Meta Platforms (NASDAQ:META) stock has been an unbelievable performer since bottoming out late last year, now up around 185%+ from its November lows. Though Meta’s hot run has been the envy of its FAANG peers, there are still catalysts that could help extend the rally, potentially all the way to all-time highs.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Undoubtedly, artificial intelligence (AI) and Zuckerberg’s “year of efficiency” have been responsible for a huge chunk of the relief rally. Looking forward, I’d look to the Metaverse as the fuel that helps the stock move higher from here. Recession or not, the next few months could be exhilarating for Meta as investors pile back into a name that was severely oversold last autumn. As such, I’m staying bullish on the stock.

Meta is Harnessing the Power of AI

With the power of AI, Meta may be able to increase the value of its ads without having to track users across the internet. The company’s Advantage+ suite of automation tools could change the landscape of the advertising world once again.

The suite leverages AI to create multiple ad variations to help advertisers find the one that best sticks with any user. Only time will tell how Advantage+ and other AI offerings help jolt Meta’s growth. Regardless, it’s hard not to be impressed by Meta’s ability to innovate through trying times.

Indeed, Apple’s privacy-focused iOS updates, which initially cost Meta dearly, may be to thank for pushing Meta to innovate its way out of a mess.

Meta is also getting into the hardware game, with recent news of the firm’s plans to develop custom chips tailored for AI. Indeed, many big software companies have been hopping on the hardware bandwagon lately. Meta seeks to launch a new AI chip called the MTIA (Meta Training and Inference Accelerator) in 2025.

Undoubtedly, Meta’s AI roadmap is impressive. The monetization possibilities seem tough to fathom at this juncture. Regardless, I still think many may be discounting the potential for AI to re-accelerate growth over the longer term. Meta isn’t just a social media or metaverse company anymore; it’s a serious AI contender.

June Could be a Big Month for the Metaverse

Many investors may have dismissed the Metaverse in favor of AI as the trend to bet on over the past six months. Looking ahead, the Metaverse may be due for a bit of a comeback. Many people that expect Apple (NASDAQ:AAPL) will unveil its mixed-reality headset at some point during its WWDC 2023 conference, which kicks off on June 5.

If it does, we might all hear about the Metaverse ad nauseam again, and that bodes well for the firms with skin in the game, most notably Meta Platforms.

Of course, it’s tough to compete against a proven tech behemoth like Apple. Fintech innovators are feeling increasing pressure from the iPhone maker as it doubles down on its wallet ambitions.

In any case, the VR (virtual reality) and AR (augmented reality) markets look large enough that more than one winner will be minted from its rise over the next decade. Further, it’s not hard to imagine that many investors have stuck with Meta for its strong social-media business and its ability to monetize AI rather than its metaverse potential.

Meta may have been punished in the past for blowing billions on metaverse efforts. That said, as the trend heats up again, we may see more investors start to think about such metaverse efforts in a more positive light — not as a cash sink but as a growth initiative that could help power some serious appreciation.

Is META Stock a Buy, According to Analysts?

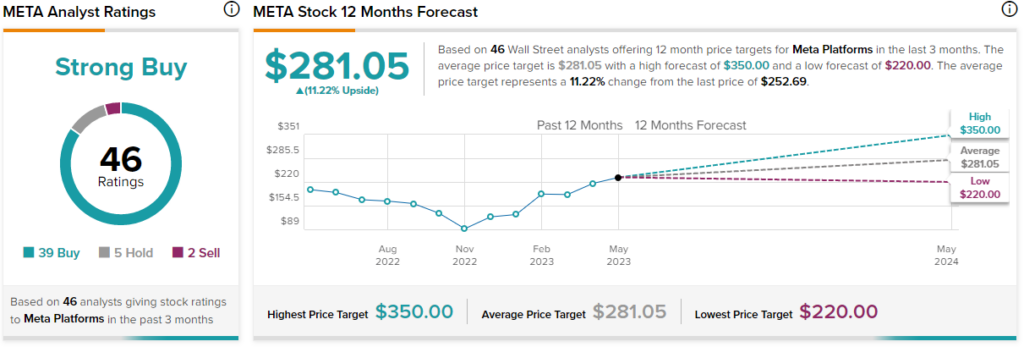

Turning to Wall Street, META stock comes in as a Strong Buy. Out of 46 analyst ratings, there are 39 Buys, five Holds, and two Sells. The average Meta stock price target is $281.05, implying upside potential of 11.2%. Analyst price targets range from a low of $220.00 per share to a high of $350.00 per share.

The Takeaway: It’s a Mistake to Bet Against Zuckerberg

There’s no doubt that META stock has come a long way since the depths of November. Though the price of admission has surged (31.1 times trailing price-to-earnings), I still wouldn’t give up on Zuckerberg’s empire quite yet.

He was right to pivot Meta into a “year of efficiency,” and I believe he’ll be right again longer term as he steers the ship toward AI and the Metaverse.