We all know how the technology sector led the way in last year’s market gains, with the mega-cap ‘Magnificent 7’ taking up the lion’s share of the headlines. But the giant technology stocks weren’t the only story in town, and software stocks, riding the AI wave, reaped their own share of the gains.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Gartner, the global IT spend is likely to hit $5 trillion this year. That represents a jump of 6.8% from last year, and a hefty opportunity for software companies able to hitch a ride on the way up. In that, AI could be the key. AI, especially generative AI, is helping to drive the increase in technology and software spending, creating openings for software companies across a multitude of industries.

Watching these developments from the investment bank Jefferies, 5-star analyst Surinder Thind has been busy recently finding compelling investment choices in the software sector. Thind’s overall thesis is based on valuation; in suggesting these software stocks to buy, he points out that they are ‘too attractive to ignore.’

Keeping this perspective in focus, Thind identifies two standout software stocks with significant potential. Let’s delve into Thind’s insights on these stocks while also leveraging the TipRanks platform to gauge the broader sentiment across Wall Street.

Similarweb (SMWB)

Similarweb, the first stock on today’s list, lives and operates in the digital economy. The company offers its customers a platform and tools to develop accurate, comprehensive data analytics, essential for effective marketing in the online world. Similarweb’s services power effective digital research, shopper intelligence, sales intelligence, and digital marketing.

The services are designed to give users the combination of data and insight needed to score sales wins, and Similarweb makes systematic use of AI technology to tailor results and analytics to the users’ specific needs.

Every company, at every scale, needs solid online data, and Similarweb has seen high success in attracting big-name enterprise customers. The company boasts such names as Walmart, Adidas, Pepsico, and DHL among its client base.

Like many high-tech startups that have since gone public, Similarweb has seen its shares fall since entering the stock market. SMWB started trading on Wall Street in May of 2021; since then, the shares have fallen by 70%.

But – there might be positive news for investors. In its most recent reported quarter, 4Q23, Similarweb showcased a net non-GAAP earnings per share of $0.06, exceeding the forecast by 6 cents per share. Moreover, Similarweb achieved revenues of $56.8 million, reflecting a 10.7% year-over-year growth and approximately a million dollars higher than anticipated.

Turning to the Jefferies view, we find analyst Thind outlining the company’s solid position in the data niche: “Although SMWB operates in a highly competitive market, it provides data and insights at a scale that is difficult to replicate, which makes for a reasonably wide moat. The overall product offering is of high quality and it has the potential to become core to many companies’ digital strategies. This can be seen in the company’s ability to continue to attract large new customers this year (i.e., 18 new clients >$100K ARR through 3Q) despite the challenging environment. At this point, mgmt believes it has penetrated <1% of its $44B TAM.”

Thind goes on to show just how this stock is a good buy for investors, by the numbers, writing, “The company is currently trading at a 2025 EV/Rev of 1.6x, which is well below the peer group average of 3.2x. With fundamentals poised to improve, we expect the stock to begin re-rating higher.”

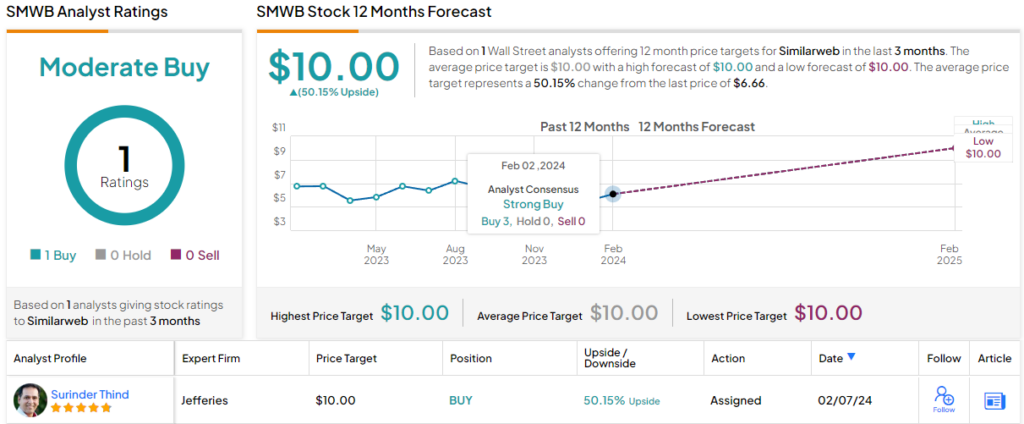

Quantifying his stance, Thind assumes coverage of SMWB shares with a Buy rating and a $10 price target that suggests a one-year upside potential of 50%. (To watch Thind’s track record, click here)

There was little action on the Street heading SMWB over the past 3 months, with Thind being the sole analyst offering insights into the web analytics company’s future prospects. (See Similarweb stock forecast)

ZoomInfo Technologies (ZI)

Next up is ZoomInfo, a software company in the cloud computing niche. The company’s chief product is a marketing-oriented search engine, designed to connect client companies with their own customers directly when the customers are ready to make purchases. ZoomInfo’s platform gives its users data-backed marketing insights crafted to align sales and marketing teams with their targeting audiences. The analytics streamline users’ go-to-market processes for greater productivity and efficiency and consequent stronger growth.

ZoomInfo has found wide acceptance around the world and maintains multiple offices. The company is based in Vancouver, Washington, and also keeps offices in such major US hubs as Atlanta and Boston, as well as reaching out to second-tier locations like Bethesda, Maryland, in the DC suburbs, and Grand Rapids, Michigan. Internationally, ZoomInfo has locations in London, Toronto, and Chennai, India.

In today’s business world, everyone needs data. It’s inescapable. ZoomInfo has leveraged that truth to build an enterprise client list with more than 35,000 names, including such major figures as Deloitte, FedEx, Duracell, and Bank of America. Users of ZoomInfo’s service have reported an overall 70% decrease in marketing spend and a 63% increase in productivity.

Yesterday, the company announced its financial results for Q4. Investors responded favorably, propelling the stock 14% higher in Tuesday’s trading session.

The top line in that report came to $316.4 million, $5.86 million better than the estimates and up 4.9% year-over-year. The company’s non-GAAP EPS figure, of 26 cents per share, was a penny ahead of the forecast.

Looking ahead, the company anticipates revenue in the range of $1.26 billion to $1.28 billion (compared to the consensus of $1.27 billion) and adjusted net income per share between $0.99 and $1.01 (compared to the consensus of $0.99) for full-year 2024.

Among the bulls is Surinder Thind, who initiated coverage of this stock at a Buy rating – and with a $24 price target implying a 31% upside to the shares for the next 12 months (To watch Thind’s track record, click here)

Thind went on to back his stance by outlining the company’s solid prospects over the next couple of years: “Strong new customer growth is being masked by reductions at existing customers, which is only now stabilizing after coming off pandemic spending highs. 2024 should mark trough LSD growth, advancing to a HSD exit rate and high-teens growth in 2025. Meanwhile, strong margins, solid FCF, and favorable secular trends remain underappreciated given top-line challenges… We believe ZI has the potential to grow revenues organically at a high teens pace in 2025, and get this above +20% y/y in 2026. This acceleration in revenues should lead to multiple expansion.”

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 5 Buys, 4 Holds and 2 Sells add up to a Moderate Buy consensus. In addition, the $21.05 average price target indicates ~15% upside potential. (See ZoomInfo stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.