The COVID-19 pandemic forced casinos to temporarily shut down their operations and lay off workers. However, the rapid roll-out of vaccines and pent-up demand following the easing of restrictions has helped them bounce back strongly, though business continues to be below pre-pandemic levels.

While uncertainty related to COVID-19 and labor challenges prevail, several casino owners are better positioned than last year to streamline their operations and focus on lucrative avenues like sports betting and online gaming.

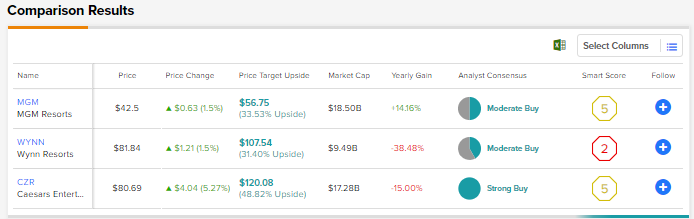

We used the TipRanks stock comparison tool for casino stocks to compare MGM Resorts, Wynn Resorts, and Caesars Entertainment. This tool allows us to compare and analyze up to ten stocks across various performance metrics, including technical indicators, analyst estimates, price targets, earning data, and more.

MGM Resorts International (NYSE: MGM)

MGM Resorts’ portfolio includes 32 hotels and gaming destinations in the U.S. and Macau, including popular resort brands like Bellagio, MGM Grand, ARIA, and Park MGM.

MGM has also emerged as one of the key players in the sports betting and online gaming market through BetMGM, a joint venture with Entain Plc, launched in 2018. On April 4, BetMGM launched its online sports betting and iGaming platforms in Ontario, Canada, thus making its international debut. Including Ontario, BetMGM now has a presence in 23 markets.

With more U.S. states legalizing sports betting, MGM sees BetMGM as a vital growth driver. MGM and Entain plan to invest $450 million in BetMGM this year. The company expects BetMGM operations to deliver net revenue of over $1.3 billion in 2022, up from $850 million in 2021.

Aside from BetMGM, the company is also investing in its digital capabilities and in developing an integrated casino resort in Japan.

Meanwhile, MGM reported stellar results for Q421 and posted adjusted EPS of $0.12 compared to a loss per share of $0.90 in Q420, driven by a 105% year-over-year growth in revenue to $3.1 billion. The company’s Las Vegas Strip Resorts and Regional Operations delivered year-over-year revenue growth of 277% and 51%, respectively, and were also above pre-pandemic levels.

However, revenue from MGM China grew by a modest 3% year-over-year and was down 57% compared to Q419. The company cited travel and entry restrictions associated with COVID-19 as the reason for its subdued performance in China.

Following the Q4 results, Citigroup analyst George Choi upgraded MGM stock to a Buy from a Hold and increased the price target to $57 from $43. Choi feels that MGM is a major beneficiary of the solid recovery in Las Vegas and the rest of the country.

The analyst added, “We also like the casino operator for its leaner cost structure and its improved gearing (after a series of asset monetization transactions). The latest update from management on BetMGM also points to encouraging market share trends (and the JV is expected to be EBITDA-positive by 2023E).”

Meanwhile, the Street seems divided about MGM stock, with a Moderate Buy consensus rating based on six Buys and six Holds. The average MGM Resorts price target of $56.75 implies 33.53% upside potential from current levels.

Wynn Resorts (NASDAQ: WYNN)

Wynn Resorts operates Wynn Las Vegas, Encore Boston Harbor, Wynn Macau, and Wynn Palace. Also, the company has a nearly 74% interest in Wynn Interactive, which operates the company’s digital sports betting and casino gaming business.

In February, Wynn announced an agreement to sell all of the land and real estate assets of Encore Boston Harbor to Realty Income for $1.7 billion in cash under a sale-leaseback transaction. The company believes that the proceeds from the deal will provide it with liquidity for several upcoming projects and the potential to retire some of its debt.

