Atlassian (NASDAQ:TEAM) shares are trending lower today after the cloud services provider delivered better-than-anticipated first-quarter numbers, but its financial outlook disappointed investors. During the quarter, revenue increased by 21% year-over-year to $977.8 million, exceeding estimates by about $12.4 million. Further, EPS of $0.65 came in ahead of expectations by $0.12.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s quarterly subscription revenue soared by 31% year-over-year to $852 million. Additionally, its operating margin improved to 23% from 18% a year ago. At the end of the quarter, TEAM’s number of customers with a Cloud annualized recurring revenue (Cloud ARR) of more than $10,000 increased by 18% over the prior year period to 40,103.

For Fiscal year 2024, Atlassian expects macroeconomic challenges to impact growth in paid seat expansion at existing customers and anticipates Cloud revenue growth to be in the range of 25% to 30% and Data Center revenue growth to be around 31%. Adjusted operating margin for the year is expected to be 20%.

For the upcoming quarter, Atlassian foresees total revenue in the range of $1,010 million to $1,030 million. Cloud and Data Center revenue are expected to rise by between 25.5% to 27.5% and 33%, respectively.

What Is the Price Target for Atlassian?

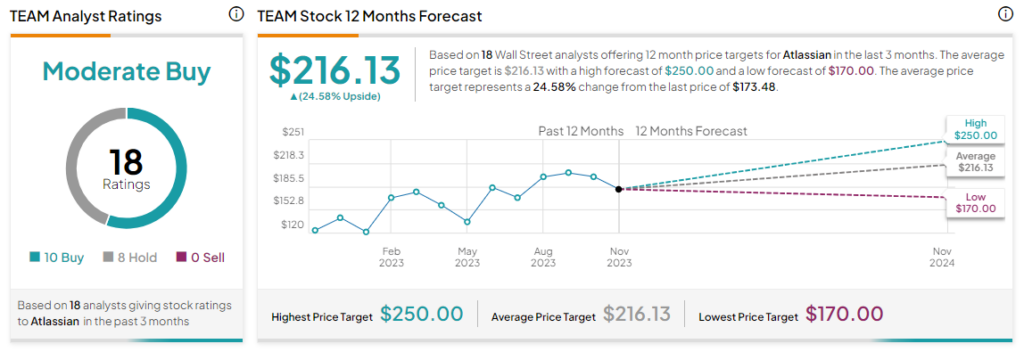

Overall, the Street has a Moderate Buy consensus rating on Atlassian. The average TEAM price target of $216.13 implies a 24.6% potential upside. Despite a recent decline, shares of the company still remain nearly 17% higher over the past six months.

Read full Disclosure