With digitalization disrupting practically every facet of existence, Vroom (NASDAQ:VRM) fundamentally appears relevant for its facilitation of online vehicular transactions. After all, the emerging Generation Z prefers digital interfacing over “analog” communications. However, when it comes to Vroom, investors should consider listening to the bears. Frankly, the current economic framework doesn’t favor a convenience-over-low-pricing business model. Therefore, I am bearish on VRM stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Bears Speak Their Minds About VRM Stock

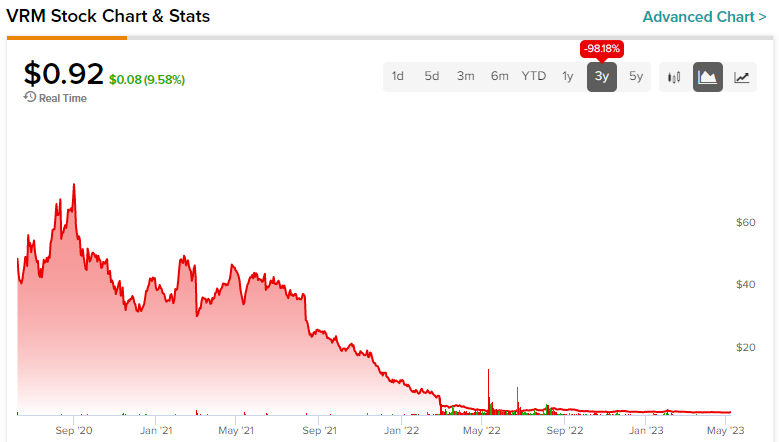

Under any other circumstance, VRM stock could be interesting. A few years prior to the COVID-19 pandemic, millennials reported a particular dislike regarding haggling with car dealerships. The oldest Gen Z members – many of whom became adults during the pandemic – would probably report similar sentiments. This benefits Vroom. It’s just that the bears simply don’t care (and Vroom faces other problems as well), brutalizing VRM since the summer of 2021.

More recently, following the close of the May 3 session, VRM stock became a “highlight” for unusual stock options volume. Specifically, total volume reached 24,570 contracts, which represented a difference of 889.13% over its trailing one-month average volume from May 3.

Moreover, the volume of puts (which generally have bearish implications) hit 23,419 contracts, while call volume reached only 1,151 contracts. This pairing yielded a put/call volume ratio of 20.35, signifying pessimistic sentiment.

To be sure, VRM stock incurs significant bearish attention, putting it at risk of a short squeeze. VRM’s short interest is 16.48% of its float, while its short interest ratio is 14.16 days to cover. Both stats are rather elevated. Sure enough, on May 5, shares popped up 11.65%, and they’re up another ~10% so far today.

However, the economic fundamentals don’t make much sense for VRM stock under the present framework. Therefore, investors should probably stay on the sidelines here.

Vroom Finds Itself Without a Relevant Backdrop

Back during the worst of the COVID-19 crisis, VRM stock made sense as a speculative wager. With few people wanting to interact with strangers as the mysterious COVID-19 virus floated around, buying personal vehicles under a contactless ecosystem killed two birds with one stone. At its peak, VRM traded for above $75. At one point this year, it traded hands at about 73 cents. The reason? Vroom now lacks a relevant backdrop.

Millennials have begun negotiating in job interviews, hotels, and airports, reports note. Essentially, people in their 20s and 30s are becoming tougher customers. Arguably most significantly, young people haggled – the one thing they don’t like to do natively – out of necessity. And necessity might be the kiss of death when it comes to VRM stock.

Without meaning any disrespect to Vroom, the underlying business model of trading comparatively low prices for convenience no longer makes sense. Look, young folks started haggling because of rising pressures in a non-pandemic environment. Post-crisis, practically every non-wealthy household must negotiate for the lowest price because of stubbornly high inflation.

Of course, Vroom’s industry – the auto dealership sector – will probably see rising demand. With mass layoffs on the rise, people can’t take their work-from-home roles for granted anymore. The best way to avoid a pink slip is to show up and be counted.

Again, however, inflation remains elevated. Therefore, those in the market for a vehicle typically will seek lower prices over convenience. That’s exactly the opposite of what VRM stock needs.

The Financials Tell the Tale

If the fundamentals didn’t dissuade against VRM stock, the financials might. For example, at the end of 2022, Vroom posted cash and cash equivalents in the amount of $472 million. On the other side, long-term debt and capital lease obligations amounted to $422.28 million. That leaves a cash-to-debt ratio of about 1.12, which isn’t that encouraging when factoring in slowing sales.

In 2022, Vroom posted revenue of $1.95 billion, well below the prior year’s tally of $3.18 billion. As the consumer economy suffers more pressure, Vroom can find itself on the outside looking in.

Is Vroom Stock a Buy, According to Analysts?

Turning to Wall Street, VRM stock has a Hold consensus rating based on one Buy, four Holds, and zero Sell ratings. The average VRM stock price target is $1.12, implying 23.4% upside potential.

The Takeaway: VRM Stock Aligns with an Irrelevant Business Model

Again, without showing disrespect to Vroom, investors must nevertheless acknowledge reality. Following the fading fears of the COVID-19 crisis (and incurring economic troubles in its wake), consumers are more than willing to trade off convenience for the lowest price. That’s the opposite of what Vroom offers, making VRM stock susceptible to further volatility.