This week, we will talk about SoFi Technologies, Inc. (SOFI). Extension of student loan moratoriums, inflation, and consumer demand worries, coupled with a broader market selloff, have led to a 65% decline in the share price of this digital financial services stock so far in 2022. Despite this fall, the stock has a short interest of roughly 19.5%.

Nevertheless, a plethora of diverse factors are gunning for SoFi and need to be looked at before taking a stance.

Robust Q1 Showing

The company’s broad product suite and financial services productivity loop (FSPL) strategy seem to be paying off. SoFi delivered robust revenue growth, which exceeded Street’s estimates. Topline jumped 49% on the back of gains across the company’s three verticals – Lending, Technology Platform, and Financial Services.

While product usage doubled in Financial services (revenue growth of 264%), new client additions helped Technology Platform accounts increase by 58%. Further, total members, at 3.9 million, recorded a growth of 70%.

These are compelling metrics in any market scenario, and more so in the current challenging one.

Moreover, a confluence of rising users and product growth offers potential for cross-selling. Finally, the top line is expected to expand from about a billion dollars in 2021 to just over two billion dollars in 2023.

Bank Charter Approval is a Major Win

Earlier this year, SoFi received approval to become a national bank through the acquisition of Golden Pacific Bancorp.

SoFi CEO, Anthony Noto, said, “With a national bank charter, not only will we be able to lend at even more competitive interest rates and provide our members with high-yielding interest in checking and savings, it will also enhance our financial products and services…This step allows us to add to our broad suite of financial products and services.”

The company has been doing just that. It has launched a new checking and savings solution that provides 1% annual percentage yield (APY), no minimum balance criteria, free add-ons, and a rewards program. The APY rate is has now been hiked to 1.25%.

Its “SoFi Money” cash management accounts are being migrated to SoFi checking and savings. These deposits will be held in SoFi Bank and used to fund loans at a lower cost of capital. While the deposits diversify SoFi’s capital sources, the resulting savings will help improve product features, selection, and pricing on the platform.

Furthermore, their new offering includes free cryptocurrency transactions for SoFi Invest, SoFi Money, and SoFi Checking and Savings members. This allows members to allocate a part of their paychecks to buying cryptocurrency automatically. At the end of Q1, deposits with the bank were at $1.2 billion.

The company also plans to deploy the expertise of Technisys and Galileo, which are recent acquisitions, to offer “the only end-to-end vertically integrated banking technology stack that can uniquely support multiple products… all surfaced through industry-leading APIs, for a broad audience.”

Rising Trading Activity and Interest

SoFi has been receiving more and more interest in online forums and was the second most mentioned stock on Reddit earlier this week. Further, Google trends indicate that in the past 30 days, SoFi has received almost as much interest as Meta on certain days.

Our data crunch at TipRanks shows our users are positive on the stock, with the number of Buy transactions at about 4x the number of Sells since April.

This interest is seen in the rising trade volume of the stock. While the average volume in the past 30 days has been 48.3 million, about 125.6 million shares were traded on May 10. That’s about 15% of the total outstanding shares of SoFi.

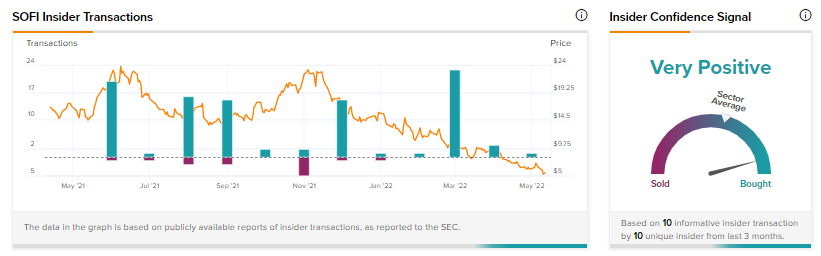

Additionally, insiders have lapped up SoFi shares worth $1.8 million in the last three months, as shown by ten informative insider transactions. Two of the buys were made by Anthony Noto, the CEO of the company.

Analysts Stick With SoFI

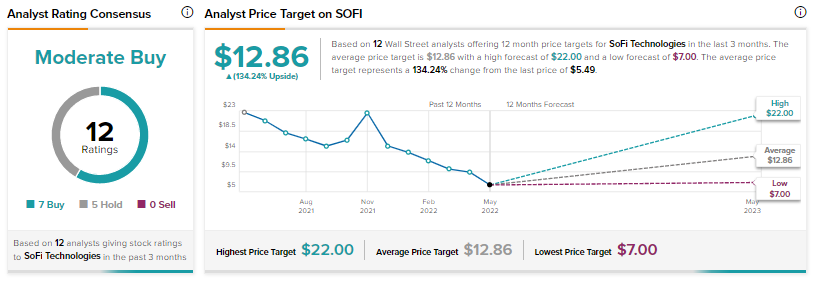

While the Street has a Moderate Buy consensus rating on the stock, the average price target of $12.86 implies a massive 134.2% potential upside, at the time of writing.

Mizuho Securities’ Dan Dolev sees a 155% upside in SoFi from current levels and has reiterated a Buy rating on the stock.

Dolev noted the market hammered SoFi after Upstart’s recent results, but its focus should be on SoFi’s ramp-up in personal loans, an upward trend in major KPIs, and the strong upside to guidance on both the revenue and adjusted EBITDA fronts.

Dolev also echoed the point that SoFi’s bank charter should drive higher profits in H2 owing to higher NIM and longer holding periods.

While SoFi has a short interest of 19.5%, lending platform Upstart Holdings currently has a short interest of 28%.

Closing Note

While the broader indices are dipping their toes into bear territory only now, the market has already hammered down SoFI by 76% in the past year. The company is making progress on major fronts, and in the bigger picture, the stock may bear fruits for the savvy investor. Dan Dolev would agree.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Kohl’s Shareholders Signal Trust in Current Board

Apple to Discontinue One of Its Iconic Products

Hyatt Stock Spikes on Flashy Q1 Performance