Meta Platform’s (NASDAQ:META) recent strategic shift has completely changed the narrative for the stock, with investors now seeing a promising future for the company. In response to Mark Zuckerberg’s “Year of Efficiency” initiative, the company has taken bold steps to return to its roots as a free-cash-flow generator. By prioritizing the growth of its core platforms and dialing back on excessive spending and vague metaverse aspirations, Meta Platforms is regaining the trust of investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With the added likelihood of TikTok’s ban, Wall Street has gone from selling off the stock in bulk to flocking to it like a moth to a flame. This sudden surge in demand for Meta shares has resulted in the stock shooting up by a whopping 146% from its 52-week low of $88.09 in just five months.

In my view, the stock’s explosive rally isn’t a groundless overreaction. The recent developments can actually have a substantial impact on the company’s financials. In fact, I believe shares bear further upside potential, given Meta’s upcoming profitability prospects. Accordingly, I am bullish on the stock.

Meta’s New Focus — Maximizing Profits

While Meta’s recent developments have been labeled as “unlocking efficiencies,” they really mean one thing — maximizing profitability. After incurring a loss of $13.7 billion in its Metaverse division last year and the consequent fall in the stock’s value, it was imperative that senior management abandon their fantasies and land back to reality.

The first news we got was last November when Meta announced it would lay off more than 11,000 employees, or about 13% of its workforce at the time. Then, earlier in March, Meta followed on with a second round of layoffs, this time letting go another 10,000 workers or another 13% of its workforce. Zuckerberg also said Meta was planning to close around 5,000 additional open positions that were yet to be filled.

Simultaneously, the company has apparently started to drop its metaverse aspirations. Not only have we gotten absolutely no news regarding any development surrounding the Metaverse in quite some time, but there are many other indicators.

One is Meta recently shutting down the metaverse platform it acquired about two years ago. With more than one-fourth of Meta’s workforce gone and the company’s focus shifting toward its core, highly-profitable platforms, investors’ past protests have indeed started to bear fruit.

Meta’s Core Platforms Continue to Impress

Setting aside the Metaverse’s lackluster reception, Meta’s fundamental platforms have consistently impressed throughout this period of transition. In early February, Meta made waves as Facebook achieved a significant milestone, exceeding two billion daily active users (DAU), growing 4% compared to the previous year. Yes, this is the same Facebook that, for the past 10 years, you have heard is dying out.

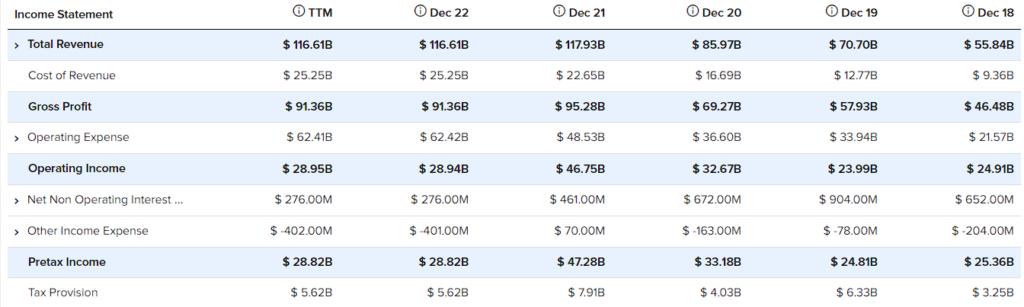

In its Fiscal 2022 results, the company also revealed that Facebook’s monthly active users (MAUs) at the end of December were 2.96 billion, also suggesting an increase of 2% year-over-year. The increase in user activity, combined with ad impressions growing by 18% during the year, more than offset the 16% decline in ad prices. Hence, Meta posted revenue growth of 4% on a constant-currency basis for the year. The 1% decline in GAAP revenues was only due to FX headwinds.

In my view, these are remarkable numbers given that the advertising industry suffered dramatically last year. Meta posting such strong user and revenue figures during such a tough market environment are a testament to the resilience and advertisers’ reliance on the company’s platforms.

Further, with the dollar’s strength in Fiscal 2022 having largely been reversed year-to-date and Meta experiencing various avenues of expansion, such as Reels and the largely untapped monetization potential of WhatsApp, the company will probably experience robust growth in 2023.

How is Meta’s Profitability Likely to Evolve from Here?

As we’ve discussed, Meta’s recent layoffs, diversion from the Metaverse, and potential for revenue growth this year have raised hopes regarding the company’s future profitability. Even though the company is set to record hefty restructuring expenses and other costs related to laying off staff, Wall Street expects that the recent developments will have a positive impact on the company’s bottom line as soon as this year.

Meta is expected to post earnings per share of about $9.67 this year, which is a 12.6% increase compared to 2022. This is to be followed by 26.3% and 19.8% growth in earnings per share in 2024 and 2025, respectively, as efficiencies reach their full potential. Of course, these are just estimates, so they should be taken with a grain of salt. Still, they are indicative of Meta’s potential for fantastic earnings growth in the coming years.

Is META Stock a Buy, According to Analysts?

Turning to Wall Street, Meta has a Strong Buy consensus rating based on 40 Buys, six Holds, and three Sells assigned in the past three months. At $231.77, the average META stock forecast implies 7.2% upside potential.

The Takeaway

Meta’s change in focus has captured investors’ interest in the stock, as evidenced by its massive rally over the past five months. With senior management slicing unnecessary jobs, dropping their unsubstantiated metaverse aspirations, and pivoting to maximizing the potential of the company’s core platforms, Meta’s future profitability prospects appear very promising.

Based on Wall Street’s earnings-per-share consensus estimates, shares are currently trading at a forward P/E of about 21.9. Coupled with expectations for strong earnings growth in the near future, there is a solid base to support the possibility of META stock continuing to climb even higher. Thus, I remain bullish on the stock and will keep holding my META shares despite the stock’s already strong comeback.