The latest economic data presents a mixed picture for the US economy. The growth data for the first quarter has been released, indicating that the GDP increased by only 1.1%, which is a sharp slowdown from 2H22, and feeding fears of a recession later this year.

On the inflation front, the steady rise in prices has been easing back, and the March year-over-year number was just 5%, below the forecast and the lowest in nearly 2 years. The moderating inflation rate is an indicator that the Fed’s policy of tighter monetary policy and rate hikes is taking hold. However, the question remains: will the Fed maintain high rates long enough to truly curb inflation?

The air of uncertainty is putting pressure on the markets, and investment giant Wells Fargo has been counseling caution. In a recent note from Christopher Harvey, Wells Fargo’s head of equity strategy, he describes the current conditions with a relatable metaphor: “Today’s equity market reminds us of a 5th-grader during the pull-up section of the old Presidential Fitness Test. Our wiry pre-teen just missed his 8th pull-up but is still hanging on. He is nearing submission – but will not quit – determined to defy gravity just one more time, perhaps with the classic ‘flutter kick.’ For equities, we may get one more ‘up’ (or perhaps not); either way, we expect a sharp drop due to exhaustion.”

Despite the challenges posed by current market conditions, Wells Fargo analysts continue to pick out stocks that can withstand the volatility and generate returns for investors. With the help of TipRanks’ database, we’ve selected two of their picks, both of which offer high-yield divided payouts, including one that yields an impressive 10%. Here are the details.

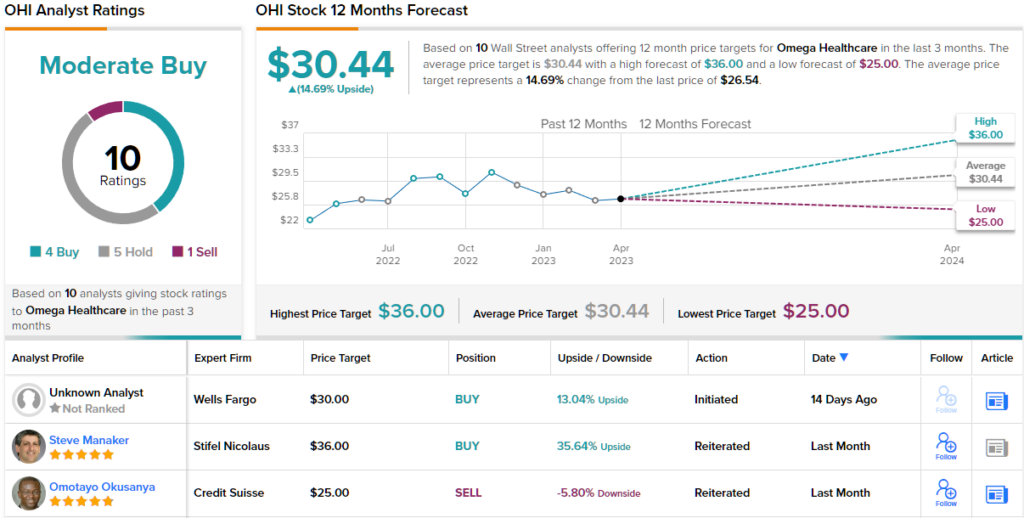

Omega Healthcare Investors (OHI)

Let’s start by taking a closer look at Omega Healthcare, one of Wells Fargo’s picks. Omega occupies a unique space in the market, combining elements of healthcare providers and real estate investment trusts (REITs). The company specializes in skilled nursing facilities (SNFs) and assisted living facilities (ALFs), owning and managing numerous properties across the US and the UK. The company’s asset portfolio of long-term healthcare properties is made up mainly of long-term triple-net leases, as well as fixed-rate mortgage loans.

By the numbers, Omega’s footprint is substantial. The company has a presence in 42 US states plus the UK, owns 901 properties, and works in conjunction with 65 facility operators. Omega’s properties boast a total of 89,965 beds, and has made $9.9 billion in total real estate investments. Looking forward, Omega is seeking to expand its presence in long-term skilling nursing facilities, seeing an opportunity in that segment as the population ages. The company is working to fund renovations of such facilities, and is pushing a management model based on 10-year net leases.

Overall, this portfolio of health facilities generated a top line revenue of $218.2 million in the last reported quarter, 1Q23; a total that was down 12.5% year-over-year. At the bottom line, the company’s net income of 15 cents per share was down 81% year-over-year.

Drilling down a bit, we find that the adjusted FFO, the non-GAAP measure, totaled $160 million for Q1. This was down 13% from the prior year. On a per-share basis, the figure was 66 cents for the quarter, an 11% decline from 74 cents for the same period in 2022.

Dividend investors will be most interested in the company’s funds available for distribution, the FAD; the metric that directly supports the dividend payment. Like the metrics above, this also fell y/y; in Q1, the FAD came to $147 million, down from $162 million in the year before. Even though it was down, the FAD supported the dividend declaration for 67 cents per common share. The company has kept up a reliable dividend since the early 2000s, and current payment, annualizing to $2.68 per common share, gives a sky-high yield of 10%.

Covering this stock for Wells Fargo, analyst Connor Siversky notes two key points driving his OHI thesis: “Fundamentally, we believe OHI’s SNF portfolio is positioned to capture increasing demand for nursing care, and will likely exhibit occupancy gains and improving rent coverage looking forward. In the event of a recession, the combination of an increase in Medicare/Medicaid beneficiaries and more favorable labor market may actually improve operating margins across OHI’s SNF portfolio.”

