Though financial technology provider SoFi Technologies (NASDAQ: SOFI) attracted investors for its potential ability to bring money-related functionalities to modernity, the pandemic imposed a rude awakening. Specifically, with the higher education sector suffering immense disruptions from the new normal, SoFi temporarily incurred a hit to its key student-lending revenue channel. Now that the federal government is committed to a new plan regarding student loans, SOFI stock should theoretically swing higher. However, nothing occurs in a vacuum. I am bearish on SOFI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to TipRanks Team, on August 24, “U.S. President Joe Biden made a bold move and waived off student loans by $10,000 per student earning less than $125,000 annually, and $20,000 per student from low-income families registered for Pell grants.” Further, TipRanks reporter Swati Goyal noted that “Biden’s relief plan is expected to wipe out outstanding student loan balances for millions of borrowers.”

Still, as Goyal noted, the matter remains controversial. “While many people are happy with Biden’s student loan cancellation plan, others have complained that it is unfair. A major argument against the plan is that it would encourage people to borrow from the government and expect their debts to be forgiven. The President’s student loan forgiveness does not include private loans. As a result, it may also seem that the action could discourage borrowing from private lenders like Sallie Mae.”

However, market analysts generally viewed the framework as positive for SOFI stock. For instance, Mizuho (NYSE: MFG) analyst Dan Dolev sees an encouraging picture for the fintech firm. “Pulling forward the end of the moratorium can help improve clarity and may also result in a pull-forward in [refinance] demand in 4Q22, similar to what occurred in late 4Q21,” Dolev wrote.

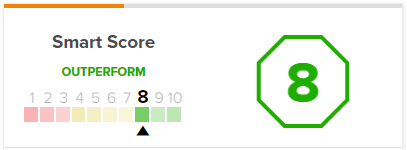

Also, on TipRanks, SOFI has an 8 out of 10 Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

Still, investors should be extremely careful about wagering on SOFI stock.

SOFI Stock Does Not Enjoy an Exclusive Benefit

Under the mainstream framework, the student debt relief program should be beneficial for SOFI stock because it forces borrowers to “game plan” their financial obligations. Put another way, the Biden administration cemented what students can expect. By understanding what benefits borrowers may receive and what remains to be paid off, college students can now reengage companies like SoFi to clear out the rest of the deck.

In theory, the narrative bodes well for SOFI stock. However, the main issue is that the debt relief program doesn’t offer an exclusive benefit to the fintech firm. If anything, the circumstances are now even more complex for SoFi Technologies.

To understand why, investors must appreciate how this student debt crisis came to a head. When the COVID-19 pandemic first capsized the U.S. economy, various agencies issued both monetary and fiscal responses. Ultimately, the money stock – per data from the Federal Reserve Bank of St. Louis – increased at an unprecedented scope and rate.

Now, the Federal Reserve is attempting to put the genie back in the bottle, primarily by attacking the subsequent inflation with high benchmark interest rates. Done effectively, this measure should reduce inflation. At the same time, rising interest rates equate to higher borrowing costs. As a consequence, student debt will become increasingly onerous.

In turn, forward-thinking investors may want to consider acquiring shares in companies specializing in blue-collar industries. While white-collar professions encounter both intense competition and layoffs, demand is simply exploding for tradespeople. Therefore, while Biden’s student debt plan initially appears bullish for SOFI stock, the Fed’s current actions will likely make attaining a four-year degree unattainable for many students.

On a net basis, then, it’s too early for analysts to consider SOFI stock as a bullish opportunity.

SoFi is Tied to Student Loans

The other major dilemma for SoFi Technologies is that during the pre-pandemic paradigm, student loans represented the company’s core revenue generator. However, with the present monetary environment making borrowing financially demanding, fewer people are likely to attend universities. That would hurt SOFI stock in the longer term, clarity or no clarity.

For instance, in the company’s presentation for its Q2-2022 earnings report, management noted that in Q1 2020 – just as the COVID-19 crisis began infiltrating the U.S. – student loan originations represented 63% of total originations. By Q4 of that year, student loans represented 43% of total originations.

Moreover, in Fiscal 2021, student loans represented about 34% of total loan originations. No longer the top segment, personal loans instead took over the reins, representing nearly 43% of all loans.

The point of mentioning this backdrop is that a substantial unforeseen headwind disrupted the student lending revenue channel. That forced SoFi to pivot to other sectors. Now, the headwind is rising borrowing costs – and if Fed chair Jerome Powell’s remarks are to be believed, those high borrowing costs will reach multi-decade plateaus.

Frankly, it’s difficult to understand how SOFI stock could not suffer from the current paradigm, irrespective of the potential economic value of clarity.

What is the Price Target for SOFI Stock?

Turning to Wall Street, SOFI stock has a Moderate Buy consensus rating based on five Buys, five Holds, and zero Sell ratings. The average SOFI stock price target is $8.00, implying 26.4% upside potential.

Conclusion: No Vacuum for SoFi

Should the student debt relief program be offered in a vacuum – with all other factors being equal – perhaps SOFI stock would be an upside opportunity. Indeed, it could be labeled a “no-brainer.” Unfortunately, investors must also consider the paradigm in which the debt relief is occurring.

Obviously, a major development like debt relief for students will reverberate across the economy. As well, with the Fed set to raise interest rates, attending a four-year university will become that much more financially onerous. Against this broader framework, people need to be cautious with their approach toward SOFI stock.