Media reports are abuzz that the Organization of the Petroleum Exporting Countries and allies (OPEC+) are planning deeper production cuts to increase oil prices. Additionally, a severe storm in the Black Sea region could hamper oil exports, potentially providing additional support to oil prices. The combination of production cuts and supply disruptions will likely prop up oil prices and benefit companies like Exxon Mobil (NYSE:XOM) and ConocoPhillips (NYSE:COP).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Against this backdrop, let’s check what the Street recommends for XOM and COP stocks.

What is the Exxon Stock Prediction?

Higher oil prices represent a positive development for Exxon, a leading integrated oil and gas company. This could lead to an uptick in XOM stock. Investors should note that Exxon’s earnings and cash flows got a solid boost from the rally in oil prices following the easing of COVID-19-led restrictions. Further, increased production and cost control measures will cushion earnings.

XOM stock has a Moderate consensus rating based on 14 Buy and five Hold recommendations. Analysts’ cautiously optimistic outlook stems from an uncertain macro environment. Nonetheless, these analysts’ average price target of $129.21 implies 26.26% upside potential.

Is COP Stock a Good Buy Now?

According to the analysts’ consensus rating, ConocoPhillips is a good buy now. Given the expected increase in oil prices, COP will likely generate robust earnings, which will support its share price. Moreover, there is potential for continued debt reduction and the distribution of cash to shareholders.

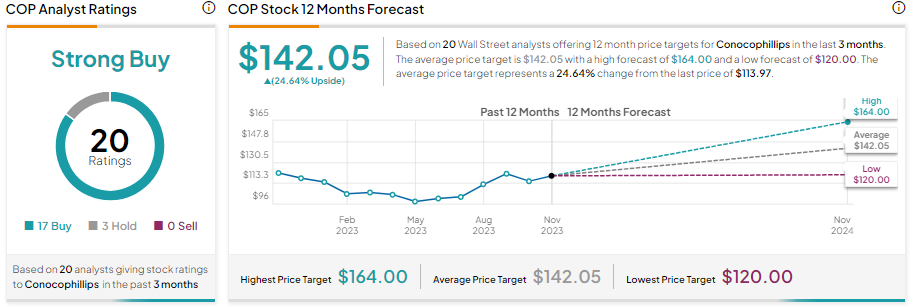

With 17 Buy and three Hold recommendations, COP stock has a Strong Buy consensus rating. Further, analysts’ average COP stock price target of $142.05 implies 24.64% upside potential from current levels.

Bottom Line

An elevated oil price scenario favors XOM and COP, strengthening their profitability and bolstering their cash reserves. A strong cash position will enable these companies to lower debt and enhance shareholders’ returns via dividends and share buybacks.