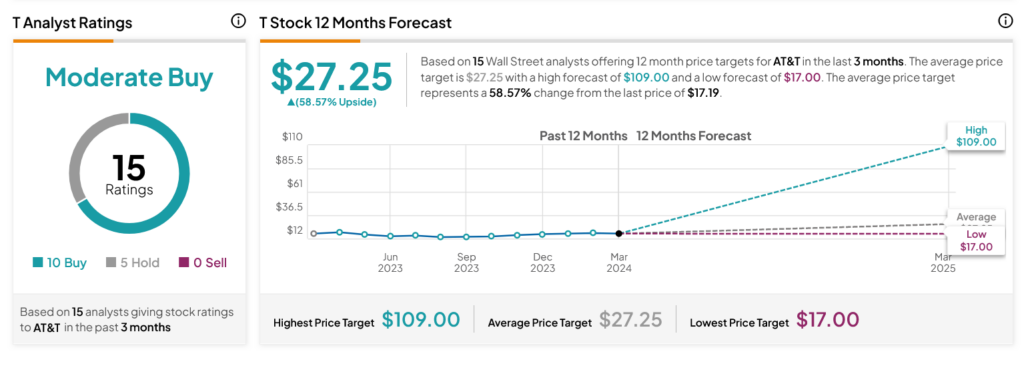

Turning to Wall Street, analysts have a Moderate Buy consensus rating on T stock based on 10 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 0.92% loss in its share price over the past year, the average T price target of $27.25 per share implies 58.57% upside potential.