The Vanguard FTSE Europe ETF (NYSEARCA:VGK) is the investment management giant Vanguard’s European ETF. After a tough year last year, which saw the ETF lose 16% on a total-return basis due to factors such as the conflict in Ukraine, Europe’s ensuing energy troubles, and rising inflation, the ETF is bouncing back nicely with a year-to-date gain of 13.5%. It’s also up an impressive 25% over just the past six months. Even after this rebound, the ETF still looks like an attractive option for investors for a variety of reasons. Here are five reasons that I like VGK.

1. Incredible Diversification

VGK is about as diversified as you can get. Not only does the fund hold 1,311 positions, but its top 10 holdings account for under 20% of assets, so this isn’t one of those ETFs that says it is diversified but, in reality, is dominated by just a handful of stocks. Swiss consumer packaged goods giant Nestle (OTC:NSRGY), the top holding, makes up just under 3% of assets.

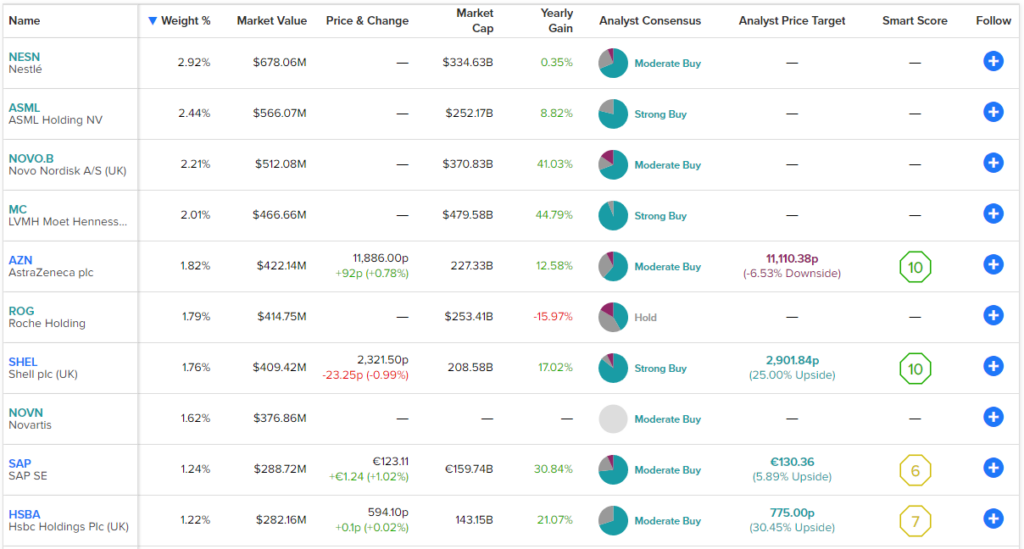

European pharmaceutical powerhouses, including Denmark’s Novo Nordisk (NYSE:NVO), the UK’s AstraZeneca (NASDAQ:AZN), and Switzerland’s Roche (OTC:RHHBY) and Novartis (NYSE:NVS) are well-represented within VGK’s top holdings. Other notable holdings include the likes of France’s renowned luxury conglomerate LVMH Moet Hennessey (OTC:LVMUY), Dutch energy giant Shell (NYSE:SHEL), and Dutch semiconductor fabrication equipment maker ASML Holding (NASDAQ:ASML).

Below, you’ll find a list of the ETF’s top holdings using TipRanks’ holdings screen, which gives investors a comprehensive overview of an ETF’s components.

The Vanguard FTSE Europe ETF also offers a decent amount of diversification across European markets. UK stocks make up the fund’s largest weighting at 24.2%, while France, Switzerland, and Germany are the only other countries with double-digit weightings. The Netherlands, Sweden, Denmark, Italy, Spain, and Finland round out the rest of the top ten, with weightings of between 2% and 6.8%.

