The bear case against Apple (NASDAQ:AAPL) in recent times has rested on the notion that growth at the tech giant is not as it was in yesteryear. However, writing off Apple at your peril seems to be the advice of Wedbush’s Dan Ives, a 5-star analyst rated in the top 2% of the Street’s stock pros, who says these concerns are misplaced and not for the first time.

“With Service revenue back to double digit growth and iPhone units that should be in the ~225 million range for FY24 we believe the ‘growth demise story’ of Apple being spun by bears is a dynamic we have seen constantly over the past decade and this is just another chapter in that book,” Ives opined.

Ives’ comments follow recent Asia supply chain checks, which show that heading into the crucial holiday season, demand for Apple’s iPhone 15 remains robust. Ives specifically singles out China, the region where fears of slowing demand have been fodder for the bear case. But with the holiday season/early 2024 already in view, Ives has not seen “any major negative revisions” around iPhone units coming out of Asia, which indicates there is a “very consistent consumer demand environment around iPhone 15 so far.”

That comes even in the face of Huawei’s success with its latest smartphone in China. Yet, with ASPs (average selling prices) on the rise, boosted this time around by a “heavier mix” of iPhone Pros, Ives is still of the mind Apple is witnessing “modest growth” for iPhones in the December quarter.

That “heavy mix” of iPhone Pro sits at ~80% for the iPhone 15 Pro compared to 60% for the Pro mix in the iPhone 14. Ives reckons that in China alone, more than 100 million iPhones are in the “window of an upgrade opportunity.” That forms a big part of the total of roughly 240 million iPhones Ives believes are due an upgrade globally during this cycle. Add in the re-acceleration of Services and the analyst concludes this is the “golden opportunity to own Apple for the next year.”

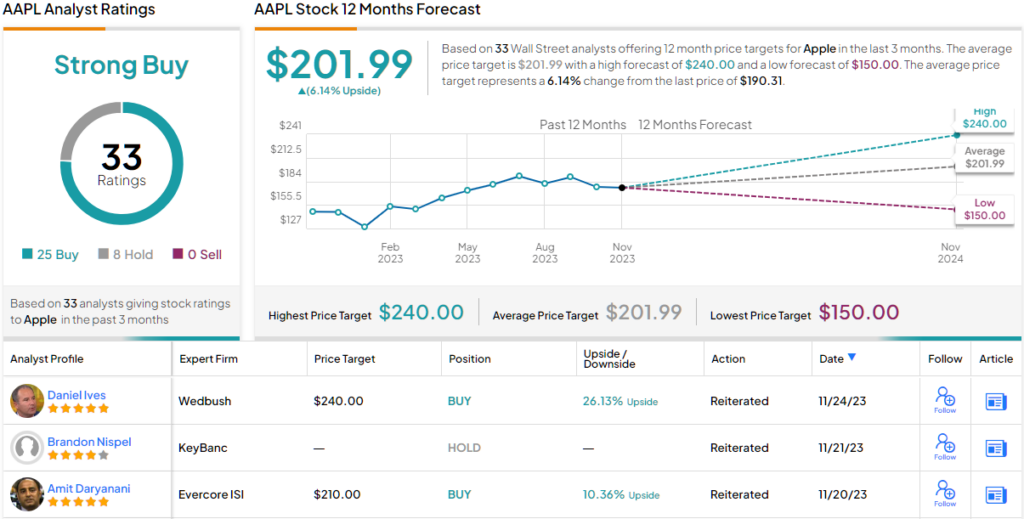

All told, Ives maintained an Outperform (i.e., Buy) rating along with a joint Street-high $240 price target, implying shares have room for growth of 26% in the year ahead. (To watch Ives’ track record, click here)

Most on the Street are thinking along the same lines. Based on a mix of 25 Buys vs. 8 Holds, the stock claims a Strong Buy consensus rating. However, the upside appears capped; going by the $201.99 average target, a year from now, investors will be recording modest gains of 6%. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.