After the stock market’s miserable open to the year, the past month saw strong stock bounces across the board. Both the S&P 500 and the NASDAQ have delivered strong rallies. However, the markets appear to be wobbling again faced with the prospect of more sanctions on Russia and some hawkish comments from the Fed. So, have investors gotten too confident, too quickly?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tracie McMillion, Head of Global Asset Allocation Strategy at Wells Fargo Investment Institute thinks the risks are “definitely rising,” and notes that the US economy has moved from a “steep recovery” to what appears to be a late cycle within just a couple of years. “Usually,” says McMillion, “it takes about 5 years for the economy to transition through early-cycle to mid-cycle to late-cycle.”

While McMillion remains “concerned” with the transition from 2022 into 2023, for now, she sees “positive growth continuing” this year.

Against this backdrop, then, the analysts at Wells Fargo have spotted three stocks which are well setup to charge ahead in this environment. And by charge ahead, we mean stocks with the potential to climb at least 60% higher over the coming months.

We ran the tickers through the TipRanks database to get a feel for what the rest of the Street has in mind for these names; turns out all are rated as Strong Buys and predicted to deliver excellent returns in the year ahead. Let’s take a closer look.

Terex (TEX)

We’ll start with Terex, one of the U.S.’s largest manufacturers of aerial work platforms and materials processing machinery. The company’s products are used in construction, energy, mining, infrastructure, and maintenance. They range from trailer-mounted articulating booms, scissor lifts, and replacement parts for construction – all part of the Aerial Work Platforms (AWP) segment – to specialty equipment such as concrete mixer trucks, biomass and recycling equipment, crushers and washing systems used by its other segment of Materials Processing (MP). Terex was founded in 1986, boasts 8,600 full-time employees and the company has a market cap just under $2.4 billion.

Like many other names, Tex has suffered from recent macro woes such as supply chain bottlenecks (for products such as chips and hydraulics) and this has made for a logistically challenging environment. As a result, TEX shares have been on a downtrend and sit 23% into the red on a year-to-date basis.

Nevertheless, the company delivered beats on both the top-and bottom-line in its latest quarterly report – for 4Q21. Revenue increased by 26% year-over-year to reach $990.1 million, coming in $37.2 million above the consensus estimate. EPS of $0.83 came in some way above the $0.54 analysts were expecting. Additionally, an operating margin of 7.0% improved on last year’s performance by 300 basis points.

Terex’s solid performance has caught the eye of Wells Fargo analyst Seth Weber, who sees the stock in a sound position.

“We view shares as inexpensive for a company with an estimated 2021-2024 EPS CAGR of 25% and revenue CAGR of 8%. We expect the combination of healthy end market demand across segments, better price/cost dynamics, a cleaner balance sheet, extensive portfolio moves and cost/efficiency initiatives should support strong growth, better cash flow/returns, and improve financial leverage,” Weber wrote.

“We see multiple catalysts ahead, including rising U.S. nonresidential construction and infrastructure activity, higher utility capex, improving supply chain bottlenecks, impact from recent price increases, and potential balance sheet actions given year-end 2021 net leverage just over 1x,” the analyst added.

Accordingly, Weber rates TEX an Overweight (i.e. Buy), while his $64 price target suggests shares will climb ~95% higher over the coming year. (To watch Weber’s track record, click here)

It’s clear that most on the Street agree with Weber’s assessment; Barring 1 skeptic, all 7 other recent reviews are positive, making for a Strong Buy consensus rating. Moreover, the average price target is a bullish one; at $61.50, the figure implies share appreciation of 87% in the months ahead. (See Terex stock forecast on TipRanks)

Academy Sports and Outdoors (ASO)

The lockdown and social distancing policies of 2020, followed by the sometimes erratic economic reopening in 2021, put people in the mind to shop for outdoor leisure activities. The advantage – these activities could be enjoyed ‘on the road,’ with family or friends, and without the need to worry about social distance or masking.

Academy Sports, a major chain in the field of sports and outdoors supply, saw clear gains in the aftermath of COVID. The company, which operates some 259 stores in 16 states, saw 4Q21 revenues (the last reported) hit a quarterly record at $1.8 billion. Comparing to 4Q19, the last pre-COVID quarter, this revenue figure was up 32%. Compared to 4Q20, it was up 12.5%. The company reported total sales of $6.77 billion in fiscal year 2021, representing a 19% year-over-year gain.

Looking at earnings, Academy Sports brought in $1.57 per share for Q4, easily beating the forecast of $1.37. Academy only went public in the fall of 2020; since then, the company has released 6 sets of quarterly financial results. During that time, EPS increased 72% from 3Q20 to 4Q21.

In the past year, Academy has used its rising revenues to return profits to investors. The company repurchased 10.6 million shares in fiscal year 2021, worth a total of $411.4 million. And, in March of this year, Academy announced its first common share dividend. On March 3, the company declared a dividend of 7.5 cents per common share, to be paid on April 14.

