After a rough 2022, it’s only natural that investors look forward to good tidings this year. Unfortunately, investors still face various challenges down the line, making Wall Street’s “Strong Buy” pick Coca-Cola (NYSE:KO) an excellent place to park your money. With a balance between passive income and capital gains potential, the soft-drink giant stands poised to handle practically anything. Therefore, I am bullish on KO stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Following the hemorrhaging of red ink last year, the benchmark S&P 500 (SPX) is off to a relatively promising start. Gaining nearly 4.7% year-to-date, circumstances seem ready for a positive reversal of fortunes. However, it’s also important to consider the bigger picture. With excess liquidity still integrated into the monetary system and consumer sentiment still down in the dumps, investors need to be cautious.

Against these and other headwinds, KO stock delivers an encouraging profile. As TipRanks reporter Sirisha Bhogaraju stated, Coca-Cola posting solid results for its third-quarter earnings report confirmed its ongoing recession-resistant thesis. Not only did the soft-drink stalwart grow its top line by 10% to $11.1 billion, but it also raised its full-year outlook. Keep in mind that management did so despite “considerable currency headwinds and higher costs.”

Also, Bhogaraju noted that KO stock represents one of the dividend kings. The company raised its dividends for 60 consecutive years. At writing, KO’s dividend yield stands at 2.9%, above the consumer staple sector’s average yield of 1.9%. Should unusual circumstances occur down the line, investors will be glad they held Coca-Cola shares. Generally speaking, dividend stocks tend to be more stable.

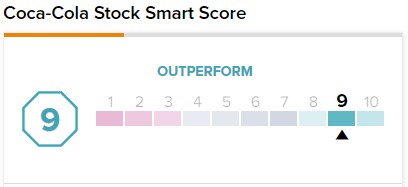

Supporting the bullish narrative, KO stock has a 9 out of 10 Smart Score rating. This indicates strong potential for the stock to outperform the broader market from here.

KO Stock Benefits from a Cynically Enticing Narrative

Looking ahead, an attractive attribute associated with KO stock centers on cynicism. Specifically, should broader economic circumstances erode, Coca-Cola could benefit. First, the core products themselves offer an addictive aura. Second, they can steal market share away from other caffeinated beverage providers.

Fundamentally, the vice plays in the consumption arena (i.e., fast food, soft drinks) command attention during rough economic cycles. As an ABC News report from its archives demonstrated, pizzerias thrived during the Great Recession. It wasn’t an unusual development if you understand basic psychology. Per Harvard Health, many people cope with difficult circumstances by eating comfort food.

The same can be said about Coca-Cola and its delectable soft drinks. With a combination of sugar, sweeteners, caffeine, and carbonation, they’re difficult to put down. During economically challenging cycles, soft drinks offer a much-needed pick-me-up.

And this latter point segues into another positive catalyst for KO stock — the underlying company’s ability to steal market share from alternative caffeinated beverage providers. Specifically, Starbucks (NASDAQ:SBUX) may be under threat. With inflation still elevated against historical norms and enterprises slashing good jobs by the thousands, consumers can’t be wasteful. Because grocery stores offer Coca-Cola products, the soft-drink maker wins the cost-comparison battle.

Coca-Cola’s Strategic Shift Pays Off

Despite Coca-Cola’s dominance, the rise of millennials and their penchant for healthier consumption habits put KO stock in a predicament. Unlike prior generations, millennials didn’t see the fascination of sugary beverages – at least not to a large magnitude. To address this dilemma, Coca-Cola made a strategic shift in 2018, rebranding its Diet Coke lineup with taller, slimmer packaging.

By logical deduction, the pivot appears to have succeeded. To be sure, the disruption of the COVID-19 crisis muddies the water. However, in 2019, the company posted revenue of $37.27 billion, up 8.65% from the prior year. Of course, Coca-Cola slumped in 2020 due to the pandemic. However, in 2021, it posted sales of $38.66 million, and in the trailing 12 months, the company is looking at a top-line performance of $42.34 billion.

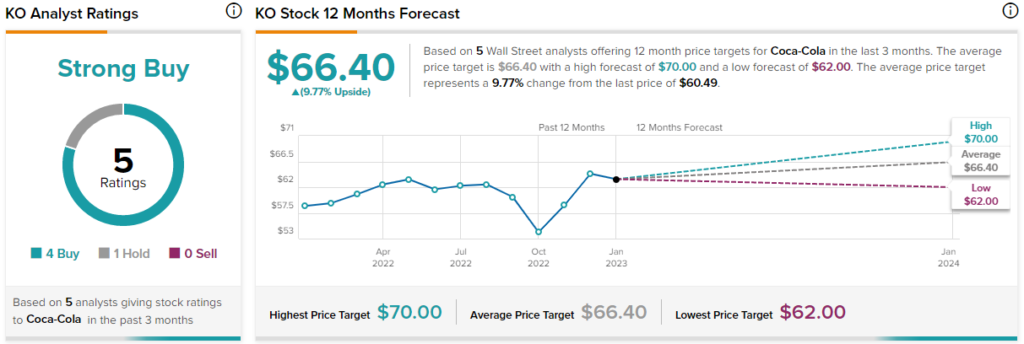

Notably, only one Hold rating prevents KO stock from achieving a unanimous Strong Buy consensus. Frankly, analysts have every right to be bullish on the underlying firm. Aside from its revenue growth, the company enjoys excellent profit margins. For instance, its net margin stands at 23.44%, above more than 94% of its peers.

What is the Price Target for KO Stock?

Turning to Wall Street, KO stock has a Strong Buy consensus rating based on four Buys, one Hold, and zero Sell ratings. The average KO stock price target is $66.40, implying 9.8% upside potential.

The Takeaway: KO Stock is Prepared for a Storm

Fundamentally, KO stock can accommodate whatever the economy throws at it. Should a bull market materialize, Coca-Cola’s strategic pivot toward millennials should pay dividends (both metaphorical and literal). However, if a downturn occurs, Coca-Cola’s cynically attractive products should keep the lights on.