While the hydrocarbon industry may be relevant, the rough ride that the sector incurred leaves many questions. In particular, options traders that were vigorously bearish on midstream operator Williams Companies (NYSE:WMB) appeared to drastically change their minds. While it’s a completely speculative hypothesis, the aberrant derivatives market action combined with broader fundamentals suggest that WMB stock could be a near-term Buy. Therefore, I’m bullish on WMB stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Bears Pounce on WMB Stock but Then Back Off

As the inflation rate skyrocketed against pre-pandemic norms, one of the biggest sources of struggle stemming from price acceleration centered on the pain at the pump. Despite the rising popularity of EVs, a majority of drivers still depend on combustion-based mobility. Therefore, when disagreements between members of the Organization of the Petroleum Exporting Countries (OPEC+) sent crude prices southward, drivers rejoiced.

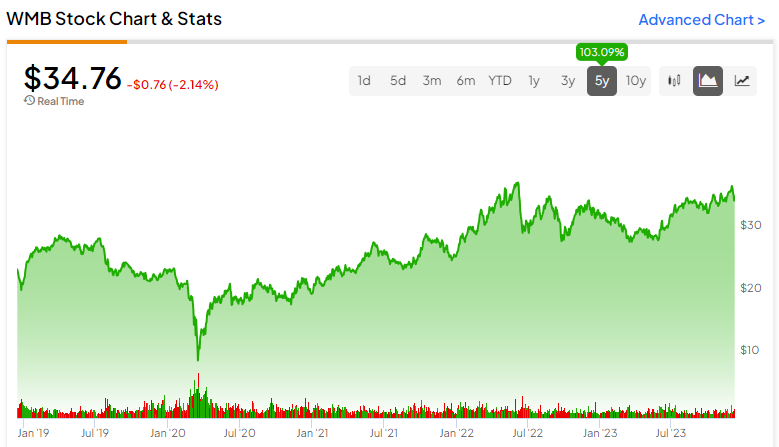

However, the deflationary sector winds did not bode well for the hydrocarbon sector, particularly impacting upstream (exploration and production) players. Now, Williams enjoyed insulation as an operator in the midstream (storage and transportation) value chain; that is, the company benefited from infrastructural relevance. Thus, WMB stock gained over 10% year-to-date. Still, considering the sudden headwinds in crude oil, the bears targeted Williams.

On December 6, options flow data posted multiple big block transactions selling WMB stock call options, specifically, 27,014 contracts of the Jan 19 ’24 32.00 call. At face value (assuming no integration of complex multi-tiered strategies), the trading entities assumed that by the expiration date of January 19 of next year, WMB would not materially rise above the $32 strike price.

Notably, the total premium collected stood at more than $1.14 million. Further, the spot price at the time of the transaction was $35.87. Therefore, so long as WMB stock doesn’t significantly rise above the spot price, the bearish speculator(s) should be profitable.

TipRanks data confirms the same, noting that the sentiment for the transaction on December 6 was “bearish.” However, something very unusual happened. From a total volume of 32,014 contracts and open interest of 9,338 contracts, these metrics fell the following day to 171 contracts and 1,333 contracts, respectively.

Something’s Not Right with This Trade

Obviously, the most glaring oddity about this transaction was the complete lack of information history. If tens of thousands of call options were sold (written) on day one, and the same traders backed out of this transaction – through buying the sold calls – the next day, that should be reflected in the volume count.

Without going down a rabbit hole, one possible explanation is that the countervailing transaction as part of off-exchange trading. If so, such a transaction might not be reflected in public resources. Having checked other options reports, this oddity is not exclusive to TipRanks.

However, that’s more of a minor detail. The bigger question is as follows: why would a bearish trader back out of the transaction just 24 hours after placing it?

At the time the trader or traders sold the massive volume of calls, the option price closed at $3.88. The following day, the price dropped 5.93% to $3.65. For a call holder, a declining option price is bad news because the derivative contract is moving further away from the money. However, for a call writer, a declining option price translates to a greater likelihood of collecting the maximum premium for underwriting the risk.

Suddenly, though, the high open interest fell to a stunning low. And as the Jan 19 ’24 30.00 call demonstrates, this is not the only time that bearish call writers quickly backed out of their net-short positions.

Fundamental Winds Can Shift

So, what could be the explanation for the sudden shift in behavior? Frankly, it’s all speculation, so investors should deploy considerable due diligence. That said, it’s possible that the seemingly negative fundamentals (for oil players) could eventually shift positively.

For one thing, OPEC+ members are determined to cut oil production, which should be net bullish for crude oil prices. Further, geopolitical tensions in Eastern Europe and the Middle East remain hot, if not getting hotter. That’s probably not going to ease up anytime soon, which is cynically positive for oil-related investments.

Is WMB Stock a Buy, According to Analysts?

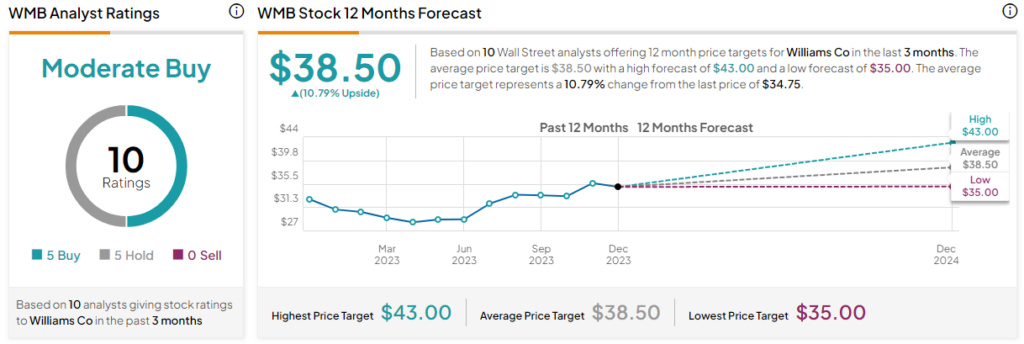

Turning to Wall Street, WMB stock has a Moderate Buy consensus rating based on five Buys, five Holds, and zero Sell ratings. The average WMB stock price target is $38.50, implying 10.8% upside potential.

The Takeaway: Exploiting the Bears’ Cold Feet in WMB Stock

Traders initially bet that Williams shares would fall but abruptly reversed course by buying back their bets, hinting at a potential price rise. This unexpected shift, combined with other favorable factors like OPEC production cuts, suggests that WMB stock might be a good near-term speculative idea.