Darden Restaurants (NYSE:DRI) will announce its fiscal 2023 fourth quarter financials before the market opens on Thursday, June 22, 2023. Ahead of the Q4 print, 12 analysts reiterated their Buy recommendation on the company, which shows their faith in the prospects of DRI. Analysts’ bullish stance stems from Darden’s ability to deliver strong growth regardless of the economic background.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wedbush analyst Nick Setyan increased the price target on DRI stock to $175 from $165 ahead of Q4 earnings. In a note to investors dated June 1, Setyan said that he expects the company’s same-store sales growth in Q4 to be at least in line with the Street’s consensus estimate. The analyst expects DRI to benefit from improved guest counts, market share gains, strength in off-premise sales, and improved staffing levels.

Echoing similar sentiments, Citi analyst Jon Tower increased his price target on DRI stock to $187 from $169 on June 14. The analyst said that Darden’s Q4 results would highlight the company’s ability to outperform competitors despite the weak macro backdrop.

Bank of America Securities analyst Katherine Griffin raised Darden stock’s price target to $187 from $172. Griffin expects Darden’s traffic to come in higher than its peers and the broader industry.

Analysts’ Consensus Estimates for Q4

Analysts expect Darden to report sales of $2.77 billion in Q4, which is within the management’s guidance range of $2.73 billion and $2.78 billion. This also compares favorably with the prior-year quarter’s revenue of $2.60 billion.

Thanks to the year-over-year improvement in sales, analysts expect Darden to report earnings of $2.54 per share, up from $2.24 reported in the prior-year quarter.

Is Darden a Good Stock to Buy?

Darden stock sports a Strong Buy consensus rating ahead of the Q4 print. It has received 17 Buy and five Hold recommendations. Meanwhile, analysts’ average price target of $170.43 implies 2.78% upside potential.

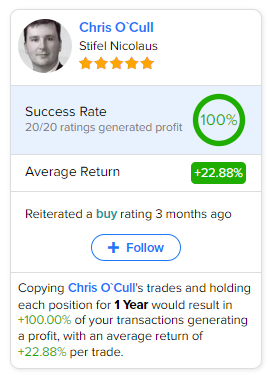

As DRI stock has trended higher over the past year, investors should note that Chris O`Cull of Stifel Nicolaus is the most accurate analyst for DRI stock, according to TipRanks. Copying the analysts’ trades on DRI stock and holding each position for one year could result in 100% of your transactions generating a profit, with an average return of 22.88% per trade.