“Financially, we believe the market is pricing in the probability of a cut to the dividend in 2023, based on our modeling that suggests OHI will exceed an AFFO payout ratio of 100% in 1Q23. Based on our analysis and modeling of OHI’s portfolio restructuring efforts, we believe the impact of cash collections and capital recycling will result in a rebound of AFFO in the latter half of the year and no dividend cut would be required,” the analyst added.

To this end, Siversky puts an Overweight (i.e. Buy) rating on OHI shares, and his price target of $30 implies a one-year upside potential of 13%. Based on the current dividend yield and the expected price appreciation, the stock has 23% potential total return profile. (To watch Siversky’s track record, click here)

Overall, OHI gets a Moderate Buy rating from the analyst consensus, based on 10 recent Wall Street reviews that break down to 4 Buys, 5 Holds, and 1 Sell. The stock’s average price target stands at 30.44, implying ~15% one-year upside form the current trading price of $26.54. (See OHI stock forecast)

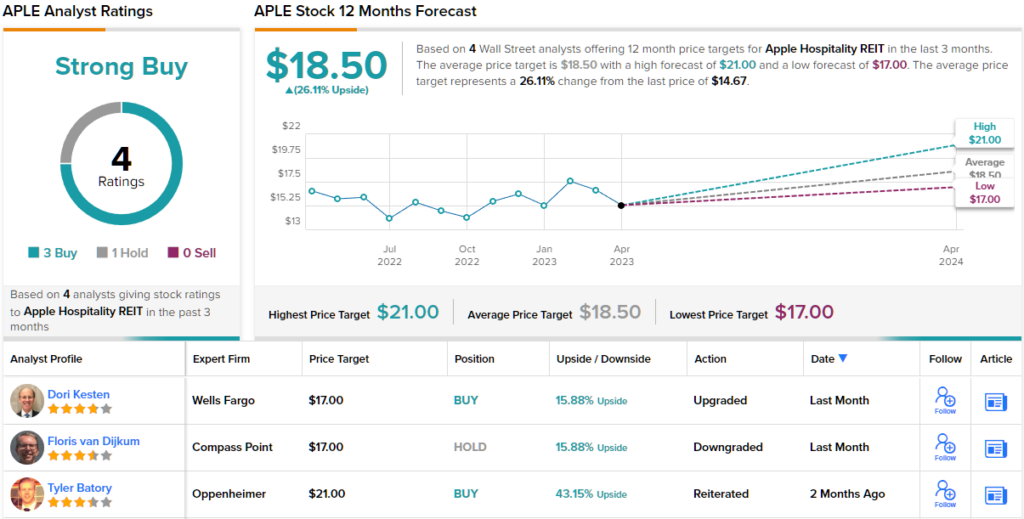

Apple Hospitality REIT (APLE)

The second stock we’ll look at, Apple Hospitality, is another REIT, this one laser-focused on the leisure sector. Apple holds a portfolio of upscale, rooms-focused hotels spread across 37 US states. In all, the company has 220 hotels, located in some the top US markets for both leisure and business travel.

When we zoom in a bit, we find that Apple’s hotel holdings have an aggregate of almost 29,000 rooms. The locations, set in 87 separate markets, include an independent hotel, 4 Hyatt hotels, 96 hotels under the Marriott name, and 119 under the Hilton brand. Urban locations include such major destinations as the New York metro area, Miami, LA, and Washington DC.

In the first quarter of 2023, Apple reported a top line revenue of $311.45 billion and a GAAP EPS of 14 cents. This represents a 20% increase in revenue compared to the same quarter last year, while the EPS figure saw a significant 75% increase. In addition, the company’s funds from operations (FFO) for Q1 were reported at 34 cents per share, a 21% increase from the same quarter in the previous year.

On the dividend, Apple pays out monthly, a mode that offers investors a more rapid access to the dividend income stream than the usual quarterly payments. The current monthly payment is 8 cents per common share. The dividend has been held at this level since the start of the year, and the $0.96 annualized rate gives a yield of 6.5%.

APLE shares caught the eye of Wells Fargo analyst Dori Kesten, who writes: “While U.S. occupancy has pulled back slightly in Q1 2023 vs. 2019, as compared to the change in Q4 2022, rates have remained elevated/ unchanged. Should the U.S. experience a recession comparable to that of 1990/91 in magnitude/duration, we expect operating headwinds to be experienced over the next several quarters, with leisure demand/rates more so impacted than group/business transient. We believe [APLE’s] limited exposure to leisure demand, top 3 ranking in our liquidity analysis, limited near term maturities as a % of its market cap, and YTD underperformance vs. its lodging REIT peers warrants an Overweight rating.”

In Kesten’s eyes, this stock gets a $17 price target to go along with that Overweight (i.e. Buy) rating. The target suggests a gain of 16% for the next 12 months. (To watch Kesten’s track record, click here)

Overall, the Wall Street analysts have published 4 recent reviews of APLE, with a 3 to 1 breakdown in favor of Buy over Hold giving a Strong Buy consensus rating. The shares have an average price target of $18.50, even more bullish than Kesten’s, and implying a 26% one-year upside from the current trading price of $14.67. (See APLE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.