2. Minuscule Fees

Vanguard is known for offering extremely low management fees on its wide array of investment products, and VGK is no exception. VGK is an attractive investment option thanks to its low expense ratio of just 0.11%. This means that an investor putting $10,000 into VGK would pay just $11 in fees during the first year, all things being equal.

Assuming no change to the management fee and a 5% return on the investment per year, an investor in VGK would pay just $35 in fees after three years, $62 after five years, and $141 over the course of 10 years, according to the prospectus.

Over many years, fees can add up and take a bite out of an investor’s return, so having a low expense ratio like this can have a big impact on your portfolio.

3. Solid Dividend

The Vanguard FTSE Europe ETF is also a solid dividend ETF. It currently yields just under 3%, which may not sound spectacular, but keep in mind that this is nearly double the average yield of the S&P 500 (SPX) right now (about 1.6%). Furthermore, VGK has a consistent track record as a dividend payer, having paid out an annual dividend for 16 straight years and counting.

4. Relatively Inexpensive Valuation

One attractive aspect of investing in VGK over an S&P 500 ETF, for example, is that European stocks are generally cheaper than their U.S. counterparts. Right now, the price-to-earnings ratio of VGK’s portfolio is just 13.5, which is much lower than the S&P 500’s average price-to-earnings ratio of 23.9. This gives investors a nice margin of safety when investing and leaves more room for upside.

I like VGK’s positioning here because it is markedly cheaper than the U.S. market, but it is only a bit more expensive than emerging markets while coming with less inherent risk since Europe is a developed market.

For comparison, the iShares MSCI Emerging Markets ETF (NYSEARCA:EEM), the largest emerging market ETF with assets under management of $24.4 billion, has an average price-to-earnings multiple of 11.2, meaning that it doesn’t offer a very substantial discount to VGK even though emerging market stocks are theoretically riskier than their developed market counterparts.

5. Defensive Positioning

Finally, as illustrated by the list of top holdings above, VGK offers investors fairly defensive positioning in the event of an economic slowdown. Healthcare stocks are widely seen as defensive and offer little correlation to the rest of the economy, so the top 10 positions, which include the aforementioned large-cap pharma names, should give VGK some resilience if we enter a recessionary environment.

Furthermore, the significant dividend yields offered by some of these pharma names and energy holdings like Shell and TotalEnergies (LSE:TTE) should help to bolster VGK’s performance in the event of a downturn.

Risks

While I find VGK to be an attractive investment opportunity based on the five factors discussed above, all investments, of course, come with risks. The main risks for VGK are an escalation of the Ukraine conflict that involves other European countries and perhaps a major resurgence in oil and natural gas prices, which hit European stocks hard in 2022.

Is VGK Stock a Buy, According to Analysts?

The analyst community agrees that VGK stock looks attractive at these levels, rating it a Moderate Buy. Of the nearly 5,000 analyst ratings on the ETF, 54.5% are Buys, 34.8% are Holds, and 10.7% are Sells. The average VGK stock price target of $72.60 implies 15.3% upside potential.

TipRanks uses proprietary technology to compile analyst forecasts and price targets for ETFs based on a combination of the individual performances of the underlying assets. Further, TipRanks calculates a weighted average based on the combination of all the ETF’s holdings. The average price forecast for an ETF is calculated by multiplying each individual holding’s price target by its weighting within the ETF and adding them all up.

Investor Takeaway

With an investor-friendly expense ratio and ample diversification, VGK offers investors a cost-effective way to gain exposure to the European market. VGK also looks attractive based on the significant discount that its portfolio of holdings trades at versus the average multiple for the S&P 500, combined with its dividend yield, which is nearly double the average yield of the S&P 500.

This disparity makes VGK particularly attractive for U.S.-based investors as a way to add some diversification and exposure outside of their home market at a more attractive valuation and with a higher yield.

As a long-term investor, I would continue to invest in the S&P 500, but it also makes sense to consider adding exposure to VGK based on these factors.