General Electric Company (NYSE:GE), the American industrial giant that has stood the test of time since its incorporation in 1892, completed the spin-off of its healthcare business on January 3. Back in 2021, General Electric announced a plan to form three public companies focused on aviation, healthcare, and energy. The healthcare business spin-off was a part of this broad plan to restructure the company’s business, and General Electric is on track to spin off its energy business next year. Although there will be some short-term pains for shareholders, GE stock is likely to head higher in the long run as the company executes more asset sales.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

General Electric shareholders received one share of GE HealthCare Technologies (NASDAQ:GEHC) for every three shares of General Electric stock held, and the company retained a 19.9% stake in GEHC, approximately.

The completion of the healthcare spin-off is a clear indication that General Electric is successfully executing its turnaround plan under the leadership of Larry Culp. GE stock is likely to suffer some pains in the coming months as the energy business spin-off approaches. I am bullish on the long-term prospects for General Electric, as the company is moving in the right direction by executing its strategic divestment plan to become a leaner business focused on aviation.

Shareholders Will Benefit from Three Individual Businesses

From an accounting perspective, a conglomerate is usually worth less than the sum of its parts because some of its parts – or business segments – could underperform others and thereby drag the business down. Even some of the best-run conglomerates in the world tend to suffer from management inefficiencies resulting from the massive size and scale of the organization. Diversifying into several non-related business lines could make it difficult for a company to retain its core values. A conglomerate discount is therefore applied when assessing the intrinsic value of a diversified conglomerate.

General Electric’s crown jewel is its aviation business, but the challenges faced by the company’s energy business have overshadowed the bright prospects for this segment. GE Aerospace is one of the leading manufacturers of jet engines and integrated systems for commercial and military aircraft. The company’s clients include the likes of Boeing (NYSE:BA) and NASA, and the expertise brought to the table by GE Aviation is considered second to none in the industry.

With the healthcare business now out of the picture while the energy business is scheduled to be spun off next year, the high-margin aviation business will attract the eyeballs of investors starting in 2024, which is good news for shareholders.

Data published by the Transportation Security Administration highlights the stellar recovery of airline passenger traffic in recent months, which is now close to pre-pandemic levels. For instance, in the week ending December 31, 2022, 14,780,439 passengers crossed airport security terminals compared to 16,102,233 in the same period in 2019.

Additionally, travel throughput in the last week of 2022 was substantially higher than in 2020 and 2021 and only marginally lower than in 2019, which suggests the travel sector is almost fully recovered from pandemic woes. This is encouraging news for GE Aviation, as the airline industry is likely to invest in new technologies as business conditions normalize.

General Electric’s strategic spin-offs will help bring the aviation business into focus while promoting growth-oriented decision-making at these three businesses at the individual level. Managers of each of these businesses will have more freedom to focus on what matters to their businesses as well, which should create notable efficiencies in the long run.

Investor Sentiment Toward GE Could Deteriorate in the Short Run

General Electric’s energy business is on track to be separated from the company under the name GE Vernova in 2024. The company’s energy portfolio, including renewables, power, and energy financial services, will be combined into a single business segment under GE Vernova.

Although the company’s individual business units are likely to be more valuable than the sum of its parts, the energy business is facing several headwinds stemming from the uncertainty regarding General Electric’s natural gas business. These challenges are likely to come into the spotlight in the coming months as investor focus shifts to the energy spin-off planned for the next year.

Is GE Stock a Buy, According to Analysts?

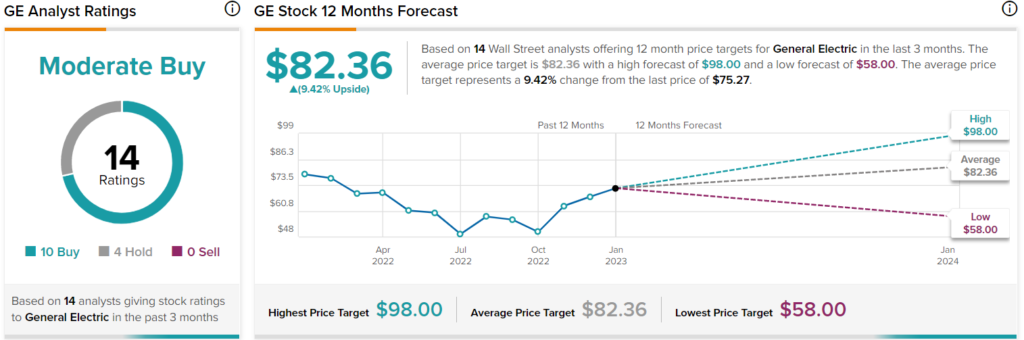

Wall Street analysts are reacting positively to the spin-off of General Electric’s healthcare business. Barclays analyst Julian Mitchell raised his price target for GE from $92 to $96 on January 6, and he is not alone. Last December, RBC Capital analyst Deane Dray raised the price target for General Electric stock from $93 to $98, citing the value that is being created by asset sales. The average General Electric price target is $82.36 based on the ratings of 14 Wall Street analysts, which implies upside potential of 9.4%.

Takeaway: Short-Term Pains, Long-Term Gains

General Electric stock declined on January 4 following the spin-off of its healthcare business, as expected. To get a better idea of the relative price performance, investors should use adjusted share prices instead of unadjusted historical prices, as investors received GE HealthCare Technologies shares on a proportionate basis to their stake in General Electric. The company is moving forward with its asset sales as planned, and the planned spin-off of its energy business will likely lead to short-term volatility in GE stock before the full benefits of these decisions are visible.