Shares of financial technology companies like SoFi (NASDAQ:SOFI) and Upstart (NASDAQ:UPST) came under pressure due to the persistently high interest rate environment. Higher interest rates could harm their credit quality and reduce consumer spending, affecting demand. On the other hand, Affirm Holdings (NASDAQ:AFRM) sees rising interest rates as a blessing in disguise, as it will boost demand for its Buy Now, Pay Later service.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In an interview with the Wall Street Journal, Affirm Holdings’ CFO, Michael Linford, said that the demand for the company’s short-term consumer loans might increase if interest rates remain elevated for an extended period. He added, “We think demand is going to go up in a higher rate environment. Everything we do means more in a high-rate environment.”

This is evident from the company’s recent financial performance. Despite the high interest rate environment, AFRM’s GMV (Gross Merchandise Volume) was $5.6 billion in the first quarter of Fiscal 2024, up 28% year-over-year. Moreover, it increased on a sequential basis as well. Further, its RLTC (Revenue Less Transaction Cost) was up 16% year-over-year. With this background, let’s look at what the Street recommends for AFRM stock.

Is Affirm Stock a Buy, Sell, or Hold?

Affirm Holdings stock has gained significantly on the back of its solid financials. It has risen over 164% year-to-date, outperforming SoFi and Upstart stocks, which are up about 62% and 92% during the same period.

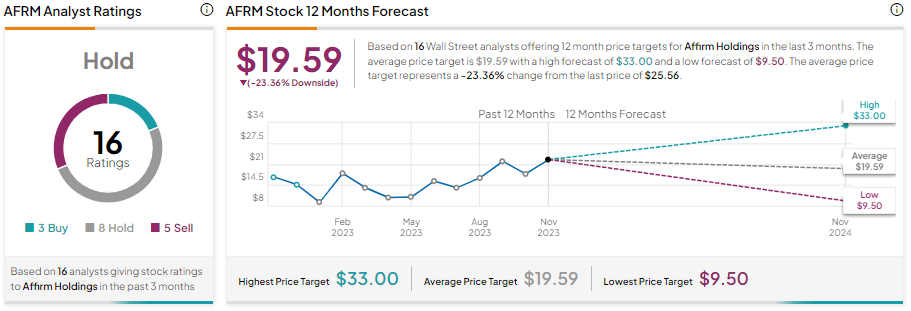

While Affirm’s management remains upbeat and expects to grow its business and manage credit even in the higher-for-longer interest rate environment, Wall Street analysts remain sidelined on the stock. Macro pressure over consumers’ financial health and the recent rally in AFRM’s share price kept analysts on the sidelines.

With three Buy, eight Hold, and five Sell recommendations, AFRM stock has a Hold consensus rating. Further, the average AFRM stock price target of $19.59 implies 23.36% downside potential from current levels.