That’s a key point for Wells Fargo analyst Kate Fitzsimons, who writes, “We expect we can see additional share repurchase authorizations to come into 2022 as management puts that cash to work. Looking ahead, 2022 cash priorities include the company’s new dividend and reinvestment in the business including a return to unit growth as ASO ultimately eyes 80-100 new store openings in the next 5 years… With a healthier balance, we continue to see ASO as one of the most underappreciated stories in consumer today, and the stock remains a top pick.”

These comments back up Fitzsimons’ Overweight (i.e. Buy) rating on the stock, while her $62 price target indicates she sees a 66% upside in the coming year. (To watch Fitzsimons’ track record, click here)

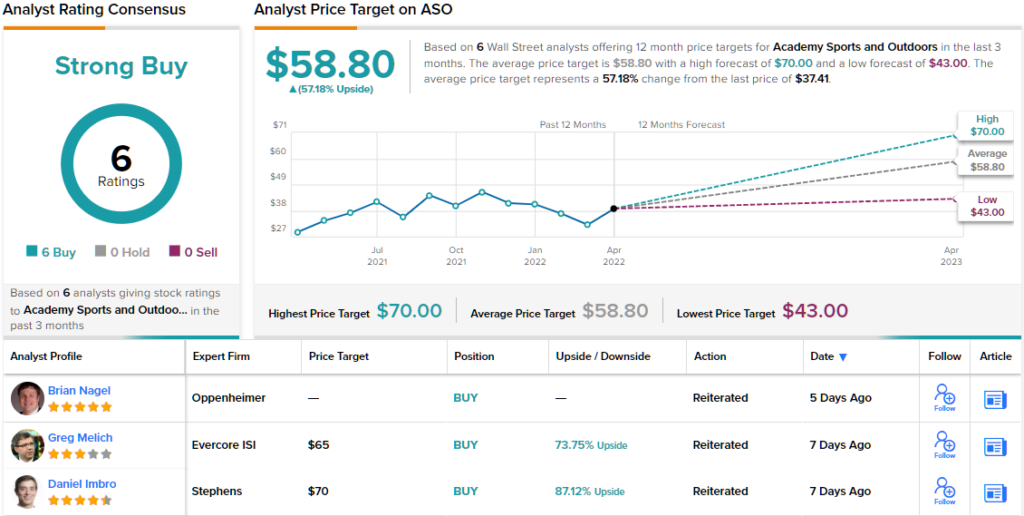

That’s a bullish outlook, but it’s no outlier. ASO shares have picked up a unanimous 6 Buy ratings in recent weeks, for a Strong Buy consensus view. The shares are selling for $37.36, and their $58.80 average price target implies a one-year upside of ~57%. (See ASO stock forecast on TipRanks)

Farfetch, Ltd. (FTCH)

Now we’ll turn to e-commerce company Farfetch, a specialist in luxury goods. Farfetch’s platform connects buyers and sellers across 190 countries around the world, and offers over 1,400 luxury brands, in everything from jewelry to fashion for men and women, to high-end shoes, to various accessories. Based in Portugal, the company boasts headquarters in London and offices in New York and LA, Tokyo and Shanghai.

Farfetch has been posting some strong numbers in recent years. The company claimed over 3.7 million active consumers as of the end of 2021, and saw $4.2 billion in gross merchandise value sold on the site last year. That number was up 33% year-over-year, and a whopping 98% from the pre-pandemic year of 2019. Revenue grew in 2021, from $485 million in Q1 to $666 million in Q4. The Q4 result was up 23% y/y.

In recent months, Farfetch has been making acquisitions, part of a concerted effort to eliminate competition and expand its own platform. In December, the company acquired LUXCLUSIF, a B2B service provider in luxury e-commerce. LUXCLUSIF brings with it a propriety tech platform that is now available for Farfetch’s use.

Following this move, in January, Farfetch acquired the luxury beauty retailer Violet Grey. Violent Grey has developed a reputation for launching beauty brands, and has cultivated a devoted community of followers. Farfetch plans to use these assets when launching its own beauty marketplace later this year. Both of these acquisitions were made for undisclosed sums.

Farfetch shares have been on the backfoot in 2022 and have shaved off 48% of their value since the turn of the year. Yet, in his coverage for Wells Fargo, Ike Boruchow sees several reasons for going all-in on Farfetch now, including: “1) impending M&A catalyst on hand; 2) secular tailwinds supporting a 30% + GMV run rate over time, including increased contribution from FPS; 3) increased confidence in the ability of the business to scale margins multi-year as the marketplace leverages demand creation expense particularly as more customers come into the funnel and garner marketplace loyalty…”

Boruchow’s bullish stance comes with an Overweight (i.e. Buy) rating on the stock, and a $35 price target that implies a robust 135% one-year upside potential. (To watch Boruchow’s track record, click here)

All in all, this high-end online retail platform has picked up no fewer than 14 reviews from the Street and these include 12 Buys against just 2 Holds, for a Strong Buy consensus rating. The stock is selling for $14.91 and has an average price target of $33.50; this suggests an upside for the next 12 months of ~124%. (See FTCH stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.