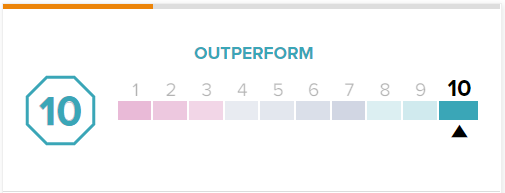

Royal Bank of Canada (TSE:RY) (NYSE:RY), also known as RBC, is the largest Canadian bank by assets, revenue, and market cap. It also has a ‘Perfect 10’ Smart Score rating, meaning that it has a high chance of outperforming the market. Based on our valuation below, we believe that RY stock has upside potential. Its growing 4.1% dividend yield and share buybacks are also nice bonuses for shareholders.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

RBC’s Dividend is Rock Solid. Buybacks are a Bonus

RBC has consistently paid dividends since 1870, similar to the Bank of Nova Scotia (TSE:BNS), which has consistently paid dividends since 1833. This is very impressive, to say the least. Its dividend is yielding 4.1% and has grown at a compound annual growth rate of about 8.1% in the past 10 years and 7.3% in the past five years. If the company keeps up its five-year dividend growth rate, it will double its dividend within 10 years. Also, its payout ratio of ~43% is in line with its historical average and suggests that its dividend is well-covered and has room for more growth.

In addition, RBC has been buying back shares recently, with a trailing-12-months buyback yield of 3.1% adding to shareholder returns.

Royal Bank of Canada Stock is Undervalued

To value Royal Bank of Canada stock, we will use the excess returns model, which is more appropriate for financial companies because they tend to have volatile free cash flows.

As a result, trying to create forecasts for them is ineffective. The excess returns model allows us to use historical numbers instead, which are actual results. There are a few steps to follow for this valuation method.

First, you calculate a company’s excess return, meaning the spread between its return on equity (ROE) and its cost of equity; a higher ROE than the cost of equity is a good thing. Next, you calculate its terminal value. Add them up, and you get your valuation. Here’s the formula:

- Excess Return = (Average ROE – Cost of Equity) x Book Value Per Share

- Terminal Value = Excess Return / (Cost of Equity – Growth Rate)

- Fair Value = Book Value Per Share + Terminal Value

We will use the following assumptions for our calculations:

Average return on equity (ROE): 16.5% (five-year average)

Cost of equity: 8.4%

Book value per share: C$72.39

Growth rate: 2.86% (used 30-year Government of Canada bond yield as a proxy for long-term growth expectations)

Now that we have our assumptions, we’ll plug them into the formula highlighted above. The numbers are in Canadian dollars:

- $5.86 = (0.165 – 0.084) x $72.39

- $105.77 = $5.86 / (0.084 – 0.0286)

- $178.16 = $72.39 + $105.77

Therefore, RY stock is currently worth C$178.16 as per this valuation method. Its current share price is near C$130, making it undervalued.

Is RY Stock a Buy, According to Analysts?

According to analysts, RY stock comes in as a Moderate Buy based on six Buys and three Hold ratings assigned in the past three months. The average RY stock price target of C$144.27 implies 11.3% upside potential.

Conclusion: Royal Bank of Canada Stock is Worth Considering

RBC is a very the biggest Canadian bank, and it has consistently paid dividends for over 150 years. RY stock is undervalued as per our calculations, and analysts seem to think it is slightly undervalued as well. The ‘Perfect 10’ Smart Score suggests outperformance, and the buybacks and dividends provide investors with tangible returns.