Ahead of visual discovery platform Pinterest’s (PINS) second-quarter 2022 results on August 1, Monness Crespi Hardt analyst Brian White reiterated a Hold rating on the stock. He cited intense competition, an inflationary economic environment roiled by concerns of a recession, and an unpredictably tense geopolitical environment as the headwinds that are blurring his outlook for the stock.

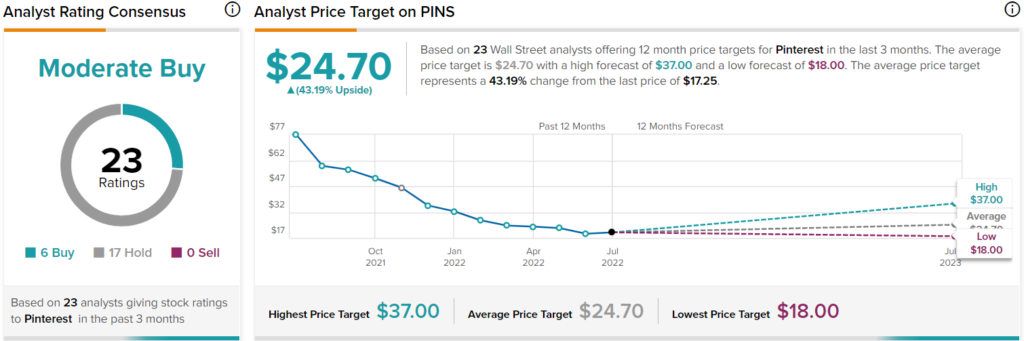

In fact, over the past three months, only six out of the 23 analysts covering Pinterest have given a Buy rating on the stock. The other 17 have reiterated their Hold ratings or have downgraded the stock to a Hold, giving the stock a Moderate Buy rating and an average price target of $24.70.

Pinterest: Decelerating Growth is Very Possible in Q2

White has been a skeptic of Pinterest, at least in the past two years, and even more so now amid a tumultuous economic situation. Despite acknowledging the company’s growth, improved support for advertisers, better user experience and shopping capabilities, and a growing international footprint over the past few years, White sees a strong possibility for Pinterest to report decelerating growth in Q2.

“We believe Pinterest will struggle to meet our 2Q:22 revenue estimate of $695.2 million (up 13% YoY; Street at $673.66 million) and our EPS forecast of $0.24 (Street is at $0.18),” said the analyst.

White also expects Pinterest’s monthly active users (MAU) to have continued to decline in Q2, albeit at a slower rate than Q1.

Moreover, the analyst also importantly pointed out that as the economy reopens, people are showing diminishing engagement on the platform. This concern is aggravated by the expectation of lower general spending on digital ads by businesses (thanks to the economic situation), which ultimately might have bitten into Pinterest’s ad revenues in Q2.

Also, Pinterest’s unpleasant rendezvous with Alphabet’s (GOOGL) algorithm updates on Google’s search engine is expected to have remained a woe in the quarter to be reported.

Looking beyond Q2, White is not very enthusiastic about the company’s C-suite changes toward the end of the second quarter, which he thinks might disrupt the company’s plans to invest in strategic growth initiatives this year. Notably, on June 28, Bill Ready was appointed as CEO, replacing Ben Silbermann.

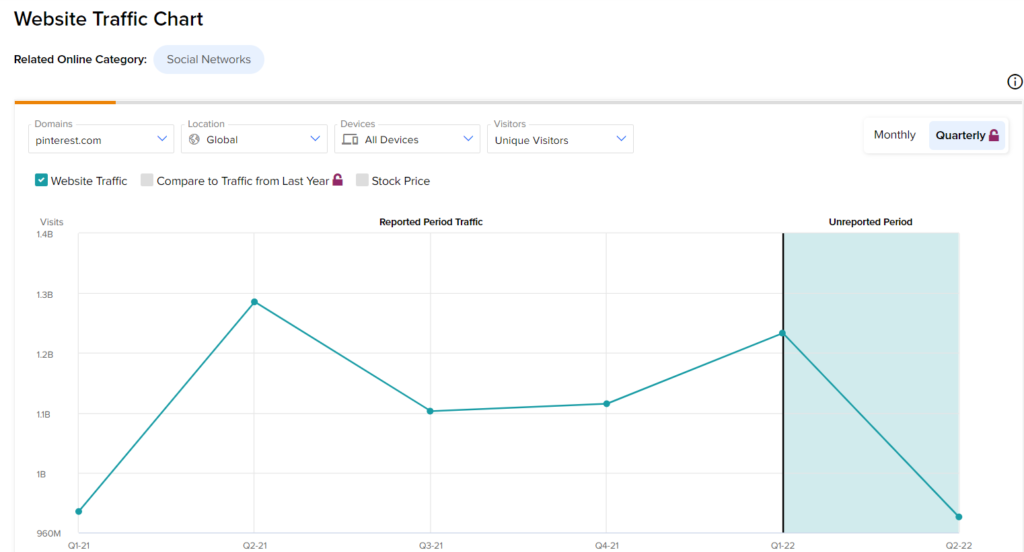

Website Traffic Trends Corroborate White’s Skepticism

Using TipRanks’ website traffic tool that tracks virtual footfall to a company’s website, what we found were discouraging trends. It showed that unique global visitors declined 20.03% sequentially in Q2 and 22.67% year-over-year.

This conforms with White’s predictions that the MAUs might have continued to decline due to the opening of economies after the pandemic.

Conclusion: It May be Best to Wait on the Sidelines

Despite having a solid growth story over the years, Pinterest might have had a weaker-than-expected Q2. White thinks that it is probably best to wait for a better entry point to start accumulating PINS shares again.

As per his estimates, he expects Pinterest’s valuation to go down in 2023. Moreover, waiting will give us more time to get better insights into how the company will navigate through these challenging times.