Recently, telecom giant AT&T (NYSE: T) delivered better-than-expected results for the second quarter of 2022. However, a significant decline in Q2 free cash flow sparked concerns about the impact of a challenging business environment. Investors are worried about the possibility of a tough macro backdrop further hurting the company’s cash flows in the quarters ahead.

AT&T’s Lower Cash Flows Overshadowed Many Positives

AT&T’s Q2 revenue declined 17.1% to $29.64 billion, marginally ahead of analysts’ expectations of $29.55 billion. Excluding the impact of divested businesses, including WarnerMedia, revenue grew 2.2%. Furthermore, adjusted earnings per share of $0.65 surpassed analysts’ consensus estimate of $0.61.

AT&T also reported better-than-anticipated postpaid phone net additions of 813,000. Robust subscriber growth helped AT&T raise its Mobility service revenue guidance to the range of 4.5% to 5%, from the previous outlook of at least 3% growth. AT&T also reported upbeat fiber net additions of 316,000.

However, what disappointed investors was a significant decline in AT&T’s free cash flow to $1.4 billion from $5.2 billion in the prior-year quarter. Higher investment spending and a delay of an average of two days by customers in paying their bills impacted Q2 cash flows.

AT&T also cited lower Business Wireline operating income and incremental investments to support higher subscriber growth as the reasons for lower free cash flows. Consequently, the company lowered its full-year free cash flow guidance to $14 billion from $16 billion. The new outlook implies that AT&T will have to generate nearly $10 billion of free cash flow in the second half of the year.

Analysts lower Price Targets after Q2 Results

In reaction to Q2 earnings, UBS analyst John Hodulik lowered his price target for AT&T stock to $24 from $25. The analyst continues to expect AT&T’s EBITDA (earnings before interest, tax, depreciation, and amortization) growth to accelerate, with the strength in Wireless and Consumer Wireline businesses more than offsetting the weakness in the Business Wireline unit.

Meanwhile, Barclays analyst Kannan Venkateshwar downgraded AT&T stock to a Hold from Buy, and cut the price target to $20 from $22. Venkateshwar believes that while Q2 results were hit by macro headwinds to a certain extent, they could raise questions about management’s credibility. The analyst feels that while the probability of a dividend cut by the company is low, the outperformance of AT&T stock relative to the broader market will moderate going forward.

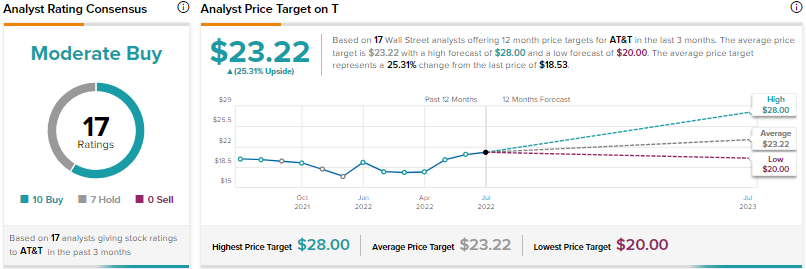

Overall, the Street is cautiously optimistic on AT&T stock, with a Moderate Buy consensus rating based on 10 Buys and seven Holds. The average AT&T price target of $23.22 implies 25.31% upside potential from current levels.

Conclusion

Wall Street analysts are less than optimistic on AT&T stock, due to near-term pressures on the company’s Business Wireline unit, increase in bad debt, and extended cash collection cycles.

So far, AT&T stock has been resilient and has fared better than the broader market. Several analysts seem optimistic about AT&T’s long-term growth, with the company investing significantly in the expansion of its 5G and fiber network. The stock also remains attractive for dividend-seeking investors.

It’s worth noting that as per TipRanks Smart Score System, AT&T scores a “Perfect 10”, implying that the stock could outperform the boarder market.