Meanwhile, China’s stringent restrictions amid rising COVID-19 cases continue to hurt Macau’s gaming business. Wynn has higher exposure to Macau than rival MGM.

In Q421, Wynn’s operating revenues increased 53.5% year-over-year to $1.05 billion, ahead of analyst forecasts of $994.1 million. Adjusted net loss per share narrowed to $1.37 from a loss of $2.45 in Q420, but was worse than analysts’ loss per share estimate of $1.25.

A strong recovery in the company’s Wynn Las Vegas and Encore Boston Harbor operations was offset by the weakness in its Macau operations (which includes Wynn Macau and Wynn Palace). That said, Wynn remains confident that the Macau market will benefit from increased travel over the coming quarters.

However, citing the Gaming Inspection and Coordination Bureau, a Bloomberg report disclosed that Macau’s gross gaming revenue in March 2022 sank 53% from the previous month (and 86% from pre-pandemic levels in 2019) to 3.67 billion patacas ($455 million), the lowest since September 2020.

Regarding casinos with exposure to Macau, Choi recently commented, “For most of 2020-21, share prices of the Macau casino operators were driven by border re-opening expectations (and, unfortunately, the resetting of such expectations).”

However, the analyst expects different catalysts to drive share prices this year, including the expected passing of Macau’s Gaming Law amendments and the license re-tendering process.

Choi believes that Wynn’s valuation is “undemanding” following the selloff in its shares and that the company should benefit from its increasing focus on the premium end of the mass market in Macau.

Based on his optimism, Choi upgraded Wynn to a Buy from a Hold but reduced the price target to $96.50 from $98.

All in all, Wynn stock has received five Buy and seven Hold recommendations for a cautiously optimistic Moderate Buy consensus rating. Further, the average Wynn Resorts price target of $107.54 puts its upside potential at 31.40%.

Caesars Entertainment (NASDAQ: CZR)

Caesars Entertainment was formed by combining Caesars Entertainment Corp and Eldorado Resorts in 2020, with the combined company operating over 50 casinos worldwide. Further, the company’s sports wagering mobile app, Caesars Sportsbook, is live across 22 states and domestic jurisdictions, 16 of which offer mobile wagering.

Last month, Caesars Sportsbook partnered with NYRABets LLC, the official online wagering platform of the New York Racing Association, to launch a new horse racing account wagering app, Caesars Racebook.

Meanwhile, Caesars’ Q421 revenue grew 63.5% year-over-year to $2.59 billion, and net loss per share improved to $2.03 from $2.67 in Q420. However, analysts were expecting revenue of $2.63 billion and a lower net loss per share of $0.83. The company’s bottom line was impacted by the Omicron outbreak and investments in the digital business.

Despite the Q421 performance, Stifel analyst Steven Wieczynski believes that right now, the risk-reward scenario in Caesars’ stock is “too compelling to ignore.”

Wieczynski explained, “From here, we see five potential catalysts for the remainder of 2022 that should allow shares to return to triple-digit land. We believe CZR remains well-positioned long term as the world eventually recovers from this pandemic given their compelling asset mix (Vegas/regionals/sports betting/iGaming).”

Wieczynski continues to believe that the company has the best management team in gaming, capable of creating significant shareholder value in 2022 and beyond. The analyst expects multiples for Caesars’ brick and mortar business to drift back in line with historical ranges as free cash flow ramps up and the balance sheet improves.

Wieczynski reaffirmed a Buy rating on CZR stock and raised the price target to $127 from $120.

Other analysts on the Street echo Wieczynski’s bullish stance, with Caesars’ stock scoring a Strong Buy consensus rating based on 12 unanimous Buys. The average Caesars Entertainment price target of $120.08 implies 48.82% upside potential from current levels.

Conclusion

While all the three stocks are in the red year-to-date, analysts are more confident about Caesars Entertainment, with expectations of a strong recovery and higher upside potential over the next 12 months.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.