The Biden administration has threatened to ban TikTok, a wildly popular social media app, from use in the U.S. unless its Chinese owners sell their stake in the platform. The nationwide ban threat is a serious escalation in the dispute about data security, which has been ongoing for a number of years. In many ways, Chinese stocks are becoming riskier than before.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The issue isn’t purely a U.S.-China dispute, as other countries have also been increasingly wary of Chinese business expansion. The U.S. government and a succession of other Western countries have blocked TikTok on government-issued devices. For instance, the European Parliament, European Commission, and the EU Council have imposed bans on TikTok on staff devices, citing cybersecurity concerns.

Further, the United Kingdom and New Zealand have become the latest to join the growing list of countries that have recently issued orders banning the use of TikTok on government-issued devices as concerns grow over the app’s privacy and security. Now, it might be time for the 100 million U.S. users of the app to be weened from the addictive short video platform.

ByteDance Bites the Dust

TikTok is owned by the Chinese internet company ByteDance. Lawmakers have cited potential cybersecurity and political influence risks, saying that the Chinese government could order TikTok to collect data and information on Americans or influence what videos they are shown on the app.

In 2020, President Trump – who took the U.S.-China information security issues public – tried to ban TikTok in the U.S., but the action was halted by federal courts. Now, the bipartisan distrust of China-owned companies has increased so much that even if the divestment demand is met with a legal challenge – which it almost certainly will be – Biden’s administration will not be alone in this fight.

This time, the “sell or be banned” ultimatum is conveyed to the social video platform by the Committee on Foreign Investment in the United States (CFIUS), composed of the Departments of Treasury, Justice, Homeland Security, Defense and Commerce, and others. According to the media, the Justice Department and the FBI are investigating the surveillance of American TikTok users by ByteDance.

In addition, the Federal authorities have backing from a group of Silicon Valley executives coming from various prominent firms such as 137 Ventures and Founders Fund. The business leaders went as far as calling TikTok a “Chinese espionage operation” against the U.S. This growing alliance between the tech and government leaders demonstrates how seriously the threat posed by China is perceived in the U.S.

Economic Superpower or Evil Empire 2.0?

TikTok is at the center of everyone’s attention at the moment, but it’s just the latest point in the growing chasm between the West and the Chinese regime. The previous peak of the West-China feud, the U.S. and Canadian ban on Huawei and ZTE (OTCMKTS:ZTCOF) on claims they had deep ties to the Chinese state, didn’t have a large following across the pond, as Europe remained addicted to Chinese network equipment.

But last year, things started moving following China’s alignment with Russia, and Germany and the Netherlands said they could ban Huawei and ZTE from their 5G networks.

The latest restrictions are part of the United States’ effort to contain China’s technological expansion, serving as an avant-garde for a wider Chinese effort to become superior to the West by ways of increasing its dependence not only on cheap Chinese manual labor but also technology and investment.

There’s also a military issue. Last year, the Biden administration imposed sweeping restrictions on providing advanced semiconductors and chipmaking equipment to Chinese companies, as U.S. officials said that advanced technology could be used to advance their military systems, including weapons of mass destruction, and to commit human rights abuses. A totalitarian regime known for its neglect of free speech and human rights is certainly a natural suspect.

Back to the Cold War?

The TikTok ban threat is a small dot on a timeline of a long-building rivalry that has escalated since Chinese economic and political ambitions have grown beyond its regional leader status. Trump’s trade war intensified a trend that existed at least since Xi Jinping, the all-powerful Chinese leader, outlined his vision of turning his country from the world’s cheap factory into a global superpower by boosting its military power as well as its economic expansion and political outreach.

Last year, the Biden administration revealed an aggressive plan to counter the Chinese military’s rapid technological advances, as the U.S. intelligence forces reported on China’s push to use artificial intelligence (AI) to develop most advanced weapon systems, as well as on continued efforts to spy on the U.S. government and military.

As a response, the U.S. is trying to choke off China’s access to advanced chips and chip production tools needed to power those abilities – just like they worked to stop the Soviets from gaining access to advanced tech during last century’s Cold War.

Following long years after the dissolution of the Soviet Union, when there was only one undisputed leading global force – the U.S. – now, we are back to square one, a bipolar world of conflicting superpowers.

Impeding Chinese Tech Development

The U.S. concerns about China’s ambitions are reflected in the administration’s national security strategy towards tech exports. Until a while ago, the semiconductor business has been primarily market-driven and laissez-faire; now, the United States is firmly focused on retaining control over the “chokepoints” in the global technology supply chains. The most important of these chokepoints are AI chips, automation software, and semiconductor equipment and components.

Biden’s ban on selling AI and semiconductor technology to China is the broadest set of export controls in a decade, affecting hundreds of Chinese firms. The restrictions block leading U.S. AI computer chip designers, such as Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD), from selling their high-end chips for AI and supercomputing to China.

