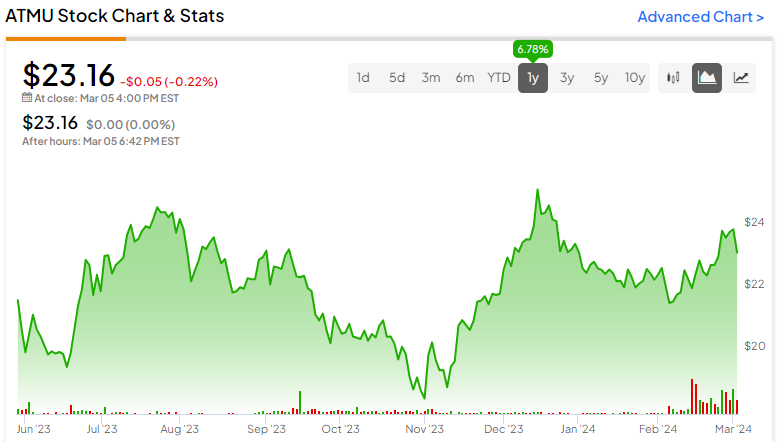

Atmus Filtration Technologies (NYSE:ATMU) has gradually delivered positive results in producing and distributing filtration products for various industries. Shares are up 6.78% over the past year, and indicators point to the stock being a relative value pick. While not flashy, it has the makings of a solid portfolio addition for value investors with a longer time horizon.

Filtration is the Game

Headquartered in Nashville, Tennessee, Atmus Filtration produces and distributes filtration products widely used in both on-highway commercial vehicles and off-highway equipment utilized in agricultural, construction, mining, and power generation industries.

Operating under the leading brand name Fleetguard, the company has a broad product portfolio. Moving forward, the company’s growth strategy is to accelerate profitable growth in its key segments while expanding into industrial filtration markets.

Recent results have been positive, with Q4 beats on revenue of $400 million and adjusted EPS of $0.49. Overall, Atmus Filtration’s 2023 full-year revenue increased by about 4% to $1.63 billion while adjusted EPS grew 8.5% to $2.31. The company expects 2024 revenue in the range of $1.610 billion to $1.675 billion, with EPS between $2.10 and $2.35. Not excessive growth by any stretch of the imagination…but slow and steady.

Completing the Spin-Off

Until recently, Atmis Filtration operated as a subsidiary of Cummins (NYSE:CMI). However, in May 2023, it was spun off with an IPO (though Cummins retained over 80% of Atmus’ common stock). Cummins has announced plans to initiate an exchange offer, allowing its shareholders to trade their shares of CMI common stock for shares of ATMU common stock at a 7% discount.

Since the announcement, there has been a substantial surge in the borrowing activity of ATMU stock, accounting for 23% of outstanding shares, suggesting investors view the exchange offer’s discount as an arbitrage opportunity.

While removing the overhang of a parent company may benefit Atmus in the long run, this could be a source of price volatility for the stock in the near term.

The Stock’s Valuation and Other Aspects

ATMU stock shows positive momentum, trading toward the higher end of its 52-week range of $18.21-$25.39. However, despite the price increase, it still looks like a value candidate.

Valuation ratios suggest the company is relatively undervalued. The TTM PE Ratio of 12.59x compares favorably to the Sector (Industrials) and Industry (Pollution & Treatment Controls) averages of 17.83x and 24.14x respectively. Also, the stock’s EV to EBITDA multiple of 9.026x compares favorably to the Industry average of 14.35x.

Technical indicators are bullish, with the stock trading above the 20-day moving average price of $22.97 and a 50-day moving average price of $22.66. The upward price momentum suggests the stock may continue to see positive price movement in the near future.

What is the 2024 Price Target for ATMU?

Wall Street analysts covering ATMU stock are mainly bullish on the long-term impact of the Cummins share distribution and above consensus 2024 guidance.

ATMU currently scores a Strong Buy consensus rating based on three Buys and one Hold recommendation. The average price target is $28, with a range of $26-$29. This average price target represents a 20.9% upside from the current levels.

Final Analysis

Atmus Filtration Technologies’ positive growth trajectory and the stock’s relative valuation suggest it’s well-positioned to continue its slow but steady upward journey. The upcoming Cummins share distribution offers the potential for near-term price fluctuations, so investors should be prepared to ride the waves or wait until the chop subsides.

While ATMU may not be flashy, it could offer an appealing option for investors eyeing a value play in the industrial filtration market.