Defensive plays, like fast-food stocks WEN and YUM, are starting to look tempting after last week’s round of volatility. At this juncture, there’s no telling if the September pullback is the start of something more ominous as recession and rate risks return to the spotlight or if we’re just in the midst of a much-needed seasonal cooldown before autumn sets in.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Either way, fast-food stocks may be able to fatten up your portfolio as more than just the leaves begin to fall going into late September. The first half of the year saw risk-on tech stocks soar by double-digit percentage points, so it’s only prudent to give some of the neglected defensive plays a second look as hot tech plays begin to give some of the gains back.

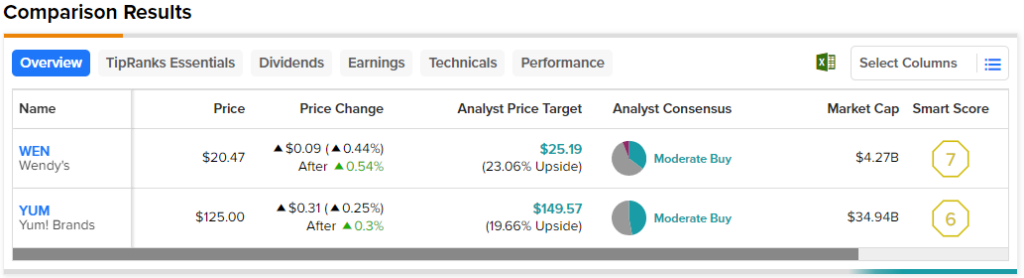

Therefore, let’s use TipRanks’ Comparison Tool to see how the following fast-food stocks stack up in a rocky market that could quickly shift back into risk-off mode if it hasn’t already after last week’s painful sell-off.

Wendy’s (NASDAQ:WEN)

Wendy’s stock has not done much over the past five years. Unless shareholders loaded up on shares in the depths of the 2020 stock market crash, Wendy’s stock has likely been a major loser. Though its 4.9% dividend yield is bountiful, the stock seems to lack any catalyst to propel it sustainably higher. The stock hasn’t gone anywhere for around four and a half years now. Undoubtedly, competition in the fast-food scene has been intense, and until now, Wendy’s stock has failed to show investors the beef!

This could change moving forward, though, as the firm stays the course with its strategic plan. Despite the recent slate of underwhelming quarters (Q2 2023 saw adjusted earnings per share of $0.24 vs. the $0.27 consensus), I am bullish on the stock, as it’s a great brand with a reasonable price of admission ahead of what could be an ugly market downturn.

What do Wendy’s strategic plans entail? Like many other quick-serve restaurant firms, Wendy’s is improving many of its existing stores, introducing new menu items (think breakfast), investing in digital initiatives, and expanding its footprint globally.

Relative to rivals, Wendy’s hasn’t been able to turn such efforts into a meaningful profit boost. Still, Argus analyst John Staszak remains upbeat, as he hiked his rating from a Hold to a Buy a few months ago. He’s bullish on the company’s initiatives and modest valuation. Other five-star analysts, such as Ivan Feinseth of Tigress Financial, are bullish as well.

At writing, Wendy’s shares trade at 22.9 times trailing price-to-earnings, just shy of the restaurant industry average of 26.7 times.

Looking ahead, look for new offerings like Wendy’s pumpkin-spice Frosty to draw bigger crowds for fall. I think Staszak is right on the money. Wendy’s is a cheap fast-food pick that doesn’t need consumer spending to take off to thrive.

What is the Price Target of WEN Stock?

Wendy’s stock is a Moderate Buy on TipRanks, with six Buys, 10 Holds, and one Sell rating assigned by analysts in the past three months. The average WEN stock price target of $25.19 entails a nice 23.1% gain from here.

Yum! Brands (NYSE:YUM)

After a near-13% plunge off its high, Yum! Brands stock looks quite delicious. At just north of 25 times trailing price-to-earnings, though, the stock is in line with industry averages and slightly pricier than Wendy’s. The company is best known for its fast-food trio of Kentucky Fried Chicken (KFC), Taco Bell, and Pizza Hut, although The Habit Burger Grill is a nice addition to the bucket of brands.

Of late, Yum! has felt the weight of industry competition. Wendy’s late-night hours have beckoned consumers with the midnight munchies, an audience that Taco Bell has done a great job feeding over the years. Still, I view Yum’s trio of brands as incredibly powerful and likely to shine through as management ramps up efforts to build a moat around its market share. Though Yum! stock looks technically unsound, I have to remain bullish in this environment.

In the latest (second) quarter, Yum! delivered a solid earnings beat, with earnings per share of $1.41 coming in comfortably ahead of the $1.24 consensus (with $1.7 billion in revenue). Despite rising competition, Yum! managed impressive same-store sales growth of 9%. Unsurprisingly, KFC, the king of fried chicken, enjoyed the best growth of the batch, with 13% in same-store sales growth.

Moving ahead, I expect Yum will have little issue navigating a more challenging economic climate. All around, Yum! reeks of value. It has a terrific value menu, and the stock itself has upside potential, according to analysts.

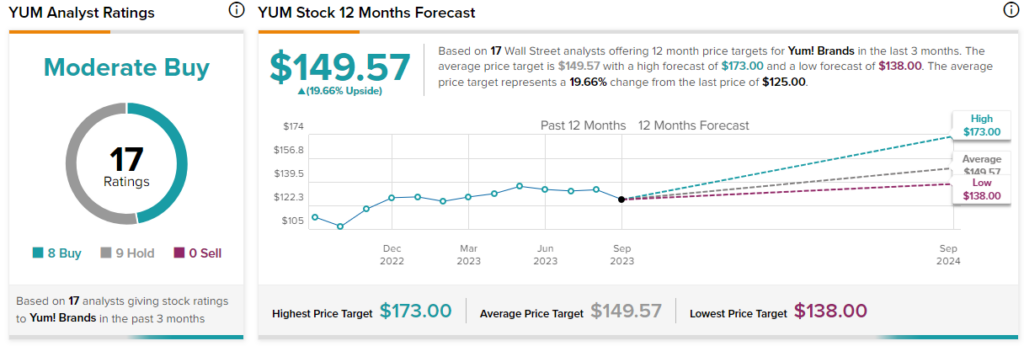

What is the Price Target of YUM Stock?

Yum! Brands stock is a Moderate Buy, with eight Holds and nine Buys. The average YUM stock price target of $149.57 implies a very respectable 19.7% upside potential.

Bottom Line

Food cost inflation and economic headwinds seem to be a plus for fast-food firms like Wendy’s and Yum! as consumers look for value options. Should higher rates weigh more heavily on consumer sentiment, I view the following fast-food plays as relative winners. And between WEN and YUM, analysts expect more gains to be had from the former.