Investing in financial technology company Affirm Holdings (NASDAQ:AFRM) has proven to be lucrative for investors in 2023 as its stock has risen by about 188% year-to-date. While peers SoFi (NASDAQ:SOFI) and Upstart (NASDAQ:UPST) are facing challenges due to the persistently high interest rates, Affirm has boosted demand for its Buy Now, Pay Later service. As the company is poised to gain from higher demand, it prompts the question: who owns AFRM?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Now, according to TipRanks’ Ownership page, Affirm is mostly owned by other institutional investors with a stake of 43.82%, followed by mutual funds who own 31.63% of the stock, and public companies and individual investors at 24.55%. It is worth noting that insiders currently do not own AFRM stock.

Digging Deeper into Affirm Holdings’ Ownership Structure

Upon a detailed examination of institutional ownership, Growth Fund of America stands out as the top shareholder of Affirm stock, holding a stake of approximately 8.75%. Following closely is Vanguard, with a notable ownership stake of 7.49% in the company.

Among the other institutions, the Hedge Fund Confidence Signal is Negative on AFRM stock based on the activity of six hedge funds.

Along with the Hedge Funds, individual investors also maintain a negative outlook on AFRM stock. Of the 704,232 portfolios monitored by TipRanks, only 0.3% have invested in Affirm stock. This suggests that investors aren’t betting on AFRM and are not confident about its prospects, at least in the near term.

Is Affirm a Buy or a Hold?

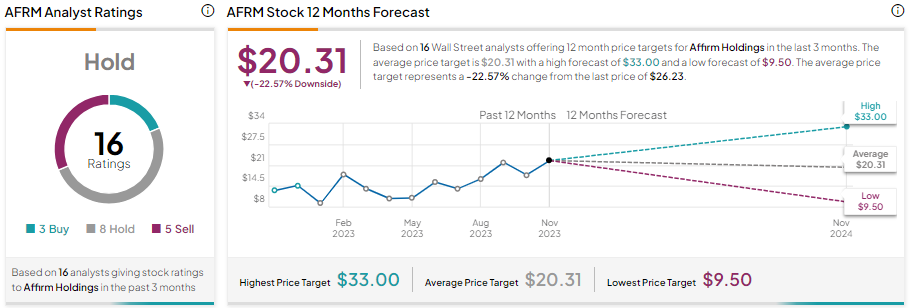

The significant appreciation in AFRM stock on a year-to-date basis and macro headwinds keep analysts sidelined. AFRM stock has a Hold consensus rating with three Buy, eight Hold, and five Sell recommendations. Further, the average AFRM stock price target of $20.31 implies 22.57% downside potential from current levels.

Bottom Line

The ownership composition of Affirm stock demonstrates a healthy mix of institutional, retail, and individual investors. Affirm Holdings is set to benefit from higher demand for its Buy Now, Pay Later service. However, macro uncertainty and the recent rally in its share price could restrict the upside potential in the stock, reflected through analysts’ Hold consensus rating.