British American Tobacco (NYSE:BTI) stock looks better than ever. The London-based tobacco and nicotine products giant behind Camel, Natural American Spirit, Newport, Vuze, and Velo, among other brands, is currently trading at an all-time low valuation. Simultaneously, shares are also offering their highest dividend yield in at least the past 25 years, which currently stands at 9.2%. Despite valid concerns that justify its decline, BTI’s investment case is too good to ignore at this point. Hence, I’m bullish on BTI stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What’s Driving BTI Stock Lower?

Shares of British American Tobacco have declined by about 9% over the past year. More importantly, though, the stock has been on a gradual decline since 2017. This raises the question of what’s driving BTI stock lower. In my view, the stock’s prolonged decline can be attributed to three factors — investors’ dislike of the tobacco industry, higher interest rates, and risks related to regulation. Let’s take a deeper look.

1. Investors’ Dislike of the Tobacco Industry

In recent times, the tobacco industry has found itself facing a notable lack of enthusiasm from investors, a sentiment echoed across major players such as Altria (NYSE:MO) and Imperial Brands (GB:IMB). Several factors contribute to this widespread investor disinterest.

They range from the inherent challenges related to the heavily regulated nature of the industry to its perceived non-alignment with ESG principles. Worries over the long-term sustainability of the industry also contribute to this concept due to the notion of a shrinking smoking population.

2. Rising Interest Rates Challenge BTI’s Income Appeal

When it comes to interest rates, high-yielding dividend stocks such as British American Tobacco can be notably affected by sudden increases, given that their income allure tends to diminish. Investors often anticipate that a significant portion of their future returns will be derived from the stock’s dividends.

Therefore, as the “risk-free” rate in the market rises, there is a parallel escalation in the returns expected by investors from British American Tobacco. The mechanics of this are simple: the stock’s equity risk premium experiences an upswing, leading to a decline in its shares and, consequently, an advancement in its dividend yield.

3. Regulation-Related Risks

BTI’s stock is feeling the weight of regulatory concerns, and it’s important to consider the broader picture. The industry it’s a part of operates in a landscape of increasing regulations, with government entities taking a strong stance against smoking and vaping. For instance, France is gearing up to ban disposable vapes as part of a national effort to discourage smoking. Australia is also eyeing a ban on recreational vaping.

These regulatory changes, with potential global implications, are causing some concern among investors. There’s a sense of caution about how these trends might impact BTI’s financials in the long run, and the stock price reflects that.

Rock-Solid Results Despite Bearish Drivers

Despite the bearish factors discussed earlier that have been pushing down British American Tobacco’s stock, the company has demonstrated remarkable resilience in its most recent H1-2023 results. BTI’s results even improved (mostly) compared to the previous year.

Combustibles Segment

As anticipated by the market, the Combustibles segment of the company witnessed a 5.8% decline in volumes during the first half of Fiscal 2023, primarily attributed to the sustained, long-term reduction in the number of smokers.

Despite this, the unique nature of cigarettes as highly addictive and inelastic products implies that smokers exhibit a relative insensitivity to price increases. Capitalizing on this characteristic, the company resorts to raising the prices of its combustible products. These hikes often surpass the rate of decline in shipment volumes. Consequently, despite the reduction in combustibles volumes, British American Tobacco posted 0.4% growth in revenue for this segment, reaching £10.5 billion.

Non-Combustibles Segment

Recognizing the limitations of perpetually raising prices as a viable long-term strategy, British American Tobacco has proactively adapted to the evolving market landscape. Much like its industry counterparts, the company has strategically diversified its product portfolio to include non-combustible alternatives, which have swiftly gained traction across various markets.

In particular, the Vapour category, featuring the Vuze electronic cigarette, witnessed a remarkable surge of 35.5% in revenues during H1 2023, reaching an impressive £837 million. Furthermore, glo tobacco-heating products and VELO oral tobacco displayed noteworthy growth, with year-over-year increases of 10.2% and 42.4%, respectively.

While these recently introduced categories currently contribute approximately 12% to the overall revenue, their collective growth rate of 27.9% in H1 2023 signifies a promising trend toward an augmented share of revenue derived from smokeless nicotine products. In light of this shift in consumer preferences, British American Tobacco is strategically positioned to capitalize on this transformative trend.

Strong Profitability Supports the 9.2%-Yielding Dividend

With BTI’s revenues holding strong, so does the company’s profitability. This is a crucial point regarding its investment case, as it means that the 9.2%-yielding dividend remains well supported. Specifically, with growing revenues in both its Combustibles and Non-Combustibles categories, BTI’s profitability also improved for the first half of the year. Adjusted EPS for H1 2023 of £181.6p was up 5.3% year-over-year.

Following a strong first half of the year, management felt confident to retain its prior guidance, expecting adjusted EPS growth in the mid-single digits. Adjusted EPS was £371.4p last year. Assuming a modest growth rate of about 4% based on management’s guidance, the result for this year would be £386.3. Thus, the current annual dividend of £230.88 remains more than well-covered, suggesting that BTI can continue its annual dividend increases.

BTI’s Valuation is at an All-Time Low

British American Tobacco is positioned for record adjusted earnings per share this year based on management’s guidance. Coupled with its continuous decline, the stock’s valuation is currently hovering near all-time-low levels. At a forward P/E at just 6.6X, BTI stock has never traded this low in at least the past 20 years, with its valuation multiple usually hovering in the double digits even during challenging years. This presents a significant margin of safety for current investors, especially considering its robust yield.

Is BTI Stock a Buy, According to Analysts?

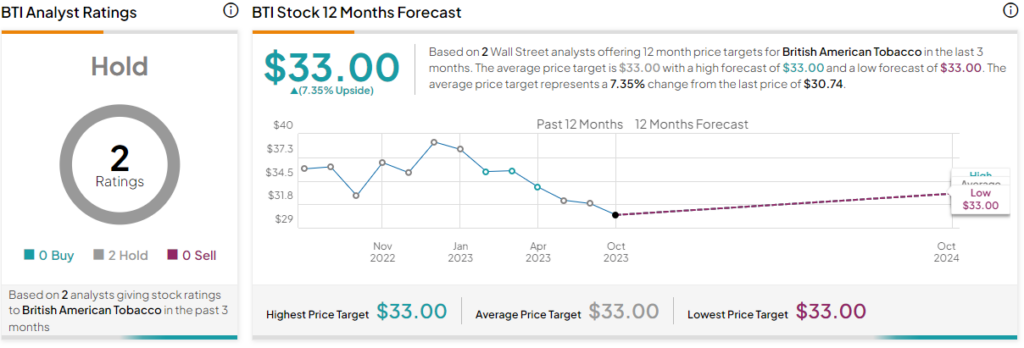

Turning to Wall Street, British American Tobacco has a Hold consensus rating based on two Holds assigned in the past three months. At $33.00, the average British American Tobacco stock forecast implies 7.35% upside potential.

The Takeaway

In conclusion, British American Tobacco faces undeniable headwinds stemming from investor aversion to the tobacco industry, rising interest rates, and regulatory risks. Yet, the company showcases remarkable resilience, reporting robust results despite a challenging environment. The shift towards non-combustible products, evident in the growth of categories like Vapour, glo, and VELO, signals adaptability to evolving consumer preferences.

With strong profitability supporting a 9.2% dividend yield and a historically-low valuation, BTI appears poised to provide long-term value. As the company navigates industry challenges and embraces innovative trends, it remains a compelling investment opportunity.