Visa Inc. (NYSE:V) and Mastercard Incorporated (NYSE:MA) could face a challenge from U.S. retailers, who wish to break the duopoly these credit card service providers enjoy in the United States. To achieve this, retailers and other trade organizations are strongly backing the Credit Card Competition Act of 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth noting that top retailers, including Walmart (NYSE:WMT), Macy’s (NYSE:M), Home Depot (NYSE:HD), and Target (NYSE:TGT), seek Congress to pass the abovementioned bill, which Senator (Illinois) and a Democrat, Richard Durbin, and Senator (Kansas) and a Republican, Roger Marshall, introduced in July 2022.

In July, Senator Durbin said, “Credit card swipe fees inflate the prices that consumers pay for groceries and gas. It’s time to inject real competition into the credit card network market, which is dominated by the Visa-Mastercard duopoly.”

“Bringing real competition to credit card networks will help reduce swipe fees and hold down costs for Main Street merchants and their customers,” the Senator added.

Amid this scenario, a brief discussion on Visa and Mastercard could be helpful for prospective investors in assessing the investment value of these stocks. A consolidated chart, designed using TipRanks’ Stock Comparison tool, on Visa and Mastercard is as follows.

Visa Inc. (NYSE:V)

Based in San Francisco, CA, this $412.55-billion company provides digital payment services. Its offerings include credit card and debit card-related services, commercial payment solutions, and prepaid products.

In July 2022, the company’s Chairman and CEO, Alfred F. Kelly, Jr., said, “Consumers are back on the road, visiting various corners of the world, resulting in cross-border travel volume surpassing 2019 levels for the first time since the pandemic began in early 2020.”

In the third quarter of Fiscal 2022 (ended June 30, 2022), Visa’s services revenues grew 13% year-over-year, while its data processing and international transaction revenues increased 8% and 51%, respectively. Meanwhile, other revenues were up 26% year-over-year.

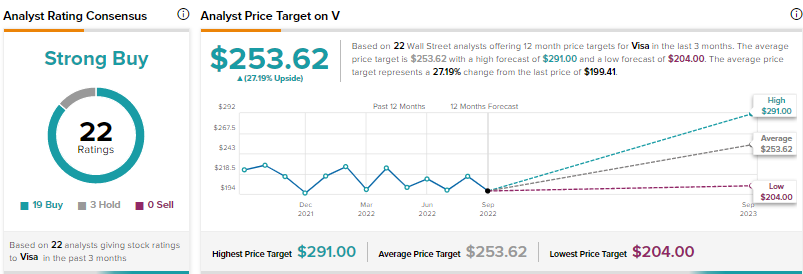

What Is the Forecast for Visa Stock?

On TipRanks, V’s average price forecast is $253, representing upside potential of 27.19% from the current level. The highest price target is $291, and the lowest is $204.

Meanwhile, analysts have a Strong Buy consensus rating on Visa, which is based on 19 Buys and three Holds. Furthermore, the stock has a Smart Score of ‘eight out of 10’ on TipRanks, which mirrors its potential to outperform the broader market.

Mastercard Incorporated (NYSE:MA)

The $314.89-billion company provides financial payment solutions. Its offering includes services related to prepaid programs, debit and credit cards, and commercial programs. It is headquartered in Purchase, NY.

In July, the company’s CEO, Michael Miebach, said, “We have a well-diversified business model and the demonstrated ability to deliver strong operating margins through up and down cycles.”

In the second quarter of 2022, the company’s revenues from domestic assessments grew 11%, while cross-border volume fees and transaction processing sales advanced 50.1% and 17.2%, respectively. Other revenues were up 18.3% year-over-year in the quarter.

Is MA Stock a Buy Right Now?

The bullish stance of analysts tracked by TipRanks and the company’s ‘Perfect 10’ Smart Score, which mirrors its potential to outperform the broader market, appear to be supporting the stock’s investment appeal. For now, the stock could be an attractive investment option for prospective investors.

On TipRanks, analysts are optimistic about the prospects of Mastercard, which warrants a Strong Buy consensus rating based on 19 Buys, one Hold, and one Sell. MA’s average price forecast of $413.60 represents upside potential of 26.93% from the current level. The highest price target is $472, and the lowest is $298.

Concluding Remarks

According to the Federal Reserve, Visa and Mastercard-powered credit cards were used for $3.49 trillion worth of transactions in the United States in 2021. Meanwhile, these credit card services companies imposed $77.48 billion in fees on U.S. merchants.

Senator Durbin opines that breaking the dominance of Visa and Mastercard “would give small businesses a meaningful choice when it comes to card networks, and it would enable innovators to gain a foothold in credit cards.”

Read full Disclosure