AstraZeneca (GB: AZN) disclosed that its Biologics License Application (BLA) for tremelimumab has been accepted for a Priority Review in the U.S.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This supports the indication of a single priming dose of the anti-CTLA4 antibody added to Imfinzi (durvalumab) for the treatment of patients with unresectable hepatocellular carcinoma (HCC).

The novel dose and schedule of the combination are called the “STRIDE” (Single Tremelimumab Regular Interval Durvalumab) regimen. It is the first dual immune checkpoint blockade regimen to improve overall survival in a Phase III trial.

The company stated that a supplemental BLA (sBLA) has also been submitted for Imfinzi.

Supporting Data

Globally, liver cancer is the third-leading cause of cancer death and the sixth most commonly diagnosed cancer. Almost 75% of all primary liver cancers are HCC.

Tremelimumab is a human monoclonal antibody. It is a potentially new medicine that targets the activity of cytotoxic T-lymphocyte-associated protein 4 (CTLA-4), triggering the immune response to cancer, thereby boosting cancer cell death.

The Food and Drug Administration (FDA) action date for their regulatory decision, or the Prescription Drug User Fee Act date, is set during the fourth quarter of 2022, following the use of a priority review voucher.

The BLA for tremelimumab as well as sBLA for Imfinzi are based on final results from the HIMALAYA Phase III trial that were presented at the 2022 American Society of Clinical Oncology Gastrointestinal Cancers Symposium.

According to the findings from the trial, patients treated with the STRIDE regimen experienced a 22% reduction in the risk of death versus sorafenib.

Further, almost one in three (31%) patients were still alive at three years, versus one in five (20%) for sorafenib.

Earlier in January 2020, Imfinzi and tremelimumab were granted orphan drug designation in the US for the treatment of HCC.

Management Weighs In

Susan Galbraith, EVP of Oncology R&D at AstraZeneca, stated, “The HIMALAYA Phase III trial showed an unprecedented three-year overall survival in this setting with a single priming dose of tremelimumab added to Imfinzi, highlighting the potential for this regimen to improve longer-term survival outcomes.”

She further added, “Patients with advanced liver cancer are in great need of new treatment options, and we are working closely with the FDA to bring this novel approach to patients in the US as soon as possible.”

Wall Street’s Take

On April 21, Morgan Stanley analyst Mark Purcell increased the price target on AstraZeneca to £111 (9.2% upside potential) from £102 and reiterated a Buy rating.

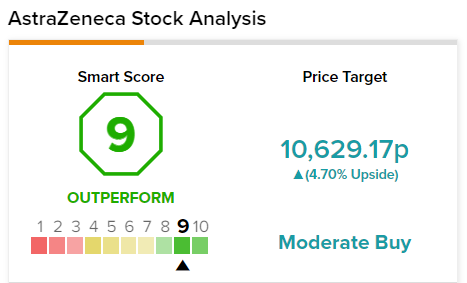

The consensus among analysts is a Moderate Buy based on nine Buys, two Holds, and one Sell. The average AstraZeneca stock forecast of 10,629.17p implies 3.54% upside potential from current levels.

Smart Score

AstraZeneca scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Conclusion

Shares of the British-Swedish multinational pharmaceutical and biotechnology company have gained almost 25% over the past year.

AstraZeneca is further assessing Imfinzi across multiple liver cancer settings as part of its extensive clinical development program in gastrointestinal (GI) cancers. Once approved, this could add another revenue driver for the company, thereby increasing profitability.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Firms Eye Bed Bath & Beyond’s Buybuy Baby Unit; Shares Surge

Kimberly-Clark’s Q1 Results Surpass Expectations

Twitter Inks Crypto Payment Deal for Creators