Perceptive Advisors LLC, director at Astria Therapeutics (NASDAQ:ATXS), bought 908,265 shares on December 19, at $11.01 apiece for a total consideration of about $10 million. As per an SEC filing, Perceptive Advisors LLC is the investment manager of Perceptive Life Sciences Master Fund Ltd., which directly holds these shares. ATXS stock was up over 4% in Thursday’s pre-market trading, following nearly a 9% rise in Wednesday’s regular trading session.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Astria Therapeutics is a biopharmaceutical company developing therapies for rare and niche allergic and immunological diseases. The company’s lead program, STAR-0215, is a “monoclonal antibody inhibitor of plasma kallikrein in clinical development for the treatment of hereditary angioedema.”

Perceptive Advisors LLC bought the aforementioned shares as part of a $100 million underwritten common stock offering of 9,082,653 shares. Perceptive Advisors’ performance track record shows a 38% success rate (compared to the S&P 500) based on 79 out of 209 profitable transactions made over the past year. Its average return per transaction stands at 4.30%.

Following this transaction, the Insider Confidence Signal is Positive for ATXS stock.

Last week, Astria Therapeutics announced positive preliminary results from the Phase 1a clinical trial of STAR-0215 in healthy subjects, establishing “early proof of concept” of STAR-0215 as a potential long-acting preventative treatment for hereditary angioedema.

It’s worth noting that TipRanks provides daily insider transactions and a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is ATXS Stock a Buy?

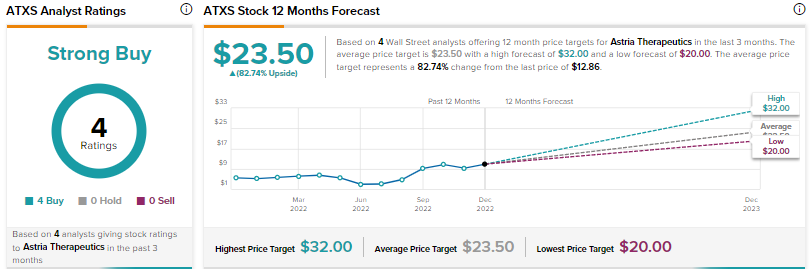

Wall Street’s Strong Buy consensus rating for Astria Therapeutics is based on four unanimous Buys. The average ATXS stock price target of $23.50 implies 82.7% upside potential. Shares have rallied by an impressive 139% year-to-date.

Final Thoughts

Share purchases by insiders generally send positive signals to investors about the prospects of a company. As per TipRanks’ Smart Score System, Astria Therapeutics earns a “Perfect 10,” which indicates that the stock could outperform the broader market over the long term.