American home goods retailer Bed Bath & Beyond (NASDAQ:BBBY) stock is in the limelight as memesters continue to swing the stock to extreme highs and lows while a series of discounts announced for the holiday season seems to have caught investors’ attention. Offering discounts signals that the cash-strapped retailer has been able to cushion itself for the upcoming holiday season.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The stock is trading down nearly 8% in pre-market trading today after closing nearly 30% higher yesterday. Further, the company has named Sue Gove as its permanent President and CEO. She was on interim basis since June.

Bed Bath & Beyond Offers Huge Discounts for the Holiday Season

Shoppers at Bed Bath & Beyond outlets can earn a flat 20% discount on all items between October 31 to November 13, the company announced yesterday. Moreover, the retailer is also offering “Deal of the Day” on select holiday special items that will feature online-only shoppers.

Similarly, the company’s buybuy BABY banner is offering several discounts for baby products and toys. The segment will also start with Early Black Friday deals every week, starting November 3 through the end of the year.

Furthermore, BBBY’s wellness and beauty products banner, Harmon, is offering a $10 Bonus Card for purchases above $50, from November 6 through November 13.

BBBY’s Recent Capital Shoring Efforts

To shore up its balance sheet, last week, BBBY offered a bond exchange program to its senior noteholders due in 2024, 2034, and 2044.

Similarly, BBBY arranged a new loan and expanded its asset-backed credit facility in August. These efforts boosted its liquidity position by roughly $1 billion, as per a WSJ report. This, however, will only sustain the retailer for less than a year.

Is BBBY a Buy or Sell?

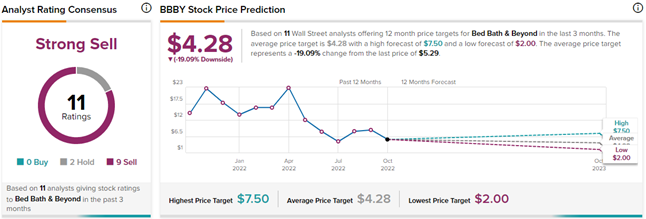

Bed Bath & Beyond is certainly not in the best position currently. Wall Street analysts have given BBBY stock a Strong Sell rating on TipRanks. This is based on two Holds versus nine Sell ratings. Also, the average Bed Bath & Beyond price forecast of $4.28 implies 19.1% downside potential to current levels.

Ending Thoughts

Bed Bath & Beyond’s recent capital-strengthening activities and holiday discounts may seem like a positive development. However, these efforts will only support BBBY’s short-term survival. Analysts too are highly pessimistic about the stock’s trajectory. Investors must wait and watch for the long-term story to unfold before making any investment decisions.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue