Shares of online marketplace Etsy (NASDAQ: ETSY) have plunged nearly 55% year-to-date as part of the broader sell-off in growth stocks.

Etsy connects sellers of unique and handmade goods with interested buyers. The pandemic accelerated Etsy’s growth and helped boost the number of sellers on its platform to 5.3 million in 2021 from 2.5 million in 2019. Further, the number of buyers increased to 90 million in 2021 from 46 million in 2019.

Etsy has been in the news recently since several sellers opposed the company’s decision to hike its transaction fee to 6.5% from 5% effective April 11. An online petition signed by over 80,000 people demanded that Etsy cancel the fee hike and raised certain other issues, including a crackdown on resellers selling mass-produced goods on the platform.

Several Etsy sellers went on a weeklong strike to show their disappointment. Meanwhile, CEO Josh Silverman assured customers that most of the incremental revenue from the fee hike would be invested into marketing, seller tools, and enhancing the customer experience.

Financial Snapshot

Etsy’s better-than-anticipated Q421 results reflected that the company is not just a pandemic play. While growth rates have normalized, the company continued to perform well even after the reopening of the economy. Notably, Etsy’s Q421 revenue grew 16.2% to $717 million, building on the unprecedented growth experienced in the prior-year quarter due to the pandemic. Q421 EPS grew 2.8% to $1.11.

Given the tough comparisons with last year and fading pandemic tailwinds, Etsy forecast Q122 revenue in the range of $565 million-$590 million. However, analysts were expecting revenue of $630 million.

Word on the Street

Recently, Loop Capital analyst Laura Champine lowered her price target for Etsy to $115 from $140 and maintained a Hold rating. Champine noted that while the company exceeded analyst expectations last quarter, the macroeconomic environment has “materially worsened.”

Further, Champine pointed out that additional data points have been negative since she downgraded Etsy in late March to a Hold from a Buy.

Champine concluded that the consumer is “distracted and bothered by inflation” and consequently, investors should remain on the sidelines due to negative near-term catalysts.

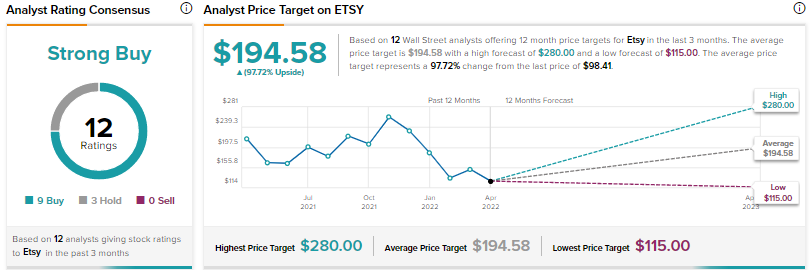

On TipRanks, Etsy scores a Strong Buy consensus rating that breaks down into nine Buys and three Holds. The average Etsy price target of $194.58 implies 97.72% upside potential from current levels.

Conclusion

While the financial impact of the strike by certain Etsy sellers is difficult to estimate at this point, a majority of Wall Street analysts remain optimistic about the company’s long-term prospects based on impressive execution and its strong position as a niche marketplace.

Meanwhile, TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, indicates that total estimated visits to the Etsy website across all devices increased by 50.25% year-over-year in Q122.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure