Synopsys (NASDAQ:SNPS), a global leader in electronic design automation, announced the acquisition of Ansys (NASDAQ:ANSS), a software company, for $35 billion. As the move will likely expand its total addressable market and boost its margins, it’s the right time to delve into Synopsys’s ownership structure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

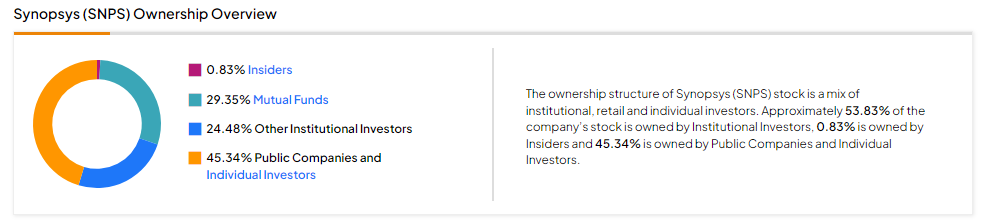

Now, according to TipRanks’ ownership page, public companies and individual investors own 45.34% of SNPS. They are followed by mutual funds, other institutional investors, and insiders at 29.35%, 24.48%, and 0.83%, respectively.

Digging Deeper into Synopsys’s Ownership Structure

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns a significant stake of 7.77% in SNPS stock. Next up is Vanguard Index Funds, which holds a 6.50% stake in the company.

Among the institutions, the Hedge Fund Confidence Signal is Very Negative on Synopsys stock based on the activity of 17 hedge funds. Notably, Hedge Funds decreased their holdings by 98.8K shares in the last quarter.

While the hedge fund confidence signal is very negative, individual investors have a Very Positive view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 5.8%. Overall, among the 710,656 portfolios monitored by TipRanks, 0.4% have invested in Synopsys stock.

Is Synopsys a Good Stock to Buy?

Synopsys stock has delivered a return of approximately 51% over the past year, outperforming the S&P 500’s (SPX) gain of 19.4%.

Further, analysts are upbeat about SNPS stock. Nine analysts cover Synopsys stock, and all recommend a Buy, leading to a Strong Buy consensus rating. Analysts’ average price target of $624.44 implies an upside potential of 22.52% over the next 12 months.

Conclusion

The Ownership tool from TipRanks provides Synopsys’s category-wise ownership structure, helping investors make an informed investment decision.