The oil industry delivered record profits in 2022. Moreover, a tight supply environment indicates that the industry could continue to outperform broader markets. Despite the favorable operating environment, large investors, pension funds, and others have reduced their exposure to oil companies due to their climate commitments, a Wall Street Journal report highlighted.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

It’s worth highlighting that the higher average realized prices for oil and cost reductions drove the share prices of the companies operating in this space. For instance, shares of Occidental Petroleum (NYSE:OXY) surged 119% in 2022. Meanwhile, Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) stocks gained 87.4% and 58.5%, respectively.

Besides for capital gains, these companies enhanced shareholders’ returns through share repurchases and dividend hikes. Furthermore, they strengthened their balance sheet by reducing debt at an accelerated pace.

While the oil industry is in a sweet spot, concerns about the industry’s greenhouse-gas emissions, climate-related government policies, and transition toward cleaner energy sources are driving investors away.

Against this background, should investors bet on oil stocks? Using TipRanks data, let’s look at what’s on the horizon for OXY, XOM, and CVX stocks.

Is OXY a Good Buy?

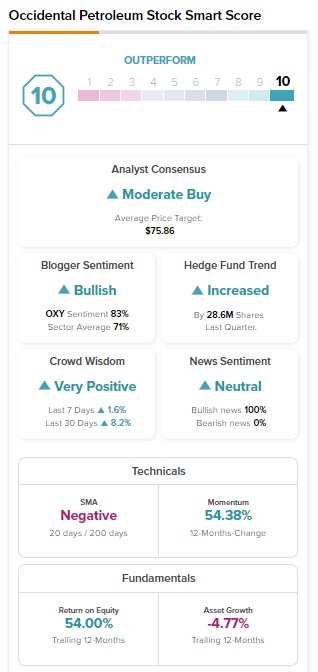

OXY stock sports a Moderate Buy consensus estimate on TipRanks based on seven Buy, six Hold, and one Sell recommendations. The stock also has the backing of ace investor Warren Buffett. While OXY stock more than doubled in 2022, analysts’ price target of $75.86 implies 23.87% upside potential.

Investors should note that hedge funds have raised their stakes in OXY. Our data shows that hedge funds bought 28.6M shares of OXY last quarter. Meanwhile, with positive indicators from retail investors and bloggers, OXY stock has a maximum Smart Score of “Perfect 10.” Note: Shares with a “Perfect 10” Smart Score have outperformed the benchmark index.

What Are Analysts Saying About XOM?

XOM stock has received 11 Buy recommendations. Moreover, seven analysts have rated it a Hold, and one assigned it a Sell. Overall, XOM stock commands a Moderate Buy consensus rating on TipRanks. Wall Street has an average price target of $125.28, implying 11.94% upside potential.

Even though analysts are cautiously optimistic about XOM stock, hedge funds sold 2.4M shares last quarter. Meanwhile, insiders sold XOM stock worth $1.8M during the same period. Overall, Exxon stock carries a Neutral Smart Score of seven.

Is CVX Stock a Buy, Sell, or Hold?

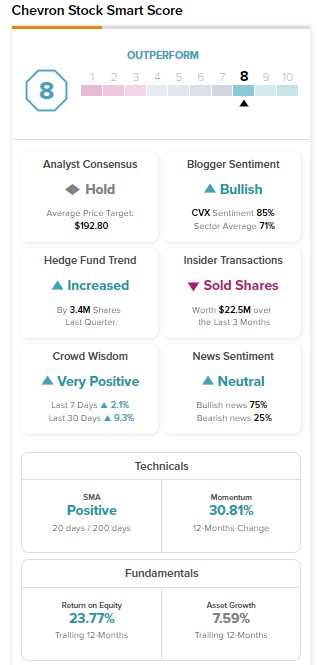

CVX stock has a consensus rating of Hold based on six Buy, eight Hold, and two Sell recommendations. Furthermore, these analysts’ average price target of $192.80 implies 13.78% upside potential.

Hedge funds bought 3.4M shares of CVX last quarter. However, insiders sold CVX stock worth $22.5M in the last three months. Nevertheless, CVX stock has an Outperform Smart Score of eight.

Bottom Line

The long-term profitability of these companies is under the radar as the world focuses on reducing greenhouse-gas emissions. However, with the ongoing transition, we’ll still need an adequate supply of conventional energy to support economic well-being. This means that the demand for oil could remain high in the coming years, supporting companies like XOM, OXY, and CVX.

Moreover, these companies are investing and developing lower-emissions opportunities to maximize shareholders’ returns.

Meanwhile, among these companies, OXY stock, with a Moderate Buy consensus rating and a maximum Smart Score of “Perfect 10,” is most likely to outperform the broader markets.