China’s most advanced computer equipment depends on chips made by Intel (NASDAQ:INTC) or Taiwan Semiconductor Manufacturing (NYSE:TSM), which use U.S. technology in their production process and so would be subject to these restrictions. The U.S. is now actively exploiting its technological dominance to prevent China from reaching a point where it presents a serious threat to the existing world order.

Made in the U.S.A.

Since Trump escalated the economic and technological standoff between the U.S. and China, American companies have been arguing that their sales to China are an important source of revenue that allows them to reinvest in research and development and retain a competitive edge. The Biden administration answered these complaints with a CHIPS Act, one of the largest federal investments in a single industry in decades.

The Commerce Department will hand out $50 billion in the form of direct funding, federal loans, and loan guarantees to companies to promote all-American chip production and limit foreign dependence. Most of the money is intended for companies such as TSM, Samsung Electronics (FRANKFURT:SSU), Micron Technology (NASDAQ:MU), and Intel to help them build U.S. production facilities.

Up until now, the U.S. – an undisputed leader in chip design – has been producing most of the technologically advanced semiconductors offshore, but China has been gaining market share in less advanced chips that are still critical for cars and consumer electronics. Shortages of chips during the pandemic underscored the need for independence in the production of critical products, and the growing feud with China makes it even more urgent.

Investors Beware

After a number of times that global investors lost money in Chinese markets due to the Communist government’s crackdown on different industries, they are already suspicious of the country’s assets. However, after the long-awaited opening of the Chinese economy from the pandemic-related restrictions, the expectations of a strong consumer rebound would surely cause greed to take over caution if it wasn’t for fear of the tech cold war with the U.S.

Those that still wish to play the China reopening trade prefer western consumer brands with a large presence in the country, such as Starbucks (NASDAQ:SBUX), Nike (NYSE:NKE), Marriott (NASDAQ:MAR), and LVMH (BIT:LVMH), over the stocks of Chinese-made firms.

U.S.-listed Chinese companies offer no serious shelter from the aforementioned headwinds. Like U.S. stocks, they are susceptible to market turmoil, such as the latest one induced by the banking trouble. In addition, there’s always a threat of the Chinese authorities’ crackdown and/or government order to delist — like Didi Global’s delisting from the NYSE and speculation that the same will happen with Alibaba (NYSE:BABA).

U.S. regulators have tightened restrictions on Chinese companies wishing to trade their shares on American exchanges, demanding full disclosure of financial information and audits.

Just recently, Beijing has ordered five major companies – China Life Insurance, PetroChina, China Petroleum & Chemical, Aluminum Corporation of China, and Sinopec Shanghai Petrochemical – to delist from NYSE because of their unwillingness to comply with U.S. regulations on audit transparency.

There are also growing speculations about the delisting of at least some of about 250 companies based in China or Hong Kong with a total market share of $1 trillion, including popular stocks like Baidu (NASDAQ:BIDU) and JD.com (NASDAQ:JD).

Besides, Chinese stocks are under threat of delisting by the U.S. stock exchanges themselves over audit disputes, trade frictions, and geopolitical issues. A large number of Chinese companies narrowly escaped the risk of being delisted from the U.S. stock exchange last year after they agreed to give the securities watchdog access to their audit. However, given Beijing’s recent history of interference with private sector firms, their future existence on the U.S. exchanges is in no way guaranteed.

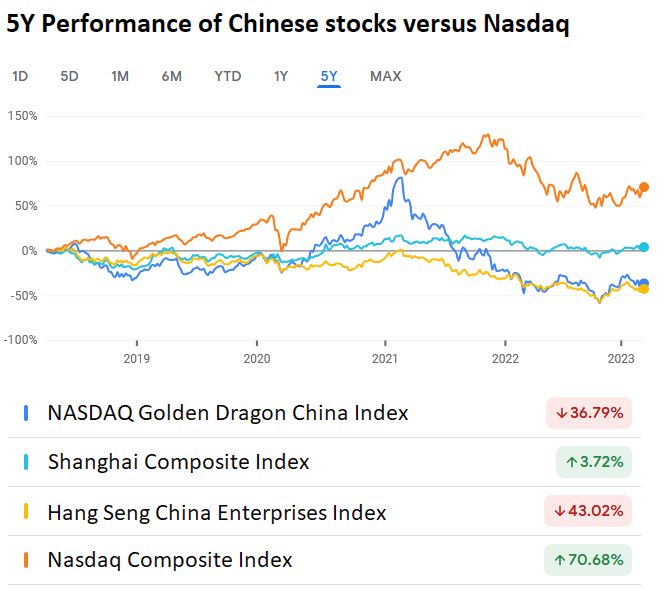

Investors should take notice that up until now, they haven’t been rewarded for the risks they are undertaking by investing in Chinese stocks, neither in the short term nor in the long term.