CarParts.com (NASDAQ:PRTS) stock trended lower and lost about 55% of its value in one year, reflecting muted revenue growth and margin pressure. Nonetheless, analysts maintain an optimistic outlook on this penny stock (learn more about penny stocks here) and expect it to rebound over the next 12 months. CarParts.com is an e-commerce company providing a digital marketplace for selling automotive parts and accessories.

It’s worth noting that lower demand has pushed prices down, taking a toll on CarParts.com’s top-line growth rate. However, higher volumes and the company’s focus on increasing efficiency and reducing costs augur well for growth. Moreover, PRTS’ solid balance sheet with no debt is positive.

The company’s management highlighted that its labor costs are trending lower. Moreover, supply-chain issues have diminished. Further, PRTS is focusing on lowering its last-mile transportation costs.

Is CarParts.com Stock a Good Buy?

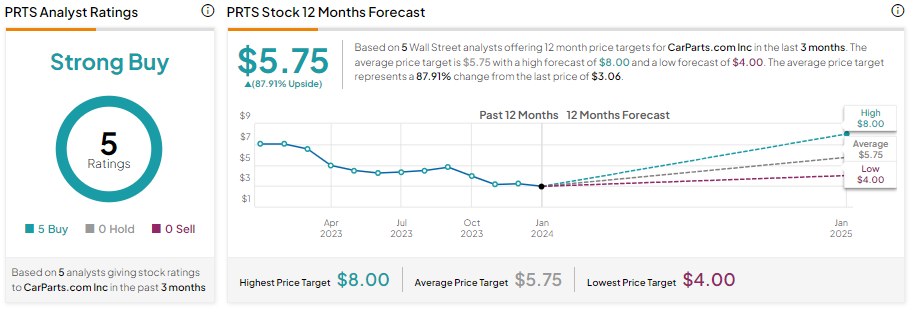

According to analysts’ ratings, CarParts.com stock is a good buy near the current levels. Five analysts cover PRTS stock, and all recommend a Buy. Further, analysts’ average price target of $5.75 implies 87.9% upside potential over the next 12 months.

Bottom Line

CarParts.com could continue to struggle in the short term due to weak demand and lower pricing. However, its strategic measures, including the modernization of its platform, will likely generate incremental revenues for the company by improving search results and bringing cross-sell and upsell opportunities.

Further, the company focuses on engaging with customers through the app, which will likely reduce costs associated with promoting its brand and products. Additionally, its digital shift, including the upgrade and cloud migration of its order management system and proprietary catalog, will likely save costs and drive its market share. These positives are reflected in analysts’ bullish outlook on PRTS stock.

While PRTS stock offers significant upside potential (based on analysts’ average price target), investors can leverage TipRanks’ penny stock screener to find more such compelling penny stocks.