Shares of Salesforce (NYSE:CRM) surged in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2022. Earnings per share came in at $1.68, which beat analysts’ consensus estimate of $1.36 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Sales increased by 14.3% year-over-year, with revenue hitting $8.38 billion. This beat analysts’ expectations of $7.99 billion.

Shareholders landed a big chunk of that revenue outright, as Salesforce returned a combined total of $2.3 billion to shareholders just in the fourth quarter. For the full fiscal year, meanwhile, it gave back right around $4 billion in share buybacks. It won’t stop any time soon, either; Salesforce hiked its share buyback plans to a total of $20 billion.

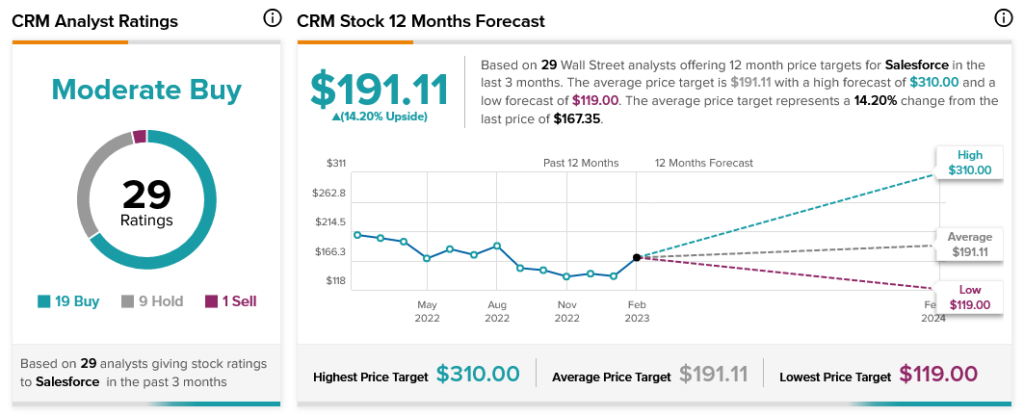

Overall, Wall Street has a consensus price target of $191.11 on Salesforce, implying 14.2% upside potential, as indicated by the graphic above.