The shares of General Electric (NYSE:GE) have gained nearly 5% in the past five days. This uptrend in stock price can be attributed to the discussions surrounding the potential collaboration between GE and India’s Hindustan Aeronautics Ltd. for the co-production of jet engines to be used in Indian military aircraft. Given the recent rally, GE stock is up about 59% year-to-date. Additionally, Wall Street top analysts’ consensus ratings and an Outperform Smart Score of nine indicate that GE stock might continue to perform well.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The deal is expected to be officially confirmed later this month by Indian Prime Minister Narendra Modi and US President Joe Biden. It is noteworthy that if the deal successfully materializes, GE stock is poised to reap the benefits.

Furthermore, the company has been focused on improving its performance with its turnaround plan, which includes the spin-off of its three divisions. Earlier in January, General Electric completed the spin-off of its healthcare business. These strategic initiatives will help the company focus on the lucrative aviation business, which bodes well for its future performance.

Moreover, at its GE’s first-quarter earnings release on April 25, management raised the lower end of its earnings guidance for the current year based on a strong performance and a 25% surge in orders during the reported quarter. The company now expects to report EPS between $1.70-$2, compared to the previously guided range of $1.60 to $2.

Is GE a Good Stock to Buy Now?

Given the successful execution of GE’s strategic plan and improving prospects for aerospace companies, General Electric appears to be in a favorable position for growth. However, it is important to note that uncertain macroeconomic conditions continue to be a significant concern.

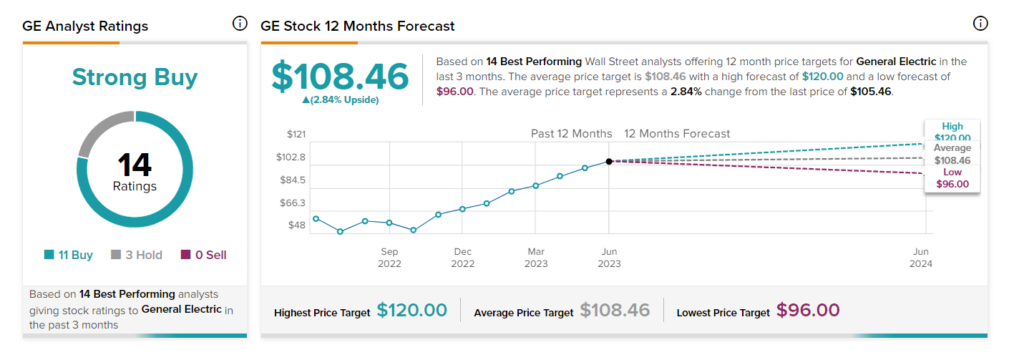

Out of the 13 top analysts who recently rated GE stock, 11 assigned a Buy rating and three suggested a Hold. Overall, top analysts are optimistic about GE with a Strong Buy consensus rating. Further, the consensus 12-month price target of all top analysts of $108.46 implies an upside potential of 3%.

It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations. Moreover, each analyst has a remarkable success rate.