Netflix (NASDAQ:NFLX) benefited significantly from the lockdowns that accelerated its subscriber growth rate. However, the easing of lockdown measures led to a sharp sequential slowdown in its paid subscriber growth rate in the first half of 2021.

Notably, Netflix added 3.98 million and 1.54 million subscribers, respectively, in Q1 and Q2 of 2021. This compares unfavorably with the 8.51 million subscribers it added in Q4 of 2020.

Given the slowdown in paid subscriber growth, Netflix stock underperformed the benchmark index in 2021. Netflix blamed a lighter-than-normal content slate due to production delays, and the pull-forward volumes in 2020 for the slowdown in the first half of 2021.

What’s Ahead in 2022?

Netflix expects a stronger content slate to boost its 2H21 performance. Notably, it benefitted from its solid content slate in Q3, as reflected through a sharp sequential growth in its net additions.

Looking ahead, Netflix expects its Q4 content slate to be strongest, implying that investors can expect the positive effects on its financial performance.

Netflix expects to add 8.5 million paid members in Q4, reflecting a sharp quarter-over-quarter increase from 4.38 million net additions in Q3.

It’s worth noting that Netflix is scheduled to announce its Q4 financials on January 20, and investors have been accumulating its stock.

Taking note of Netflix’s underperformance, Brian White of Monness stated that it “felt the brunt of difficult YoY comparisons in 2021.” However, White is bullish about Netflix’s prospect.

The analyst stated that “Netflix expanded its capabilities into new areas such as gaming and demonstrated what is possible on its platform with the runaway, global hit in Squid Game.” Further, he remains upbeat about Q4 content slate.

While Netflix will likely benefit from the higher paid net additions, its margins will take a hit from the big content releases in Q4.

Looking ahead, for 2022, White expects Netflix to benefit from paid subscribers growth and higher engagement. Moreover, he believes Netflix’s “stock can make up for lost time.”

Wall Street’s Take

Given the uncertainty, Wall Street analysts are cautiously optimistic about Netflix stock. Its Moderate Buy rating consensus is based on 23 Buys, 4 Holds, and 3 Sells. Further, the average Netflix price target of $677.50 implies 14.6% upside potential to current levels.

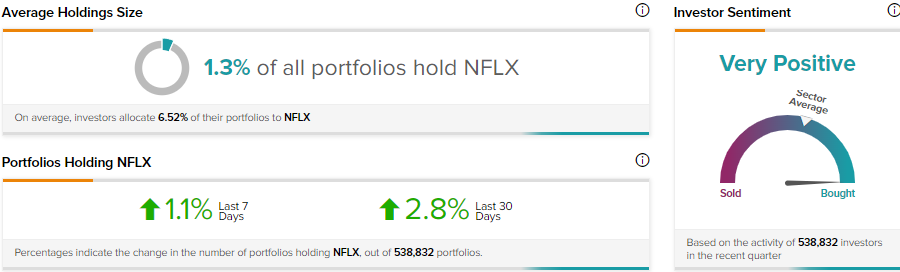

It’s worth noting that Netflix is scheduled to announce its Q4 financials on January 20, and investors have been accumulating its stock. TipRanks’ Stock Investors tool shows that about 2.8% of investors holding portfolios on TipRanks have raised their stake in NFLX stock in the last 30 days.

Download the mobile app now, available on iOS and Android

Disclosure: On the date of publication, Amit Singh had no position in any of the companies discussed in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >