Shares in pharmaceuticals giant AstraZeneca (AZN) were healthier today as it announced plans for a dual-listing of its shares in the U.S. and U.K.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AstraZeneca said it was set to directly list its ordinary shares on the New York Stock Exchange to help it “reach a broader mix of global investors”.

Ordinary Choice

Until now it has traded in the U.S. through so-called American depositary receipts (ADRs) on Nasdaq, but ordinary shares are typically easier to trade.

It stressed that the plans would not affect its primary listing on London’s FTSE 100 market and its U.K. corporate headquarters. It means that investors will soon be able to trade ordinary shares in the firm in London, New York and Stockholm.

Michel Demaré, Chair, AstraZeneca said: “Today we set out our proposed harmonised listing structure which will support our long-term strategy for sustainable growth. It will make it even more attractive for all our shareholders to have the opportunity to participate in AstraZeneca’s exciting future.”

Shareholders will vote on the planned U.S. listing changes at a general meeting on November 3.

Tariff Pressure

It comes during an increased focus by the company on the U.S. amid efforts to lessen the impact of U.S. president Donald Trump’s trade tariffs, with AstraZeneca recently announcing plans to invest $50 billion in the U.S. over the next five years.

This will include a new state-of-the-art manufacturing facility in Virginia – set to be its largest single manufacturing investment in the world – and expansion of its research and development (R&D) and cell therapy manufacturing operations in Maryland, Massachusetts, California, Indiana and Texas.

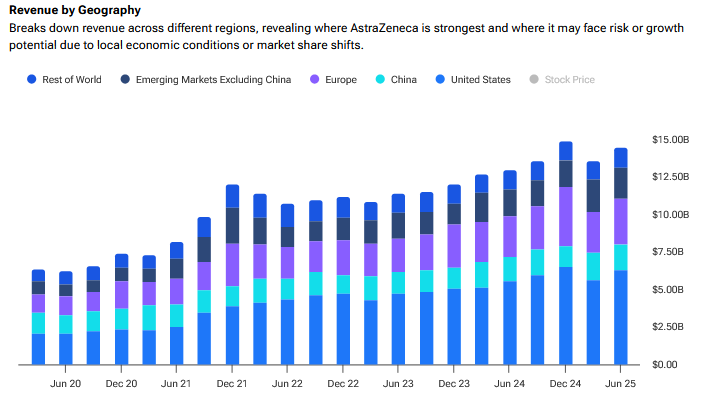

Despite being headquartered in the U.K., America is AstraZeneca’s largest market, where it employs more than 18,000 staff and makes 42% of total group sales.

It already has 19 R&D, manufacturing and commercial sites across the country.

AstraZeneca is also reportedly concerned about how quickly Europe is falling behind the U.S. and China when it comes to medicine innovation. Chief executive Pascal Soriot is also known to be frustrated by the restrictions on approvals of new drugs and treatments by the state-owned National Institute for Health and Care Excellence, or NICE – such as breast cancer drug Enhertu.

American Future?

AJ Bell investment director Russ Mould said this could be a first step to a bigger embrace of the U.S. “While there is logic to shifting to a direct listing in the US rather than American Depositary Receipts beyond setting up for any longer-term moves, it does at least hint at the possibility of a more dramatic shift at some point in the future,” he said. “Big investors could well end up asking questions about AstraZeneca’s ultimate intentions ahead of a vote on the change later this year.”

Richard Vosser, analyst at JP Morgan was impressed by the move reiterating his Buy rating on the stock and keeping a price target of 14,000p.

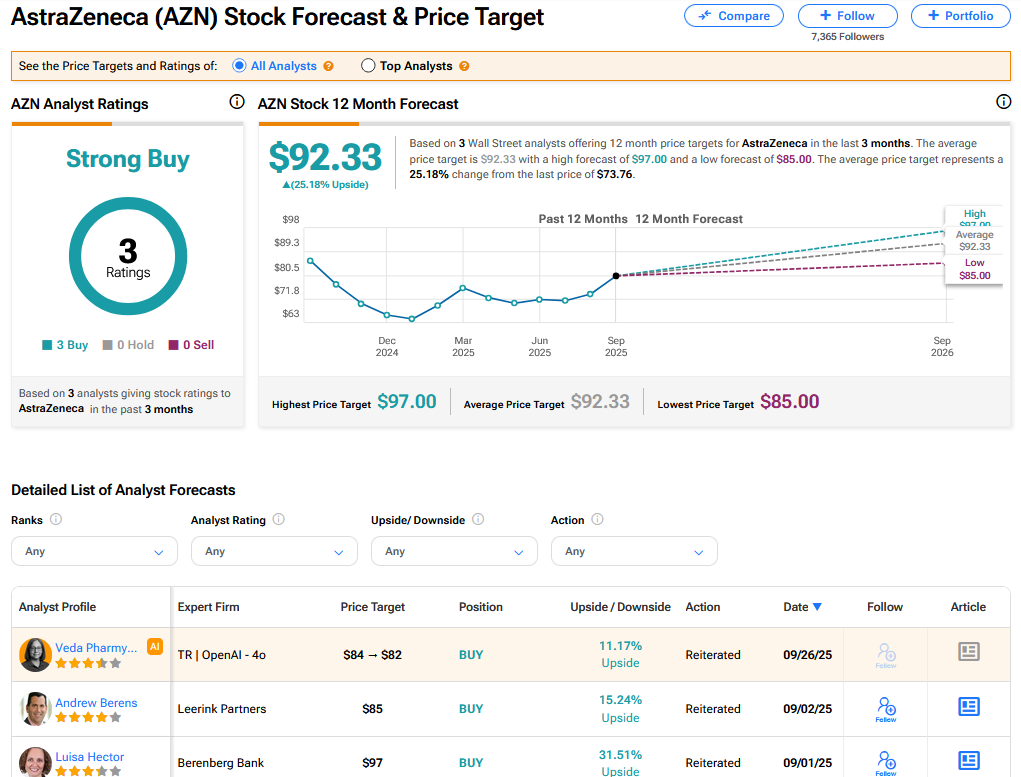

Is AZN a Good Stock to Buy Now?

On TipRanks, AZN has a Strong Buy consensus based on 3 Buy ratings. Its highest price target is $97. AZN stock’s consensus price target is $92.33, implying a 25.18% upside.