Hedge fund manager Cathie Wood’s flagship exchange-traded fund (ETF), ARK Innovation ETF (ARKK) is shrinking in size, with investors pulling out a net $717 million over the past 12 months, the Wall Street Journal reported citing FactSet data. Investors seem to be booking profits, given ARKK has jumped 56% year-to-date following a significant decline last year. Additionally, investors seem to be averse to several holdings in the ARKK ETF that are still unprofitable.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

ARKK ETF’s Shrinking Size

Cathie Wood’s ARKK ETF now has over $9 billion in assets under management (AUM) down from $28 billion in February 2021, mostly due to investment losses.

The fund enjoyed a strong run and successfully attracted investors’ funds during 2020, as it placed its bets on companies focusing on “disruptive innovation.” However, continued rate hikes dampened investor sentiment about unprofitable growth stocks trading at sky-high valuations. Several investors liquidated their positions last year to invest in safer bets due to persistent macro challenges. In 2022, ARKK shares tanked 67%. While ARKK ETF has rallied year-to-date in 2023, it is trading 70% below its all-time high.

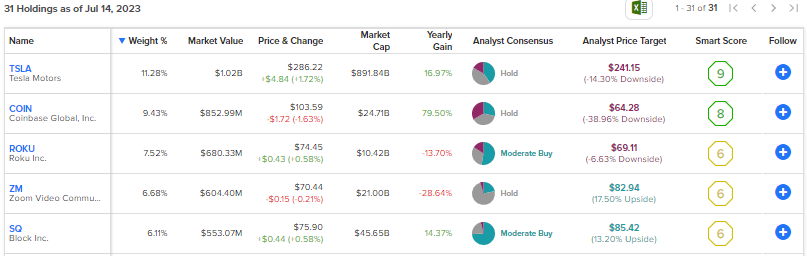

Although many growth stocks have rebounded strongly this year, most of them are companies generating solid cash flows. Meanwhile among ARKK’s top five holdings – Tesla (NASDAQ:TSLA), Coinbase (NASDAQ:COIN), Roku (NASDAQ:ROKU), Zoom Video (NASDAQ:ZM), and Block (NYSE:SQ), only Tesla and Zoom generated profits on a GAAP basis in 2022. Aniket Ullal, head of ETF data and analytics at CFRA Research, thinks that many of ARKK’s holdings won’t generate huge cash flows until “way out in the future,” especially when the high-interest rate backdrop is expected to continue for a longer time period.

It is interesting to note that while ARKK’s AUM is shrinking, other ETFs are enjoying solid inflows. As per State Street, active funds have seen inflows worth $10 billion in June and more than $100 billion over the past year.

Meanwhile, Wood, who owns a majority stake in ARKK’s parent company ARK Investment Management, continues to make good money from the ETF, thanks to the fee revenue. ARKK has an annual fee of 0.75%, which is about double the average fee of active ETFs.

What is the Future of ARKK Stock?

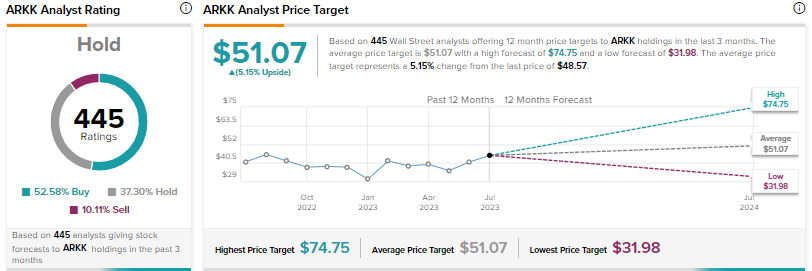

ARKK has a Hold consensus rating based on the ratings of 445 analysts on its holdings. The average price target of $51.07 implies 5.2% upside.