Amid growing uncertainty, investors are hunting for resilient stocks, such as Yum! Brands (NYSE:YUM), which owns top brands like Pizza Hut, KFC, and Taco Bell. That’s because no matter what the world does, it won’t stop eating! The stock continues to be resilient thanks to its premium business model, global expansion, and growth across its brands as well as expected tailwinds from China’s recovery. Still, while it remains a potential long-term buy among defensive stocks, I will wait for a better entry point, as the stock looks fairly valued at current levels.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Looking at its recent results, Yum! Brands reported an upbeat Q4, topping both revenues and earnings expectations despite weakness in the Chinese region impacting its Pizza Hut and KFC segments. Even more impressive was that YUM continued to report expanding operating margins across all its major brands. For instance, its Q4 operating margin improved by 530 basis points (bps) to 34.5% in the Pizza Hut segment.

With the stock trading close to its all-time high of $136+, let’s look at the underlying fundamentals to make an investment decision.

Robust Growth from Unit Expansion Despite Headwinds

The most noteworthy takeaway from YUM’s Q4 results was the resilience of the business. Undaunted by the macroeconomic challenges, the company opened 4,560 gross units and added 3,100 net new units during 2022, taking its total restaurant count to over 50,000. Unit development across all its major brands and international expansion is laudable, especially given the challenges in key markets like China and Russia.

Brand-wise, the company successfully opened 496 gross new Taco Bell units, 2,447 gross new units at KFC, and 1,584 new Pizza Hut units. Thanks to the new units added, YUM’s total restaurant count surged to 55,361 at the end of 2022, which is very impressive.

Overall, global same-store YUM sales grew 6% year-over-year, driven by a strong performance from the Taco Bell segment, which recorded same-store sales growth of 11%. Specifically, strong momentum at Taco Bell in Q4 was aided by net unit growth as well as an acceleration in international development.

The company has also benefited from a number of strategic initiatives that include revamped food menus with value offerings, shifting to digitalization, and content marketing campaigns to attract more customers.

The benefits of scale across the three brands coupled with margin upside bode well for the stock in the long run. On top of that, a recovery in the Chinese market should add to its revenues and margins.

Impressive Dividends and Buybacks

YUM has consistently grown its quarterly dividend and continued even in FY2022 despite a tough economic environment. Concurrent with its Q4 earnings, the company increased its quarterly dividend by 6.1% to $0.605 per share. Overall, the firm has recorded an annual dividend growth rate of 14% over the past five years.

YUM’s current dividend yield is attractive at 1.85% and is superior to its peer group average of 0.6%. Its five-year average dividend payout ratio of 43.7% and its current payout ratio of 49% are also reasonable.

On top of that, YUM repurchased 10 million shares in 2022 worth $1.2 billion. Combined with the dividend, the company returned approximately $1.85 billion (over 5% of the current market cap) to investors in 2022.

Is YUM Stock a Buy, According to Analysts?

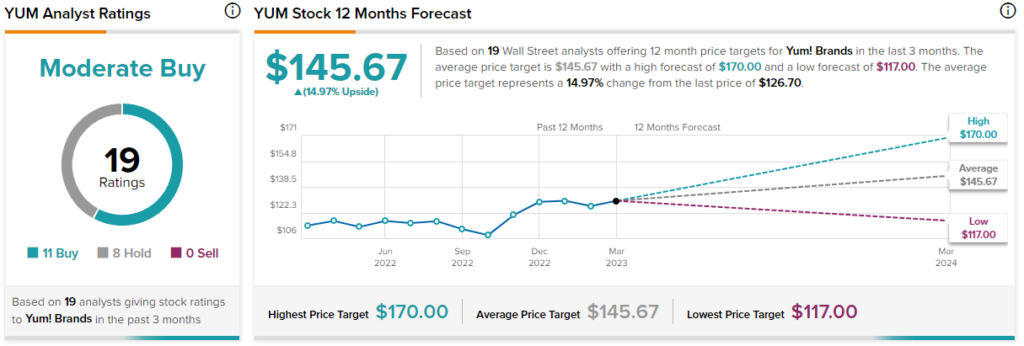

Turning to Wall Street, analysts are cautiously optimistic about YUM stock, giving it a Moderate Buy consensus rating based on 11 Buys and eight Holds. Further, Yum! Brands stock’s average price forecast of $145.67 implies 15% upside potential.

YUM Stock Looks Fairly Valued

In terms of its valuation, YUM has mostly traded at a premium to its peers. Nonetheless, the premium is justified given its favorable industry-leading position and the three well-known, growing brands under its radar.

Presently, the company is trading at P/E ratio of 28x, higher than the peer group median of 12x. In addition, it is trading close to its own five-year average of 29x. However, it’s relatively cheaper than its top competitor McDonald’s (NYSE:MCD), which is trading at a P/E of 32x.

Conclusion: Wait for a Better Entry Point

YUM is a top stock, as it offers great defense during uncertain times. In addition, its fundamentals remain sturdy, backed by a strong balance sheet and unit growth among its top three brands — KFC, Taco Bell, and Pizza Hut.

While its revamped menus with something for every consumer, be it value or premium items, should continue to satisfy customers, the stock remains fairly valued at current levels. Therefore, any share price dip in the coming months could be a good buying opportunity. Until then, though, I’ll stay on the sidelines.