In what is the largest auto retail acquisition since 2021, the automotive retailer and service provider Asbury Automotive (NYSE:ABG) has agreed to acquire Jim Koons Automotive Companies. The latter is the ninth-largest private dealership group in the U.S.

Jim Koons brought in $3 billion in revenue last year and sold over 61,000 units. The company has a major presence in the Washington D.C., Baltimore, and Philadelphia regions, and this acquisition is expected to significantly boost Asbury’s footprint in key auto markets.

The sale encompasses 20 dealerships, 29 franchises, six collision centers, and marquee Toyota and Stellantis dealerships in the U.S. Asbury’s existing portfolio includes 138 dealerships and 32 collision repair centers.

Asbury plans to fund the transaction with its available cash and credit facility. The transaction is anticipated to close in either the fourth quarter of 2023 or early in the first quarter of 2024.

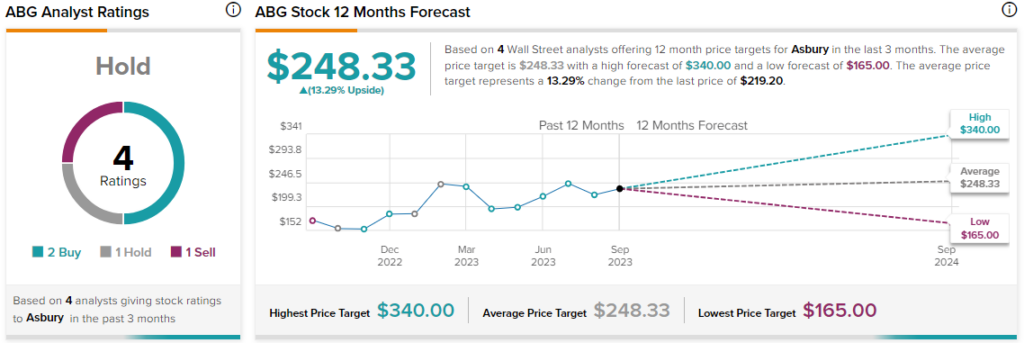

Overall, the Street has a consensus price target of $248.33 for Asbury, along with a Hold consensus rating. The company’s shares have gained nearly 29% over the past year.

Read full Disclosure