Salesforce (NYSE:CRM) stock has gained about 14% since the company delivered impressive results for the fourth quarter of Fiscal Year 2022 on March 1. The Q4 earnings beat, solid shareholder returns, and better-than-expected forecast supported the rally. Consequently, about 25 Wall Street analysts and 20 top analysts assigned bullish ratings to the stock based on Salesforce’s strong prospects, but other analysts were less optimistic on CRM’s forecast.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Salesforce is a cloud-based software company that provides businesses with tools for customer relationship management.

The company’s solid performance and operating margin growth outlook for Fiscal 2024, which was well above the consensus estimate, keep Morgan Stanley analyst Keith Weiss optimistic about CRM stock. Weiss believes that Salesforce’s current share price does not reflect the company’s expected compound annual earnings per share growth of 20% through Fiscal 2026.

As a result, Weiss raised the CRM stock’s price target to $240 from $236. The current price target implies a 28.7% upside potential from the current level. It is worth highlighting that the analyst has a five-star ranking on TipRanks. He has a 63% success rate so far, with an average return of 14% per transaction.

Another five-star analyst, Brian Schwartz of Oppenheimer, reiterated a Buy rating on the stock and raised the price target to $225 from $185. Schwartz noted that current remaining performance obligation (CRPO) billings growth in the fiscal first quarter reflects a sharp year-over-year decline. However, he remains impressed with the company’s overall fourth-quarter results.

Is CRM a Good Stock to Buy Right Now?

The strong momentum in Salesforce’s business and robust cash flow position make Salesforce an attractive stock.

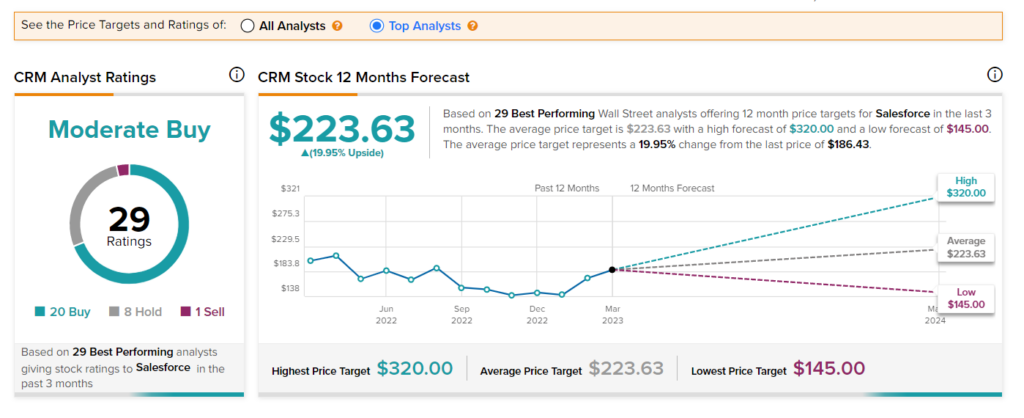

Following the release of the Q4 results, the stock received ratings from 36 Wall Street analysts. Overall, it has a Moderate Buy consensus rating based on 25 Buy, 10 Hold, and one Sell recommendations. Also, the average price target of $224.21 implies 20.3% upside potential.

Furthermore, based on the ratings of the top 29 analysts on TipRanks, which include Weiss and Wood, CRM stock is a Moderate Buy. It has been assigned 20 Buy, eight Hold, and one Sell recommendations in the past five days. Salesforce’s average price target implies an upside potential of 20% from the current level.