Zoom Video Communications (NASDAQ:ZM), commonly just called Zoom, isn’t a market darling in 2024. Look at the big picture, though, and you’ll surely see that Zoom can demonstrate growth and top Wall Street’s expectations. Hence, even though few traders are paying attention to the company, I am bullish on ZM stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

California-based Zoom provides a popular video-conferencing platform. During the onset of the COVID-19 pandemic and the ensuing lockdowns, Zoom’s software was in high demand, and the share price zoomed higher.

By last year, however, the landscape had changed dramatically, and Zoom had lost its market-darling status. On the other hand, that’s why contrarian investors should be more interested in Zoom than they’ve been in a long time. Don’t just take a contrarian trade yet, though, as it’s important to check Zoom’s financials before deciding whether to hit the “buy” button or not.

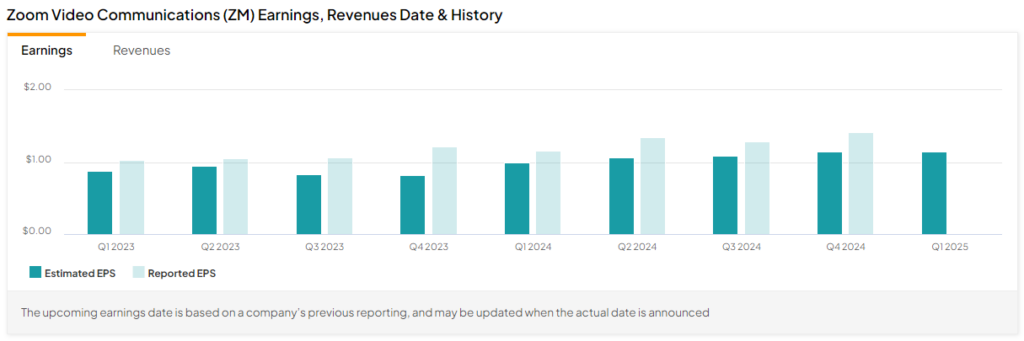

Have You Seen Zoom’s Earnings Track Record?

Here’s a perfect example of why I use TipRanks’ tools every day. On the earnings page for Zoom, I could see at a glance that the company is consistently profitable, has a stellar track record of quarterly EPS beats, and has (with a few hiccups along the way) grown its quarterly EPS over time.

You can also check out the Zoom stock chart and see that it went up today. It’s not difficult to figure out why this occurred, since Zoom recently released its financial results for the fourth quarter of Fiscal Year 2024 as well as for the full fiscal year.

It’s funny how analysts can look at the same quarterly press release and come up with different assessments. For example, JPMorgan Chase (NYSE:JPM) analysts claim (according to Reuters) that Zoom’s results “do not convey a materially improving business.” The JPMorgan Chase analysts reiterated their Neutral rating on ZM stock and cut their price target on the shares from $83 to $80.

In contrast, Wells Fargo (NYSE:WFC) analyst Michael Turrin told Bloomberg that Zoom’s newly announced share buybacks (which we’ll cover in a moment) are likely to be the biggest area of focus for investors. Furthermore, Turrin believes that this new share-repurchase announcement “answers one element of uncertainty” around how Zoom will use its stockpile of cash.

So, let’s talk about the big announcement. Zoom’s board of directors approved a program authorizing the repurchase of up to $1.5 billion of the company’s common shares. That’s positive news, as it signals the company’s self-confidence and could also help to keep the share price up for a while.

Don’t Sleep on Zoom’s Impressive EPS Beat

Even if you may have overlooked Zoom in 2023, don’t sleep on ZM stock, as the company actually ended last year with strong results. In particular, while Wall Street expected Zoom to have earned $1.15 per share in Q4 of FY2024, the company easily beat that with earnings of $1.42 per share.

Moreover, Zoom’s quarterly revenue increased by 2.7% year-over-year to $1.15 billion, surpassing the consensus estimate by $18 million. That’s not massive revenue growth or a gigantic Street beat, but it’s pretty good since some people probably assumed that Zoom was a struggling company in late 2023.

One notable data point for Zoom is that the company’s Q4-FY2024 Enterprise revenue grew 4.9% year-over-year to $667.3 million. This is why I disagree with the JPMorgan Chase analysts’ claim that Zoom’s results don’t “convey a materially improving business.” We shouldn’t just dismiss the nearly 5% improvement in Zoom’s revenue from business customers.

Finally, I should touch upon a crucial aspect of Zoom’s financials. The company’s fourth-quarter FY2024 operating cash flow increased 66% year-over-year, believe it or not, to $351.2 million. Plus, for the full Fiscal Year 2024, Zoom’s operating cash flow grew 23.9% year-over-year to $1.599 billion. So, again, I disagree with the contention that Zoom doesn’t have a “materially improving business.”

Is ZM Stock a Buy, According to Analysts?

On TipRanks, ZM comes in as a Hold based on two Buys, five Holds, and two Sell ratings assigned by analysts in the past three months. The average ZM stock price target is $76.25, implying 13.2% upside potential.

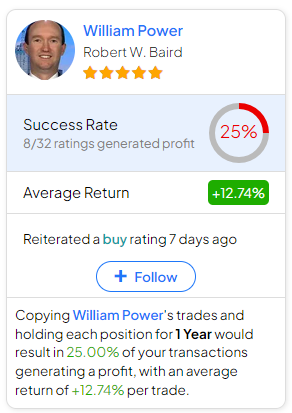

If you’re wondering which analyst you should follow if you want to buy and sell ZM stock, the most profitable analyst covering the stock (on a one-year timeframe) is William Power of Robert W. Baird, with an average return of 12.74% per rating. Click on the image below to learn more.

Conclusion: Should You Consider ZM Stock?

Many people overlooked Zoom during the past couple of years, but that’s not a bad thing for opportunistic, contrarian-minded investors. Just look at the actual data and form your own conclusion about whether Zoom has demonstrated a “materially improving business.”

Besides, Zoom surpassed Wall Street’s top-line and bottom-line estimates, and the company plans to buy back its own shares. Therefore, even though the share price just popped, I am still strongly considering a buy-and-hold position in ZM stock today.