AstraZeneca PLC (GB:AZN) announced the acquisition of all outstanding shares of TeneoTwo Inc, including the experimental blood cancer drug TNB-486, which is being tested as a treatment for non-Hodgkin’s lymphoma.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The company will pay $100 million upfront and the total deal value is $1.27 Billion. The remaining will be a contingent payment based on the company’s R&D and commercial performance.

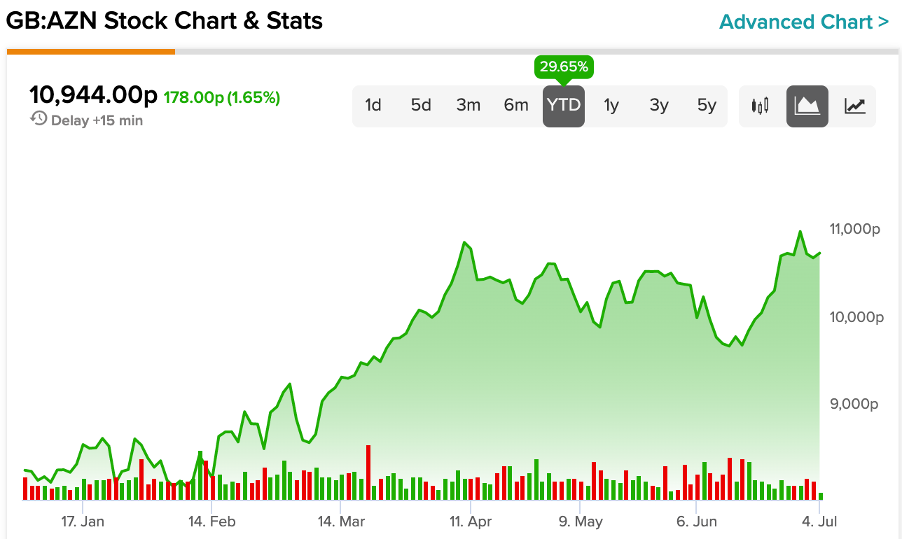

Investors seem happy with the news as the stock continued its positive momentum. AstraZeneca’s stock is up close to 30% in the year to date.

AstraZeneca is a multi-national biopharmaceutical company dealing in R&D and marketing of medicines.

Solid portfolio

With this acquisition, AstraZeneca is able to expand its hematology cancer pipeline. TNB-486 is currently in Phase 1 clinical trial.

Anas Younes, AstraZeneca’s senior vice president of haematology R&D, said, “We believe this innovative molecule, which was designed to optimise the therapeutic window of T-cell activation, will enable us to explore novel combinations that have the potential to become new standards of care in this setting.”

The company’s line-up of projects under trial in late, as well as early stages, is strong, with five approved and potential new medicines for hematological diseases shown off at the European Hematology Association (EHA) Annual Meeting in June.

View from the city

According to TipRanks’ analyst rating consensus, AstraZeneca stock is a Moderate Buy. That’s based on ten Buy, three Hold, and one Sell assigned in the past three months.

The average AstraZeneca price target of 15,300p implies a drop of 4.5%. Analyst price targets range from a low of 1010p per share to a high of 10,446p per share.

Conclusion

The company is raising the standards of care with its acquisitions and drug approvals. Overall, the growth is stable and the icing on the cake is AstraZeneca’s dividend yield of 1.95% as compared to the industry average of 1.57%. This is a win-win for both income and growth investors.