Shares of footwear, apparel, and accessories maker Skechers (NYSE:SKX) are down more than 10% in Friday’s pre-market session as it provided a lower-than-expected 2024 sales and earnings outlook. The company expects Q1 sales to be in the range of $2.175 to $2.225 billion, which is below the consensus estimate of $2.19 billion. Also, Q1 earnings per share are expected to be below the Street estimate of $1.20 per share. As SKX stock is under pressure, it’s the right time to delve into its ownership structure.

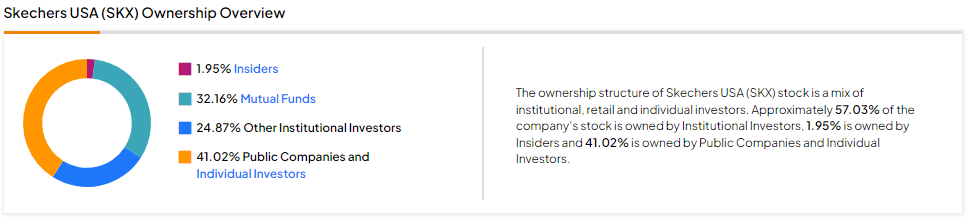

Now, according to TipRanks’ ownership page, public companies and individual investors own 41.02% of SKX. They are followed by mutual funds, other institutional investors, and insiders at 32.16%, 24.87%, and 1.95%, respectively.

Digging Deeper into Skechers’ Ownership Structure

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns a 9.05% stake in Skechers stock. Next up is Vanguard Index Funds, which holds an 8.58% stake in the company.

Among the institutions, the hedge fund Confidence Signal is Very Negative on SKX stock based on the activity of 14 hedge funds. Notably, Hedge Funds decreased their holdings by 1.2M shares in the last quarter.

While the hedge fund confidence signal is Very Negative, individual investors have a Very Positive view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 9.9%. Overall, among the 713,412 portfolios monitored by TipRanks, less than 0.1% have invested in Skechers stock.

What is the Forecast for Skechers?

Wall Street is bullish about Skechers’ prospects. It has received five Buy and one Hold recommendations for a Strong Buy consensus rating. However, these ratings were set before the Q4 earnings release. This implies that SKX stock might witness adjustments in its consensus rating due to the lower-than-expected full-year guidance.

Skechers stock jumped over 29% in one year. Analysts’ average price target of $70.50 implies 10.85% upside potential from current levels.

Conclusion

TipRanks’ Ownership tool shows Skechers’ ownership structure by category, enabling investors to make well-informed decisions when considering investments.